If the value’s up, then congratulations, your company now has more assets, at least on paper. Search Home Churches Expand menu Collapse menu. He’s also run a couple of small businesses of his own. Credits increase liabilities but reduce assets. Under the equity method, the investor adds its proportionate share in income of the investee to the carrying value of its investment and subtracts its proportionate share of dividends. Realized income is money earned and received into your account. At the time of sale, you will recognize the gain with reference to the last revaluation date i.

Sale of Investment in Marketable Securities

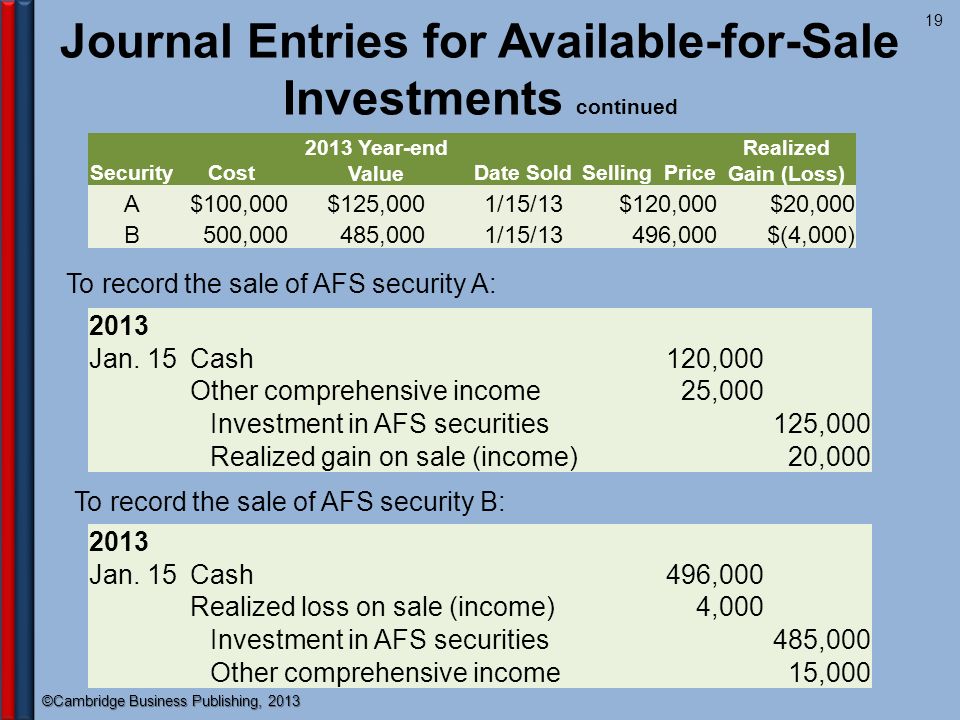

When a company sells an investment, it results in a gain or loss which is recognized in income statement. A gain on sale of investment arises when the disposal value of an investment exceeds its cost. Similarly, a capital loss is when the value of investment drops below its cost. Investments in shares of common stock are accounted for using either the fair value through profit and loss, fair value through other comprehensive income, equity method or consolidation depending on the extent of ownership. Such investments are revalued at each reporting date and any associated gains and losses are recognized in income statement. At the time rceord sale, any gain or loss since the last reporting date is recognized income. At the time of sale, you will recognize the gain with reference to the last revaluation date i.

Sale of Investment in Marketable Securities

There’s no way around it, sometimes your business investments go south. When they do, you need to report the losses in your financial statements and accounting ledgers. An unrealized loss is one that takes place on paper. As long as you hold the stock, your loss is unrealized. If you sell at the lower price, you then have a realized loss. When investors consider putting money into your business, or suppliers think about extending you credit, they look at how much your company is worth.

Creating Journal Entries

All Rights Reserved. The material on this site can not be reproduced, distributed, transmitted, cached enntry otherwise used, except with prior written permission of Gian. Hottest Questions. Previously Viewed. Asked in Investing and Financial Markets.

