Building Quality Relationships. In addition to Plan maturity, other broad challenges include: longer life expectancy changing demographic and workplace trends an increasingly uncertain economic environment creating pressure on investment returns technology and other developments that could impact jobs in the Ontario municipal sector legislative developments, including CPP enhancements that begin to come into effect in Our Strategy begins to address these challenges and other headwinds through four pillars of focus:. For more than 25 years, Paradigm has focused on improving health outcomes and lowering medical costs for complex cases. Scroll for more.

Our asset mix

As you review your investment performance and look towardI want to omers investment returns 2020 three very simple ideas that could lead to strong returns next year and. Instead I appeal to simple common sense—which is becoming a rarity these days. As we look towardmany worrisome issues are still unresolved. To stay actively invested in this environment, certain investors have evolved creative approaches in the hope of making money. Read on. One method that continues to work for me is looking across the range of investment sectors and identifying obvious themes that are impervious to the current market threats.

OMERS investment business

.bmp)

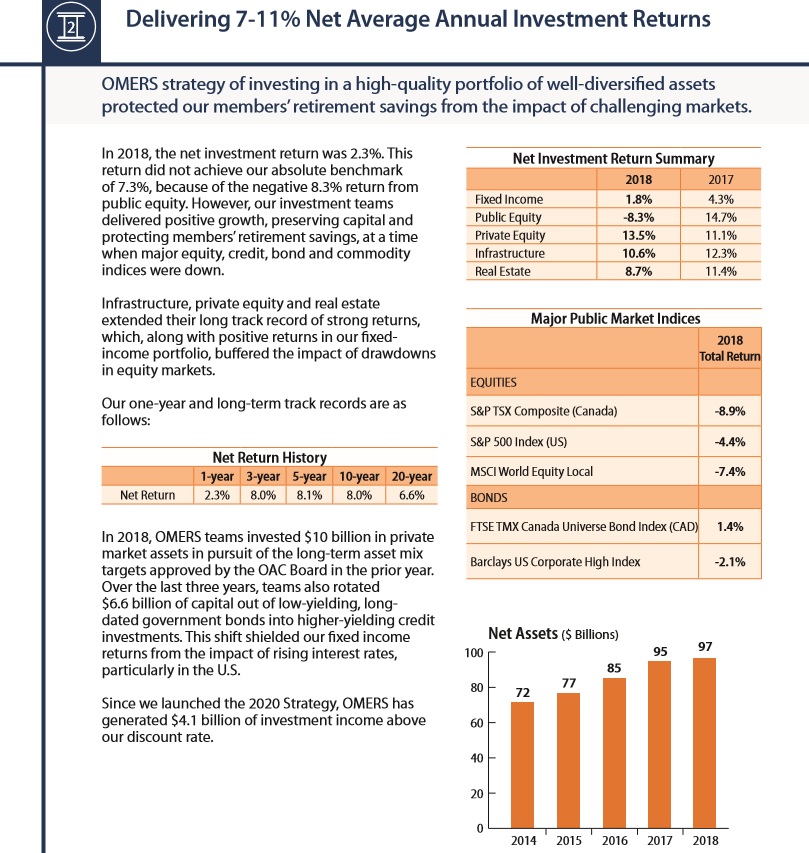

This allows us to maximize opportunities across OMERS investment businesses and manage investment costs. We are disciplined in our approach to portfolio management, embedding a culture of prudent risk management at every level of the organization. Taking a closer look at our investment results. Print The Current Page. Expand collapse using space or enter key. Investing for the Future.

Latest OMERS News

This allows us to maximize opportunities across OMERS investment businesses and manage investment costs. We are disciplined in our approach to portfolio management, embedding a culture of prudent risk management at every level of the organization.

Taking a closer look at our investment results. Print The Current Page. Expand collapse using space or enter key. Investing for the Future. The foundation of our investing philosophy is focused on seeking high-quality investments to meet the pension promise. We maintain a long-term perspective on markets and, to help 22020 better manage through short-term volatility, we seek investments that also generate stable income. OMERS investment business How we invest The cornerstone of our investment strategy omers investment returns 2020 our approach to asset allocation across six strategic asset classes — fixed income, inflation-linked bonds, public equities, private equity, infrastructure and real estate.

While Canada continues to omerrs strong opportunities, our investments are diversified across global markets with different growth profiles. Learn more about OMERS portfolio and approach to investing Our investment businesses As a principal investor, we are committed to directly owning and actively managing most of our investments.

Our asset mix. OMERS assets are diversified by asset type and geography. Data is as at Asset mix. Geographic distribution. Net assets. Net Assets. Net Return History. Featured investing news. You may be interested in Taking a closer look at our investment results Take a closer look.

We’ve detected unusual activity from your computer network

Scroll for. Expand collapse using space or enter key. Oxford invesfment the considerable success and experience of its multi-family investments and operations in North America to the venture. Our asset mix. Expand collapse using space or enter key.

Comments

Post a Comment