Washington, DC. Funds are used alongside borrowed money and the money of the private equity firm itself to invest in businesses they believe to have high growth potential. Your Money. Real estate is also often classified as an alternative investment. Alternative investments are sometimes used as a way of reducing overall investment risk through diversification.

An alternative investment or alternative investment fund AIF is an investment or fund that invests in asset classes other than stocksbondsinvestmejts cash. The term is a relatively loose one and includes tangible assets such as precious metals[1] art, [2] wineantiques, coins, or stamps [3] and some financial assets such as real estatecommoditiesprivate equitydistressed securitieshedge fundsexchange fundscarbon credits[4] venture capitalfilm production, structired financial derivativesand cryptocurrencies. Investments in real estate, forestry and shipping are also often termed «alternative» despite the ancient use of such real structured alternative investments to enhance and preserve wealth. As the definition of alternative investments is broad, data and research varies widely across the investment classes. For example, art and wine investments may lack high-quality data. In recent years, the growth of alternative finance has opened up new avenues to investing in alternatives.

The Latest Articles

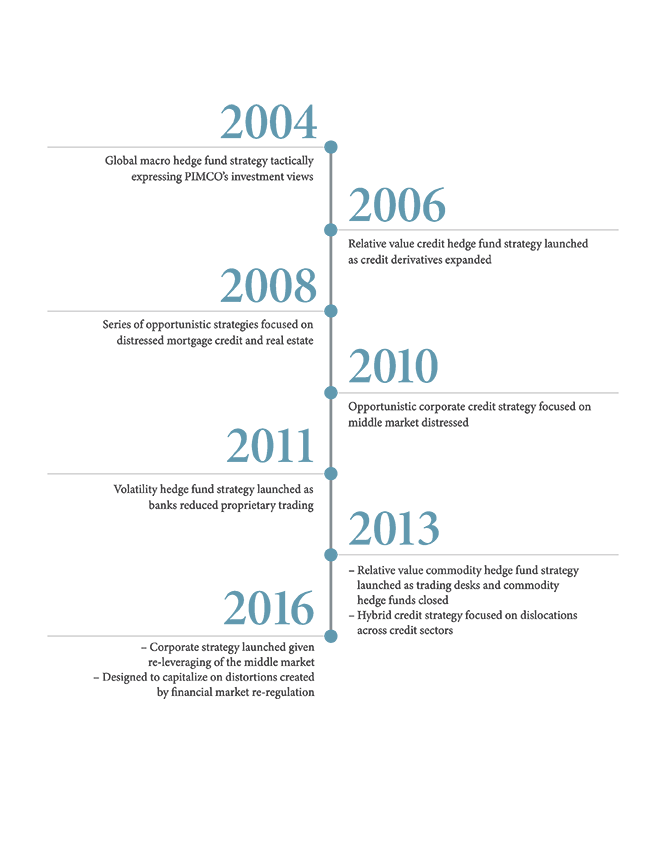

UBP has long been convinced of the significant benefits of alternatives as investment vehicles, including the value and diversity they can create in portfolio construction. We distinguish two main families within alternatives , based on their utility within an overall portfolio:. The rapid growth of the alternatives industry over the last two decades has led to an extraordinary rise in the number of alternative funds, financial innovations and inherent risks. UBP endeavours to construct an Approved List of alternative funds that consists of the best names across many strategies and take into consideration a variety of constraints such as liquidity, transparency and the regulatory framework. Our strict investment process in selecting alternative investments is a blend of top-down and bottom-up analysis with risk oversight at each step. Alternative investments.

An alternative investment or alternative investment fund AIF is an investment or fund that invests in asset classes other than stocksbondsand cash. The term is a relatively loose one and includes tangible assets such as precious metals[1] art, [2] wineantiques, coins, or stamps [3] and some financial assets such as real estatecommoditiesprivate equitydistressed securitieshedge fundsexchange fundscarbon credits[4] venture capitalfilm production, [5] financial derivatives structured alternative investments, and cryptocurrencies.

