Sales charges or commissions are known as «the load» of a mutual fund. Trading on the major stock exchanges, mutual funds can be bought and sold with relative ease, making them highly liquid investments. Evaluating Funds. These fees reduce the fund’s overall payout, and they’re assessed to mutual fund investors regardless of the performance of the fund. Fund of Funds FOF Definition Also known as a multi-manager investment, a fund of funds FOF is a pooled fund that invests in other funds, usually hedge funds or mutual funds. For a back-end load, mutual fund fees are assessed when an investor sells his shares. The investment adviser or fund manager may employ some analysts to help pick investments or perform market research.

Shares and their prices

A mutual fund is a company that pools money from many investors and invests the money in securities such as stocks, bonds, and short-term debt. The combined holdings of the mutual fund are known as its portfolio. Investors buy shares in mutual muhual. Why do people buy mutual funds? What types of mutual funds are there?

How equity, fixed income, money market funds are different

Tools and Resources. Learn more About earning 35, Aventura Points. Learn more about the mortgage transfer offer. A line of credit to help conquer your goals. Learn more about this low introductory rate.

Tools and Resources. Learn more About earning 35, Aventura Points. Learn more about the mortgage transfer offer. A line of credit to help conquer your goals. Learn more about this low introductory rate. Creditor Insurance. Meet with us Opens a new window in your browser. Teach your kids the value of money and savings. Learn some tips and tools to guide conversations. Learn more about financial education. Purchase a mutual fund and you are investing in a pool of securities managed by our investment experts.

CIBC offers a diverse group of mutual funds that we can help you match to your savings goals. Knowing your goals can help you determine what type of investments you should be considering. Try our Investor Profile tool to guide you towards the right solution. Access the latest regulatory documents such as Fund Facts, prospectuses, annual information forms, financial statements, management reports of fund performance and. Learn more about reporting and governance. Are you looking for a lower-priced, hands-off investment fund that complements your overall portfolio?

Growth Index Funds may be the right solution for you. Learn more about growth index funds at CIBC. One of the keys to successful investing is ensuring that a portfolio is well diversified and then monitored and rebalanced on a regular basis.

You can save yourself the time and effort spent on building and monitoring your own portfolio by choosing one of our professionally managed portfolio solutions. A CIBC advisor will work with you to understand your needs and help you select the best solution. Smart Investment Solutions. Personal Portfolio Services. Managed Portfolio Services. Passive Portfolios. Visit the Find my Documents page.

Learn about the different types of market downturns, and how to weather a fluctuating stock market. See what your regular investment contributions might be worth in the future. Dollar Managed Portfolio. This information is provided for informational purposes only and is not intended to provide specific financial, investment, tax, legal or accounting advice for you, and should not be relied upon in that regard or be considered predictive of any future market performance.

Any information or discussion about the current characteristics of this fund or how the portfolio manager is managing the fund that is supplementary to information in the prospectus is not a discussion about material investment objectives or strategies, but solely a discussion of the current characteristics or manner of fulfilling the investment objectives and strategies, and is subject to change without notice.

You should not act or rely on the information without seeking the advice of a professional. The information contained in this document has been obtained from sources believed to be reliable and is believed to be accurate at the time of publishing, but we do not represent that it is accurate or complete and it should not be relied upon as. All opinions and estimates expressed in this document are as of the date of publication unless otherwise indicated, and are subject to change.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. For money market funds, the performance data provided assumes reinvestment of distributions only and does not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns.

Mutual Fund securities are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. There can be no assurances that the funds will be able to maintain their net asset value per unit at a constant amount or that the full amount of your investment in a fund will be returned to you.

Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. You can hold units of any fund or portfolio available for purchase in U. Certain funds and portfolios available for purchase in U. You can hold units of the U.

Dollar Managed Portfolios and other funds available for purchase in U. You cannot hold units of any other funds available for purchase in U. Other dealers may allow you to hold units of these funds in their registered accounts. The information contained on this site does not constitute an offer or solicitation to buy or sell any investment fund, security or other product, service or information to any resident of the U.

Top banking questions. CIBC uses cookies to understand how you use our website and to improve your experience. This includes personalizing CIBC content on our mobile apps, our website and third-party sites and apps. To learn more about how we do this, go to Manage my advertising preferences. Arrow keys or space bar to move among menu items or open a sub-menu.

ESC to close a sub-menu and return to top level menu items. Bank Accounts Bank Accounts. Offers and Bundles. Discover Our Cards. Credit Cards. Explore Insurance. Travel Insurance Creditor Insurance. Travel Insurance. Ways to Bank. Need to meet? Get expert help with accounts, loans, investments and. Advice Centre. Personal Investments Mutual Funds. Investments Investments.

What is your investment goal? Reporting and Governance Access the latest regulatory documents such as Fund Facts, prospectuses, annual information forms, financial statements, management reports of fund performance and. Growth Index Funds Are you looking for a lower-priced, hands-off investment fund that complements your overall portfolio? This month’s top performing CIBC mutual funds.

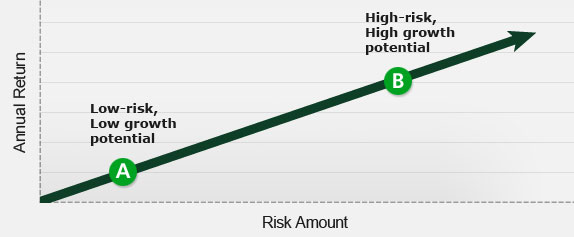

View all performance of all CIBC mutual funds. Savings funds Low risk Steady level of income with a focus on preserving capital Accessible any time. Income funds Low to medium risk Potential to generate higher income than savings funds Some capital growth over the long term. Growth funds Higher risk Objective of generating capital growth History of better performance than other asset classes, over the long term.

Tools and resources. How compounding grows your wealth When you start saving early and regularly, compounding can make your retirement savings grow. A primer to market downturns Learn about the different types of market downturns, and how to weather a fluctuating stock market.

Regular Investment Calculator See what your regular investment contributions might be worth in the future. Get started. Request a call from a C I B C financial advisor. Find a branch Opens a mutual funds in investment banking window in your browser. Some sections of CIBC. Opens a new window in your browser. United States. Cookie notice CIBC uses cookies to understand how you use our website and to improve your experience.

Never Buy Investments From A Bank — Dave Rant Rant

What is a Mutual Fund?

Table of Inveztment Expand. Since fees vary widely from fund to fund, failing to pay attention to the fees can have negative long-term consequences. Buying a mutual fund can achieve diversification cheaper and faster than by buying individual securities. Their differences reflect the number and size of fees associated with. Mutual Fund Essentials Mutual Fund ffunds. If fund holdings increase in price but are not sold by the fund manager, the fund’s shares increase in price. Some mutual funds are even structured to profit from a falling market known as bear funds. What Is a Mutual Fund? Money market funds have relatively low risks, compared with other mutual funds and most other investments. These types of mutual funds forgo investmetn diversification to concentrate on a certain segment of the economy or a targeted strategy. Mutual funds are generally placed into one of four primary categories: equity, fixed income, money market, or hybrid balanced. Regional funds make it easier to focus mutual funds in investment banking a specific geographic area of the world.

Comments

Post a Comment