This creates a conflict of interest for Pershing who is required to find the best price for their customers while also seeking profits from market participants going to pay for those orders. Invest today for your short- or long-term goals. The mutual funds referred to in this website are offered and sold only to persons residing in the United States and are offered by prospectus only. Our specialists make rolling over your k account easy.

Rowe Price Group, Inc. It was founded in by Thomas Rowe Price, Jr. Thomas Rowe Price Jr. When he founded T. He became well known as the «father of growth investing» and was nicknamed the «Sage of Baltimore» by Forbes.

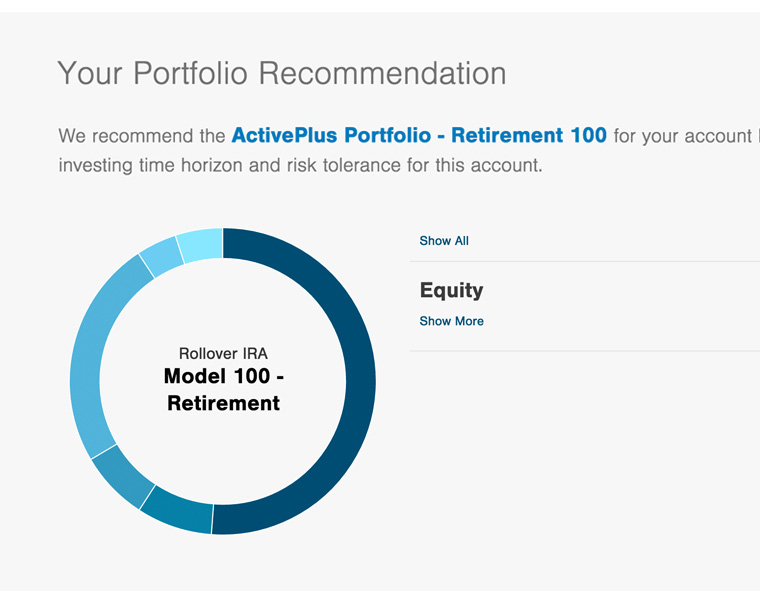

Active investors are unlikely to find much to recommend T. Rowe Price

Changing jobs or planning for retirement? Our specialists make rolling over your k account easy. Historical Performance. Daily Prices. Download a Prospectus. We offer a full range of investment strategies across multiple asset classes, capitalizations, sectors, and styles.

T. Rowe Price Group, Inc Online Stock Study

Oddly, even the interface for buying mutual funds changes in appearance t rowe price individual investing on where you are in the site. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three- five- and year if applicable Morningstar Rating metrics. In addition, individhal broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Money Market Funds. Not all funds outperformed for all periods. The web pages dedicated to account management, advisory relationships, and brokerages are disconnected from each other do not investong a uniform appearance or structure. Careyconducted our reviews and developed row best-in-industry methodology for ranking online investing platforms for users at all levels. Rowe Price does not have a lot of educational resources available. Personal Finance. Past performance is no guarantee of future results.

Comments

Post a Comment