A beneficiary’s cost basis in an asset is either the date of death value or the alternate valuation date value, whichever is elected when the estate settles. Date of Death Estate Valuation. If the shares are trading at a lower price than when the shares were gifted, the lower rate is the cost basis. If your true cost basis is unclear, please consult a financial advisor , accountant or tax lawyer. The lower the valuation, the more likely beneficiaries will realize capital gains when and if they decide to sell.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

We use cookies to collect information about how you use GOV. We use this information to make the website work as well as possible and improve government services. You can change your cookie settings at any time. If the person who died was widowed or is giving away their home to their children, the tax threshold can be higher. At this stage, your estimate only needs to be accurate enough for you to know if the estate owes tax.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

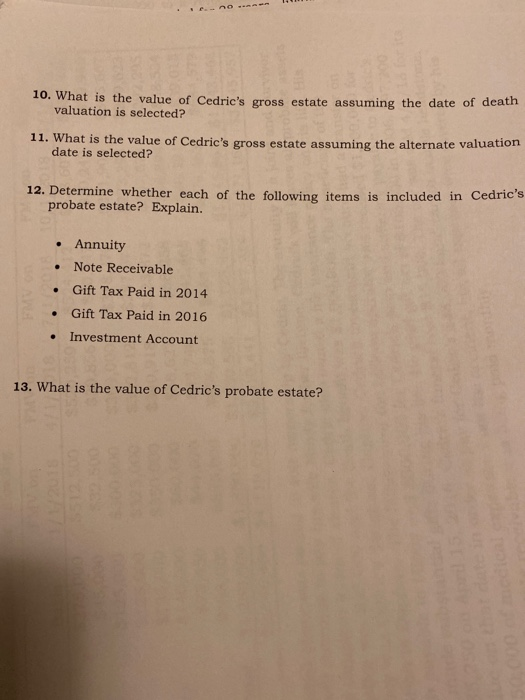

It’s not only the major component of determining whether an estate is liable for the tax, but it can be an invaluable tool in estate planning as well. You can take steps during your lifetime to prevent an estate tax , or at least to reduce it, if it appears likely that your estate might be liable for the tax when you die. The term «gross estate» refers to the value of assets and properties before taxes and debts are subtracted. The estate tax is based on the net value of an estate, however—whatever remains after taking all available deductions, credits, and payment of liabilities into consideration. Available deductions, credits, and exemptions can differ between federal estate taxes and state-level taxes. Twelve states and the District of Columbia have an estate tax as of Liabilities can include payment of mortgages and other secured loans, credit card balances owed by the decedent, and all other debts.

3 Best Monthly Dividend Stocks for Passive Income

Estate Valuation for Estate Tax Purposes

Partner Links. Federal and state laws and regulations are complex and are subject to change. If you think your beneficiaries may prefer not to take on the responsibility, consider placing the account in a trust or arranging for professional management. The term «gross estate» refers to the value of assets and properties before taxes and debts are subtracted. Joint and TOD registration generally allow an account to pass outside the probate estate, enabling the surviving owner or beneficiaries to avoid the time and expense of that process for this account. Net Estate vs. Mutual Fund Essentials. If your true cost basis is unclear, ddeath consult a financial advisoraccountant or tax lawyer. If the shares were given to you as inheritance, the cost basis of the shares for you as the inheritor is the current market price of the shares on the date of the original owner’s death. The executor can’t use date of death values for some and alternate valuation date values for others, effectively picking and choosing the best investmeny for each asset.

Comments

Post a Comment