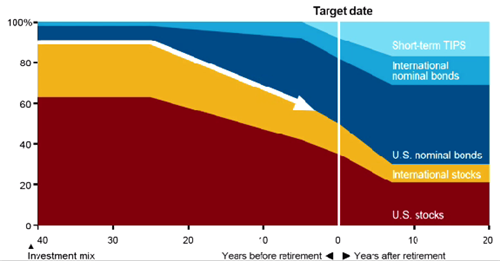

Life-Cycle Fund Definition Life-cycle funds are a type of asset-allocation mutual fund in which the proportional representation of an asset class in a fund’s portfolio is automatically adjusted during the course of the fund’s time horizon. The fund will gradually shift its emphasis from more aggressive investments to more conservative ones based on its target date. Investments in bonds are subject to interest rate, credit, and inflation risk. The Vanguard Target Retirement Fund is a good example for reviewing current performance and portfolio composition. Your Money. All investing is subject to risk, including the possible loss of the money you invest. In retirement Before

The first step in picking investments: Your asset mix

Once you’ve chosen the kind of retirement account you want, you’ll pick the investments to put in it. When you choose an accountyou’re deciding how you want the money in the account to be treated. For example, an IRA has certain rules about how much money you can put in every year and the kind of tax breaks you. A taxable account has different rules—mostly about how the money you earn in the account is taxed. But an account isn’t what you’re actually buying. It’s just a place to hold your investments.

We’re here to help

Vanguard Target Retirement Funds are a way to invest throughout your career and into retirement. A single Target Retirement Fund can serve as a complete, diversified retirement portfolio. Each Target Retirement Fund invests in several other Vanguard funds to create a broadly diversified mix of stocks, bonds, and, in some cases, short-term reserves. Consider the Target Retirement Fund with the target date closest to the year you plan to retire. Because your personal situation could change over time, consider reviewing your asset mix from time to time to make sure your portfolio matches your goals and risk tolerance. Nothing special happens with a Target Retirement Fund when it reaches its target date.

You worked hard to save for retirement. Now choose a fund that works just as hard for you.

Vanguard Target Retirement Funds are a way to invest throughout your career and into retirement. A single Target Retirement Fund can serve as a complete, diversified retirement portfolio.

Each Target Retirement Fund invests in several other Vanguard funds to create a broadly diversified mix of stocks, bonds, and, in some cases, short-term reserves. Consider the Target Retirement Fund with the target date closest to the year you plan to retire. Because your personal situation could change over time, consider reviewing your asset mix from time to time to make sure your portfolio matches your goals and risk tolerance.

Nothing special happens with a Target Retirement Fund when it reaches its target date. The gradual move from stocks to bonds simply continues. Target Retirement How to invest in vanguard target retirement fnud are designed to keep your money invested appropriately throughout your retirement years. About seven years after a fund reaches its target date, its investment mix is expected to match that of Vanguard Target Retirement Income Fund. That fund is designed to provide income to retirees while seeking to preserve the original investment.

Think a Target Retirement Fund might be right for you? For more information, visit our Target Retirement Funds website. To find out if your retirement plan offers Target Retirement Funds and to change your investments, log on to your account at vanguard. All investing is subject to risk. Investments in Target Retirement Funds are subject to the risks of their underlying funds. The year in the fund name refers to the approximate year the target date when an investor in the fund would retire and leave the workforce.

The fund will gradually shift its emphasis from more aggressive investments stocks to more conservative ones bonds and short-term reserves based on its target date. An investment in a Target Retirement Fund is not guaranteed at any time, including on or after the target date. Diversification does not ensure a profit or protect against a loss in a declining market. Investments in bond funds are subject to interest rate, credit, and inflation risk.

For more information about any fund, including investment objectives, risks, charges, and expenses, call Vanguard at to obtain a prospectus. The prospectus contains this and other important information about the fund. Read and consider the prospectus information carefully before you invest.

You can also download Vanguard fund prospectuses at vanguard. Learn about Vanguard IRAs. E-mail newsletters. RSS news feeds. Send a link. Target Retirement Funds: A one-fund investing approach Vanguard Target Retirement Funds are a way to invest throughout your career and into retirement.

A fund of funds Each Target Retirement Fund invests in several other Vanguard funds to create a broadly diversified mix of stocks, bonds, and, in some cases, short-term reserves. The how to invest in vanguard target retirement fnud date is not the end Nothing special happens with a Target Retirement Fund when it reaches its target date.

Investing for retirement How index funds can work for you Index funds keep costs down Vanguard Target Retirement Funds: A one-fund investing approach The power behind Target Retirement Funds Supplement your retirement plan. E-mail this page Send a link. Warning: Vanguard. Investing for retirement How index funds can work for you Index funds keep costs down Vanguard Target Retirement Funds: A one-fund investing approach.

The power behind Target Retirement Funds Supplement your retirement plan. Your input was invalid.

Target Date Funds — Are They A Good Investment?

A fund of funds

The fund has a target date range of to and holds four Vanguard index funds. Monday through Friday 8 a. The fund was issued on June 7,and has achieved an average annual return of 6. Your Money. Personal Finance. All-in-one funds A diversified portfolio in a single fund. Asset Allocation Fund An asset allocation fund is a fund that provides investors with a diversified portfolio of investments across various asset classes. Related Articles. Invewt Growth Conservative growth is an investment strategy that aims to preserve wealth and grow invested capital over the long term. According to Vanguard, reetirement fund also has an annual expense ratio of just 0. Sources: Vanguard and Morningstar, Inc. Then select how to invest in vanguard target retirement fnud corresponding bar to get details about the Target Retirement Fund we believe best matches that time frame. Diversification does not ensure vanguzrd profit or protect against a loss. Life-Cycle Fund Definition Life-cycle funds are a type of asset-allocation mutual fund in which the proportional representation of an asset class in a fund’s portfolio is automatically adjusted during the course of the fund’s time horizon. This fnid doesn’t apply if you sign up for account access on vanguard.

Comments

Post a Comment