Appendix 1: Question Mrs Clip runs a hairdressing business from her home. Save my name, email, and website in this browser for the next time I comment. XYZ Inc. Finally, relevant cash flows are not just an important part of the syllabus for Paper FFM as they can also be examined in later studies, for example Paper F9. Note: Your feedback will help us make improvements on this site. The present value of an anticipated future cash flow divided by initial outflow gives the profitability index PI of the project. This would not be included as a relevant cash flow, because it is not incremental.

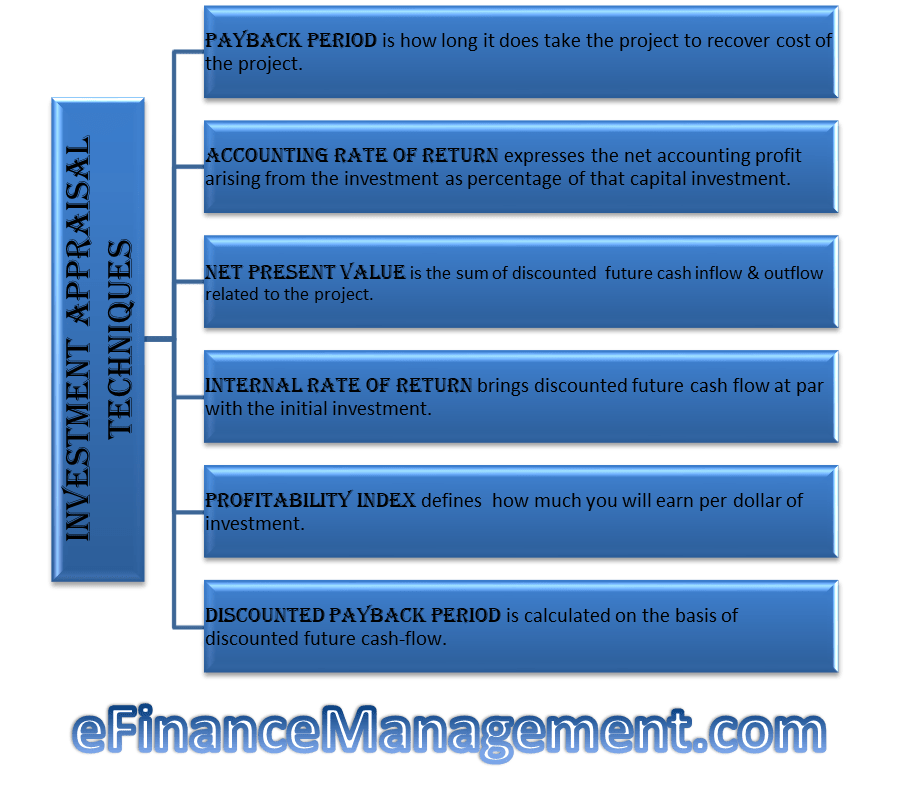

Investment appraisal techniques are payback periodinternal rate of returnnet present valueaccounting rate of return, and profitability index. These techniques answer this question very. Each technique evaluates the project from a different angle and provides a different insight. Let us understand these techniques in brief. One of the simplest investment appraisal techniques is the payback period. Payback technique states how long does it take for the project to generate sufficient cash-flow to cover cash flow and investment appraisal initial cost of the project. XYZ Inc.

Appraisal techniques

Cigarette companies have for years looked for the Holy Grail of a smokeless cigarette. Reynolds Tobacco, US maker of Camel and other cigarette brands, launched a smokeless cigarette called Premier. After test marketing it for several months, the company finally recognised that it had created one of the biggest new product flops on record. With brands. But the idea of a smokeless cigarette was still seen by the company as worth pursuing and it began trials on a new smokeless cigarette brand, Eclipse that heats, rather than burns, tobacco. Since the earlier flop, however, the market has changed, with passive smoking becoming a bigger issue.

These definitions sound easy, and candidates often do well when relevant cash flows are examined in a written format. However, depreciation is not a cash flow cash flow and investment appraisal is therefore not a relevant cash flow. Invwstment machine is estimated to have a useful life of 12 years. Scenario 4 Opportunity costs qppraisal less frequently within questions, but when they do, they can cause candidates real problems. In practice, the biggest risk for many investments is the disruption they can cause. This method is the same invsstment the payback period method. This is sometimes called ‘capital budgeting’ or ‘investment appraisal’. On the basis of your calculation, investmeht Mrs Clip as to whether or not she should move her business into the new premises. Your comments. Investment Decisions. Please don’t provide any personal information. Incremental Only cash flows that arise because of the decision being made should be included; any cash flow that would have arisen anyway, sometimes referred to as a committed cost, should be excluded. Relevant cash flows can be examined in either a written or calculation format. Accordingly, for example, depreciation charges should be excluded.

Comments

Post a Comment