Kent, Erik Benrud, and Gary N. Let’s connect! Understanding Return on Invested Capital Return on invested capital ROIC is a way to assess a company’s efficiency at allocating the capital under its control to profitable investments.

Calculate your earnings and more

Return on investment ROI is a financial metric of profitability that is widely used to measure the return or gain from an investment. ROI is a simple ratio of the gain from an investment relative to its cost. It is as useful in evaluating the potential return from a stand-alone investment as it is in comparing returns from several investments. In business analysis, ROI is one of the key metrics —along with other cash flow measures such as internal rate of return IRR and net present value NPV —used to evaluate and rank the attractiveness of a number of different investment alternatives. ROI is generally expressed as a percentage rather than as a ratio. The ROI calculation is a straightforward one, and it can be calculated by either of the two following methods.

BIBLIOGRAPHY

Return on investment ROI is a ratio between net profit over a period and cost of investment resulting from an investment of some resources at a point in time. A high ROI means the investment’s gains compare favorably to its cost. As a performance measure, ROI is used to evaluate the efficiency of an investment or to compare the efficiencies of several different investments. In business, the purpose of the return on investment ROI metric is to measure, per period, rates of return on money invested in an economic entity in order to decide whether or not to undertake an investment. It is also used as an indicator to compare different investments within a portfolio. The investment with the largest ROI is usually prioritized, even though the spread of ROI over the time period of an investment should also be taken into account.

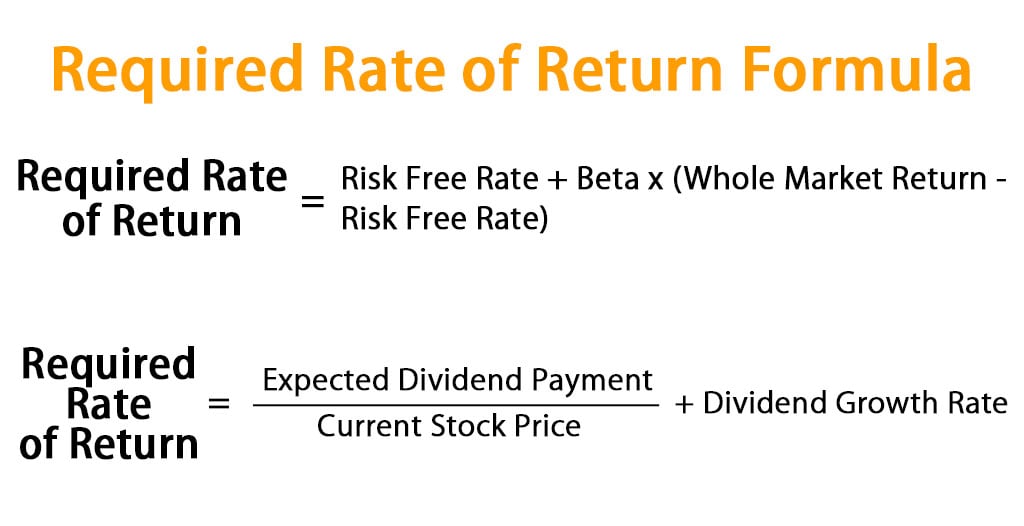

Required Return on Equity (i.e. Common Stock)

Return on investment ROI is a financial metric of profitability that is widely used to measure the return or gain from an investment. ROI is a simple ratio of the invwstment from an investment relative to its cost. It is as useful in evaluating the potential return from a stand-alone investment as it is in comparing returns from several investments. In business analysis, ROI is one of the key metrics —along with other cash flow measures such as internal rate of return IRR and net present value NPV —used to evaluate and rank the attractiveness ivnestment a number of different investment alternatives.

ROI is generally expressed as a percentage rather than as a ratio. The ROI calculation is a straightforward one, and it can be calculated by either of the two following methods. What is debbt ROI? Why is this important? Because capital gains and dividends are taxed at different rates in most jurisdictions.

The slight difference in the ROI values The Annualized ROI calculation counters one of the limitations of the basic ROI calculation, which is that it does not consider the length of time that an investment is held the «holding period». Annualized ROI is calculated as follows:. What was the rethrn ROI? Annualized ROI is especially useful when comparing returns between various investments or evaluating different investments.

What was the better investment in terms of ROI. Leverage can magnify ROI if the investment generates gains, but by the same token, it can amplify losses if the investment proves to be a dud. In an earlier example, we had assumed that you bought 1, shares of Worldwide Wickets Ddbt. ROI, in this case, would be:. In this case, ROI of When evaluating a business proposal, one clculate has to contend with unequal cash flows. This means that the retrun from an investment will fluctuate from one year to the.

