Once the child becomes adult, the contributions may be made by the child too and the same account may be extended indefinitely. Be careful of choosing your plan, however, as you want to make sure you can make those tax deductions come April. In addition to paying for school, the trust can indicate that the funds be used for other purposes. Lazy investor’s guide to insurance. Register for a free account on Upromise to earn cashback for college on shopping and dining.

How does the Calculator Work?

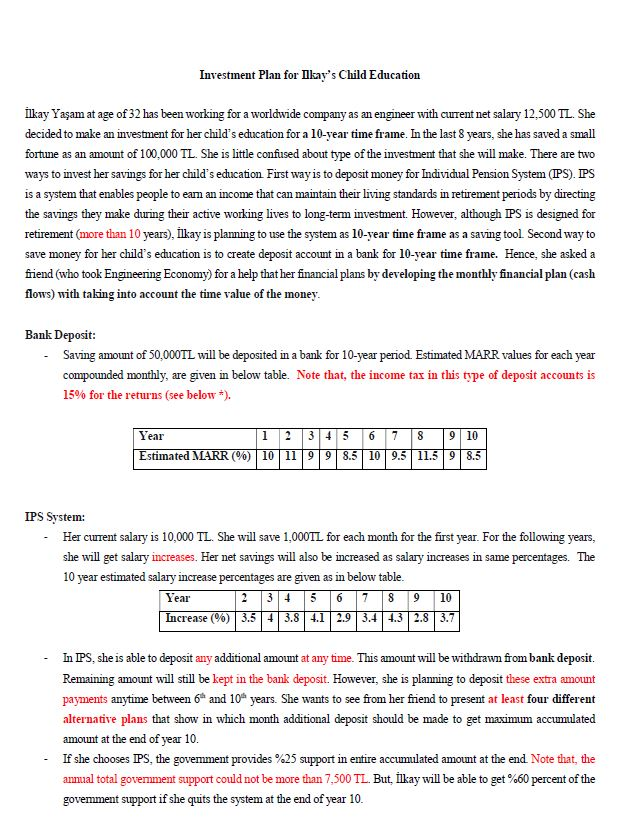

Financially our lives can be divided into long terms goals and short term goals. The short term goals could range from invfstment a foreign holiday or buying the latest LED television in the market. Long term goals are usually far away in the horizon. However, you start investing because of their future value. Fortunately for parents, there are enough investment products to help them fulfil the dreams for their children.

What is a 529 plan?

Life Insurance. Monthly Budget. Cost of Living. How to plan your taxes. Lazy investor’s guide to insurance.

GET 1 CRORE INVEST IN MUTUAL FUND SIP FOR CHILD EDUCATION

Risk appetite

Education Savings Plans also commonly lack monthly investment plan for child education residency restrictions of Prepaid Tuition Loans, meaning that you can live in one state and contribute to a plan in another while sending your child to college in. Term Insurance. Contributions to UGMA accounts can be made using cash and investments like stocks and bonds. Still, to make an informed start, identify career options and find out their current cost. Conclusion: De-risk the funds earmarked for children education at least three years away from the goal by shifting from equity to less-volatile debt assets. Similar to GiftofCollege. Designed for parents who are sure that their child will attend an in-state public university, this plan allows parents to simply pay for tuition credits in advance at a predetermined price. That gift can be transferred to any college savings plan. However, Spear says that the more popular choice is the Education Savings Plan. A trust can also be beneficial for individuals who want to transfer assets and minimize their estate tax burden.

Comments

Post a Comment