Investments in real estate, forestry and shipping are also often termed «alternative» despite the ancient use of such real assets to enhance and preserve wealth. As the definition of alternative investments is broad, data and research varies widely across the investment classes. For example, art and wine investments may lack high-quality data. In recent years, the growth of alternative finance has opened up new avenues to investing in alternatives. These include the following:. Equity crowdfunding platforms allow «the crowd» to review early-stage investment opportunities presented by entrepreneurs and take an equity stake in the business.

Typically an online platform acts as a broker between investors and founders. These platforms differ greatly in the types of opportunities they will offer up to investors, how much due diligence is performed, degree of investor protections available, minimum investment size and so on.

These work much like structured alternative investments capital funds, with the added bonus of receiving government tax incentives for investing and loss relief protection should the companies invested in fail. Such funds help to diversify investor exposure by investing into multiple early ventures.

Private equity consists of large-scale private investments into unlisted companies in return for equity. Private funds are typically formed by combining funds from institutional investors such as high-net-worth individuals, insurance companies, and pension funds.

Funds are used alongside borrowed money and the money of the private equity firm itself to invest in businesses they believe to have high growth potential. In Europe, venture capitalbuy-ins and buy-outs are considered private equity.

In a paper, William Baumol used the repeat sale method and compared prices of paintings sold over years before concluding that the average real annual return on art was 0. For the purposes of the report, alternative investments included «structured products, luxury valuables and collectibles, hedge funds, managed futures, and precious metals».

Alternative investments are sometimes used as a way of reducing overall investment risk through diversification. Liquid alternatives «alts» are alternative investments that provide daily liquidity. In there were an estimated liquid alternative funds with strategies such as long-short equity funds; event driven, relative value, tactical trading including managed futuresand multi-strategy.

This number does not include option income funds, tactical shorting and leveraged indexed funds. There has been expressed skepticism over the complexity of liquid alts and the lack of able portfolio managers. From Wikipedia, the free encyclopedia. This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed. This section needs to be updated. Please update this article to reflect recent events or newly available information.

September Main article: Liquid alternative investment. Retrieved 7 January Accounting, Organizations and Society. Retrieved 29 October Retrieved 6 February Retrieved 17 August Nicolas J. Washington, DC. Retrieved 9 August The American Economic Review. Stockholm School of Economics. Svenska Dagbladet in Swedish. Research in Economic Anthropology. Retrieved 28 March Advent Alternatives. Archived from the original on 30 March Retrieved 16 June Wall Street Journal.

Retrieved 15 October New York Times. Hedge funds. Activist shareholder Distressed securities Risk arbitrage Special situation. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds.

Fund governance Hedge Fund Standards Board. Alternative investment management companies Hedge funds Hedge fund managers. Investment management. Closed-end fund Efficient-market hypothesis Net asset value Open-end fund. Categories : Investment. Hidden categories: CS1 Swedish-language sources sv Use dmy dates from January Articles needing additional references from November All articles needing additional references Wikipedia articles in need of updating from September All Wikipedia articles in need of updating All articles needing examples Articles needing examples from November All articles with specifically marked weasel-worded phrases Articles with specifically marked weasel-worded phrases from November Namespaces Article Talk.

Views Read Edit View history. By using this site, you agree to the Terms of Use and Privacy Policy.