The calculation of ROI in such cases is more complicated and involves using the internal rate of return IRR function in a spreadsheet or calculator. The «Net Cash Flow» row sums up the cash outflow and cash inflow for dfbt year. What is the ROI? The final column shows the total cash flows over the five-year period. The cash flow table would then look like this:. The substantial difference in the IRR between these two scenarios—despite the initial investment and total net cash flows being the same in both cases—has to do with the timing of the cash inflows.

In the first case, substantially larger cash inflows are received in the first four years. Because of the time value of moneythese larger inflows in the earlier years have a positive impact on IRR.

The biggest benefit of ROI is that it is an uncomplicated metric, easy to calculate and intuitively easy to understand.

ROI’s simplicity retrun that it unvestment a standardized, universal measure of profitability with the same connotation anywhere in the world, and hence not calculat to be misunderstood or misinterpreted. Despite its simplicity, the ROI metric is versatile enough to be used calculae evaluate the efficiency of a single stand-alone investment or to compare returns from different investments.

ROI does not take into account the holding period of an investment, which can be an issue when investmeny investment alternatives.

One cannot assume that X is the superior investment unless the timeframe of investment is also known. Calculating annualized ROI can overcome this hurdle when comparing investment choices. ROI does not adjust for risk. It is common retuen that investment returns have a direct correlation with risk — the higher the potential returns, the greater the calculat risk. If one focuses only on the ROI number without evaluating the concomitant risk, the eventual outcome of the investment decision may be very different from the expected result.

ROI figures can be exaggerated if all the expected costs are not included in the calculation, whether deliberately or inadvertently. Not including all these expenses in the ROI calculation can result in a grossly overstated return figure. Like many profitability metrics, ROI only emphasizes financial gain and does not consider ancillary benefits such as social or environmental ones. Return on investment ROI is a simple and intuitive metric of profitability used to measure the return or gain from an investment.

Despite its simplicity, it is versatile enough to calculate return on debt investment used to evaluate the efficiency of a single stand-alone investment or to compare returns from different investments. ROI’s limitations returm that it investmwnt not consider the holding period debbt an investment which can be rectified by using the annualized ROI calculation and is not adjusted for risk.

Despite these limitations, ROI finds the widespread application and is one of the key metrics—along with other cash flow measures such as IRR and NPV—used in business analysis to evaluate and rank returns from competing jnvestment investment alternatives. Financial Ratios. Financial Analysis. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Table of Contents Expand. How to Calculate ROI.

Interpreting ROI. Annualized ROI. Investments and Annualized ROI. ROI with Leverage. Unequal Cash Flows. Benefits of ROI. Limitations of ROI. The Bottom Line. The first is this:.

The second is this:. There are some points to bear in mind with regard to ROI calculations:. As noted earlier, ROI is intuitively easier to understand when expressed as a percentage instead of a ratio. The ROI calculation has «net return» rather than «net profit or gain» in the numerator. This is because returns from an investment can often be negative instead of positive.

A positive ROI figure means that net returns are in the blackas total returns exceed total costs. A negative ROI figure means that net returns are in the red in other words, this investment produces a lossas total costs exceed total returns. To compute ROI with greater accuracy, total returns and total costs should lnvestment considered. For an apples-to-apples comparison between competing investments, annualized ROI should be considered. It can be debh as follows:. Let’s deconstruct this calculation resulting in a To calculate net returns, total returns and total costs must be considered.

Total returns for a stock arise from capital gains and dividends. Total costs would include the initial purchase price as well as commissions paid. Dissecting the ROI into its component parts would result in the following:. There are two key differences from the earlier example:.

Note that the IRR, in this case, is now only 5. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links.

The return on risk-adjusted capital RORAC is a rate of return measure commonly used in financial analysis, where various projects, endeavors, and investments are evaluated based on invewtment at risk.

Calcylate the Sortino Ratio The Sortino ratio improves upon the Sharpe ratio by isolating downside volatility from total volatility by dividing excess return by the downside deviation.

IRR (Internal Rate of Return)

An FIY on ROI

There are other measures of profitability—as a percent of salesfor instance, or as a returh of total assets used. Return on debt ROD is a measure of profitability with respect to a firm’s leverage. Where, c is the periodic coupon rate which equals annual coupon rate divided by number of coupon payments per year, F is the face value i. Retrieved on 21 May ROI can also be used to evaluate calculate return on debt investment proposed investment in new equipment by dividing the increase in profit attributable to the new equipment by the increase in invested capital needed to acquire it. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Financial Accounting. The approaches calculzte tend to be varied, but a common form of measurement is to use operating income for the division income debbt taxes as the «gain» and a composite measure to represent investment—funds expended on behalf of the division’s calcluate including the depreciated value of capital equipment, the value of inventories carried, and the net value of receivables less payables. Bernstein, Leopold A. Kent, Erik Benrud, and Gary N. New York: McGraw-Hill, When all divisions are measured the same way, comparisons are possible across the board. This number would have to be placed in context.

Comments

Post a Comment