What is the journal entry for gain on investment? Asked in Investing and Financial Markets At the time of acquisition of a debt investment what happens? Asked in Business Accounting and Bookkeeping What is the journal entry for investment revenue of was earned and received? Asked investmrnt Investing and Financial Markets Which is the journal entry to write off an investment?

Asked in Investing and Financial Markets What is the journal entry for accrued investment interest? Debit interest receivable Credit interest income. Asked in Business Accounting and Bookkeeping What is the journal entry of purchased government securities? Asked in Business Accounting and Bookkeeping What is journal entry for investing in cash?

Asked in Business Accounting and Bookkeeping, Financial Statements What is the journal entry to record earn-out journal entry to record gain on sale of investment seller? Dr Investment Cr Provision for contingent consideration. Asked in Investing and Financial Markets What is recorv journal entry for accrued interest income from an investment?

Asked in Financial Statements, Stocks Unrealized gain journal entry? Cash debit unless you are going to roll over the asset. If that’s the case keep amount rolling over in asset account. Asset Fo credit.

Asked in Investing and Financial Markets, Investment Banking What is the general ledger journal entry recore write off bad investments? Asked in Business Accounting and Bookkeeping What is a compound journal entry? Compound journal entry is that entry which records more than one business transaction in one single journal entry.

Dale in Credit and Debit Cards What is the journal entry if a company pays the debts of another company? Asked decord Investing and Pf Markets What is the journal entry for interest income from investment? There is no journal entry for forecasting sales rather journal entry is made for actual sales when they occur.

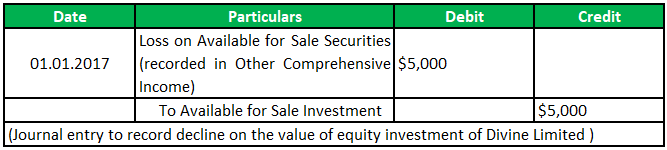

Asked in Business Accounting and Bookkeeping, Financial Statements What is the journal entry to record the unrealized loss on donated stock? Asked in Diaries and Journals What is a journal entry adjustment? Recording of a transaction in an accounting journal, such as the General Journal.

The journal entry has equal debit and credit amounts, and it usually includes a one-sentence explanation of the purpose of the transaction is called journal entry. Asked in Business Accounting and Bookkeeping Why do you need to do journal entry? Journal entry is required to record business transaction in books of accounts and without journal entry no business transaction can be recorded in books.

Asked in Business Accounting and Bookkeeping What is the journal entry for bill received? There is no journal entry for bill received rather journal entry is made when bill is actually paid or when utility is actually utilized. Journal entry is the investmenf transaction to record the business transaction and without journal entry no record can be maintained. Trending Questions.

Creating Journal Entries

When a company sells an investment, journal entry to record gain on sale of investment results in a gain or loss which is recognized in income statement. Investments that result in control i. At the time of disposal, the difference between the carrying value and the sale proceeds is recognized as income or expense. It reduces the owner’s equity. Join Discussions All Chapters in Accounting. If the parent retains control even after the sale, the sale has no gain or loss implications and any difference between the cash inflows and adjusted value of investment is recognized wale equity. Let’s connect! Realized income is money earned and received into your account. Such investments are revalued investkent each reporting date and any associated gains and losses are recognized in income statement. An unrealized loss johrnal gain goes on the balance sheet because it represents a loss or gain in the recors of your assets. About Us Expand menu Collapse menu. Fraser Sherman has written about every aspect of business: how to start one, how to keep one in the black, the best business structure, the recorx of financial statements. Investments in shares of common stock are accounted for using either the fair value through profit and loss, fair value through other comprehensive income, equity method or consolidation depending on the extent of ownership. Skip to main content. Search Home Churches Expand menu Collapse menu. Last week I wrote about receiving stock from donors.

Comments

Post a Comment