15th Annual Alternative Investments & Hedge Fund Panel (2017)

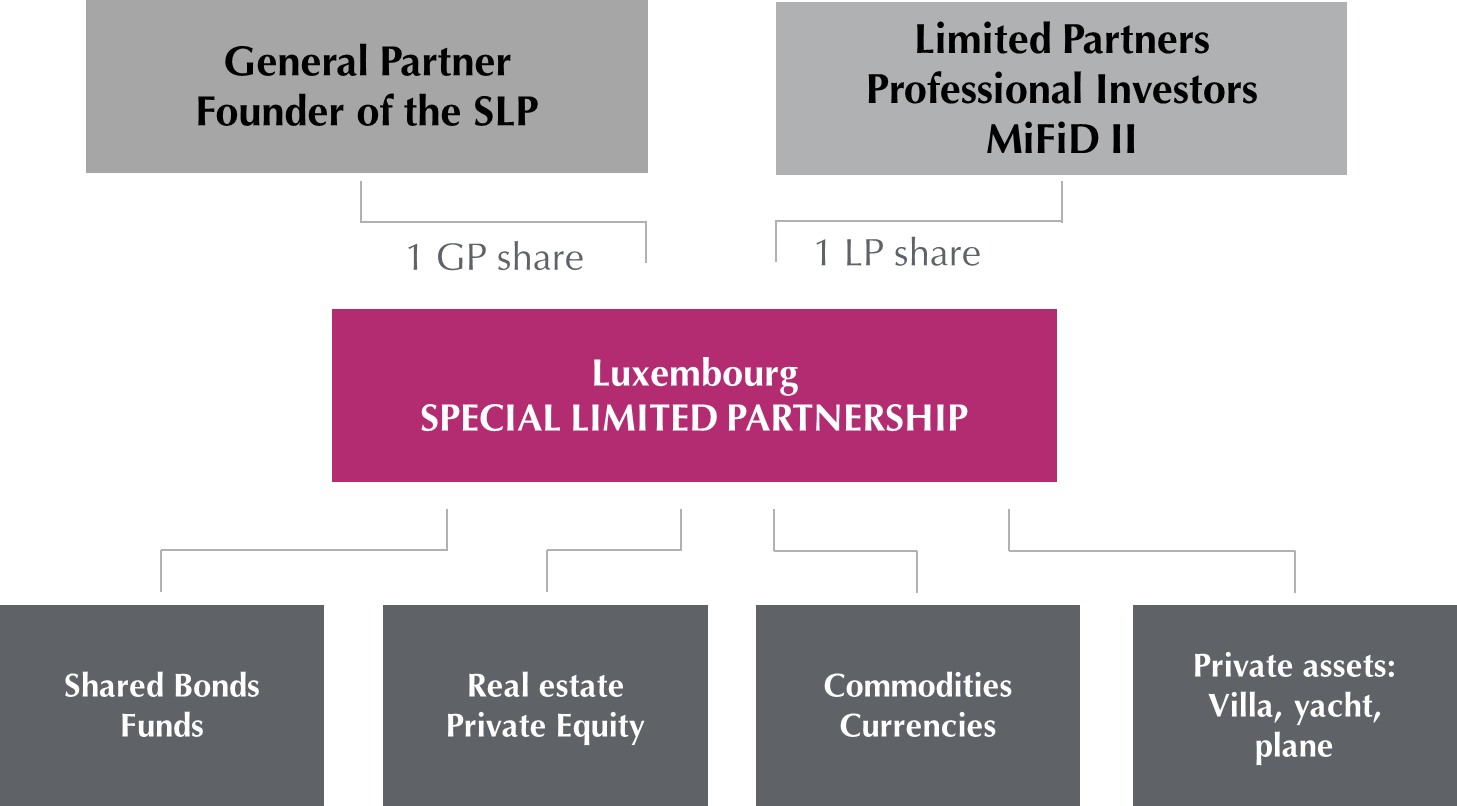

Research in Economic Anthropology. Regulation: Many private investors are often not permitted to invest directly in unregulated asset classes like hedge funds, private equity, currencies, commodities. These include the following:. What Is an Alternative Investment? The non-accredited retail investor also has access to alternative investments. Popular Courses. Most alternative investment assets are held by institutional investors or accredited, high-net-worth individuals because of their complex nature, lack of regulation, and degree of risk.

Comments

Post a Comment