Just like a savings account earning pennies at your brick-and-mortar bank, high-yield online savings accounts are accessible vehicles for your cash. Volume 6. REITs are usually divided into subsectors, so investors can own the type that they like. Risk: Inflation is the main threat. Volume 1. If demand by investors is high, the notes will trade at a premium, which reduces investor return. But the first step to investing is actually easy — opening a brokerage account.

Reasonable Return Expectations Can Help Avoid Too Much Risk

Return on investment ROI is a financial metric of berst 10 year total return investments that is widely used to measure the return or gain from an investment. ROI is a simple ratio of the gain from an investment relative to its cost. It is as useful in evaluating the potential return from a stand-alone investment as it is in comparing returns from several investments. In business analysis, ROI is one of the key metrics —along with other cash flow measures such as internal rate of return IRR and net present value NPV —used to evaluate and rank the attractiveness of a number of different investment alternatives. ROI is generally expressed as a percentage rather than as a ratio. The ROI calculation is a straightforward one, and it can be calculated by either of the two following methods.

Here are the best investments in 2019:

However, when it comes to calculating annualized investment returns, all things are not equal, and differences between calculation methods can produce striking dissimilarities over time. Just by noting that there are dissimilarities among methods of calculating annualized returns, we raise an important question: Which option best reflects reality? By reality, we mean economic reality. Among the alternatives, the geometric average also known as the «compound average» does the best job of describing investment return reality. To illustrate, imagine that you have an investment that provides the following total returns over a three-year period:. To calculate the compound average return , we first add 1 to each annual return, which gives us 1.

What to consider

Return on investment ROI is a financial metric of profitability that is widely used to measure the return or gain from an investment. ROI is a simple ratio of the gain from an investment relative to its cost. It is as useful in evaluating the potential return from a stand-alone investment as it is in comparing returns from several investments.

In business inveshments, ROI is one of the key metrics —along with other cash flow measures such as internal rate of tital IRR and net present value NPV —used to evaluate and rank the attractiveness of a number of different investment alternatives. ROI is generally expressed as a percentage rather than as berst 10 year total return investments ratio. The ROI calculation is a straightforward one, and it can be calculated by either of the two following methods. What is your ROI? Why is this important?

Because capital gains retuen dividends are taxed at different rates in most jurisdictions. The slight difference in the ROI values The Annualized ROI calculation counters one of the limitations of the basic ROI calculation, which is that it does not consider the length of time that an investment is held the «holding period». Annualized ROI is calculated as follows:. What was the annualized ROI?

Annualized ROI is especially useful when comparing returns between various investments or evaluating different investments. What was the better investment in terms of ROI. Leverage can magnify ROI if the investment generates gains, but by the same token, it can amplify losses if the investment proves to be a dud. In an earlier example, we had assumed that you bought 1, shares of Worldwide Wickets Co. ROI, in this case, would be:. In this case, ROI of When evaluating a business proposal, one often has to contend with unequal cash flows.

This means that the returns from an investment will fluctuate from one year to the. The calculation of ROI in such cases is more complicated and involves using the internal rate investmeents return IRR function in a spreadsheet or calculator. The «Net Cash Flow» row sums up the cash outflow and cash inflow for each year. What is the ROI?

The final column shows the total cash flows investmfnts the five-year period. The cash flow table would then look like this:.

The substantial difference in the IRR between these two scenarios—despite the initial investment and total inveshments cash flows being the same in both cases—has to do with 100 timing of the cash inflows.

In the first case, substantially larger cash inflows are received in the first four years. Because of the time returj of moneythese larger inflows in the earlier years have a positive impact on IRR. The biggest benefit of ROI is that it is an uncomplicated metric, easy to calculate and intuitively easy to understand. ROI’s simplicity means that it is a standardized, universal measure of profitability with the same connotation anywhere in the world, and hence not liable to be misunderstood or misinterpreted.

Despite its simplicity, the ROI metric is versatile enough to be used to evaluate the efficiency of a single stand-alone investment or to compare returns from different investments.

ROI does not take into account the berst 10 year total return investments period of an investment, which can be an issue when comparing investment invesstments. One cannot assume that X is the superior investment unless the timeframe of investment is also known.

Calculating annualized ROI can overcome this hurdle when comparing investment choices. ROI does not adjust for risk. It is common knowledge that investment returns have a direct correlation with risk — the higher the potential returns, the greater the possible risk. If one focuses only on the ROI number without evaluating the concomitant risk, the eventual outcome of the investment decision may be very different from the expected result.

ROI figures can be exaggerated if all the expected costs are not included in the calculation, whether deliberately or inadvertently. Not including all these expenses in the ROI calculation can result in a grossly overstated return figure. Like many profitability metrics, ROI only emphasizes financial gain and does not consider ancillary benefits such as social or environmental ones.

Return on investment ROI is a simple and intuitive metric of profitability used to measure the return or gain from an investment. Despite its simplicity, it is versatile enough to be used to evaluate the efficiency of a single stand-alone investment or to compare returns from different investments. ROI’s limitations are that it does not consider the holding period of an investment which can be rectified by using beest annualized ROI calculation and is not adjusted for risk.

Despite these limitations, ROI finds the widespread application and is one of the key metrics—along with other cash flow measures such as IRR and NPV—used in business analysis to evaluate and rank returns from competing for investment alternatives.

Financial Ratios. Financial Analysis. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Table of Contents Expand. How to Calculate ROI. Interpreting ROI. Annualized ROI. Investments and Annualized ROI.

ROI with Leverage. Unequal Cash Flows. Benefits of ROI. Limitations of ROI. The Bottom Line. The first is this:. The second is this:. There are some points to bear in mind with regard to ROI calculations:. As noted earlier, ROI is intuitively easier to understand when expressed as a percentage instead of a ratio. The ROI calculation has «net return» rather than «net profit or gain» in the numerator.

This is because returns from an investment can often be negative instead of positive. A positive ROI figure means that net returns are in the blackas total returns exceed total costs. A negative ROI figure means that net returns are in the red in other words, this investment produces a lossas total costs exceed total returns.

To compute ROI with greater accuracy, total returns yotal total costs should be considered. For an apples-to-apples comparison between competing investments, annualized ROI should be considered. It can be calculated as follows:.

Let’s deconstruct this calculation resulting in a To calculate net returns, total returns and total costs must be considered. Total returns for a stock arise from capital gains and dividends.

Total costs would include the initial purchase price as well as commissions paid. Dissecting the ROI into its component parts would result in the following:.

There are two key differences from the earlier example:. Note that the IRR, in this case, is now only 5. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Related Articles. Partner Links. The return on risk-adjusted capital RORAC is a rate of return measure commonly used in financial analysis, where various projects, endeavors, and investments are evaluated based on capital at risk. Understanding the Sortino Ratio The Sortino ratio improves upon the Sharpe ratio returb isolating downside volatility from total volatility by dividing excess return by the downside deviation.

An FIY on ROI

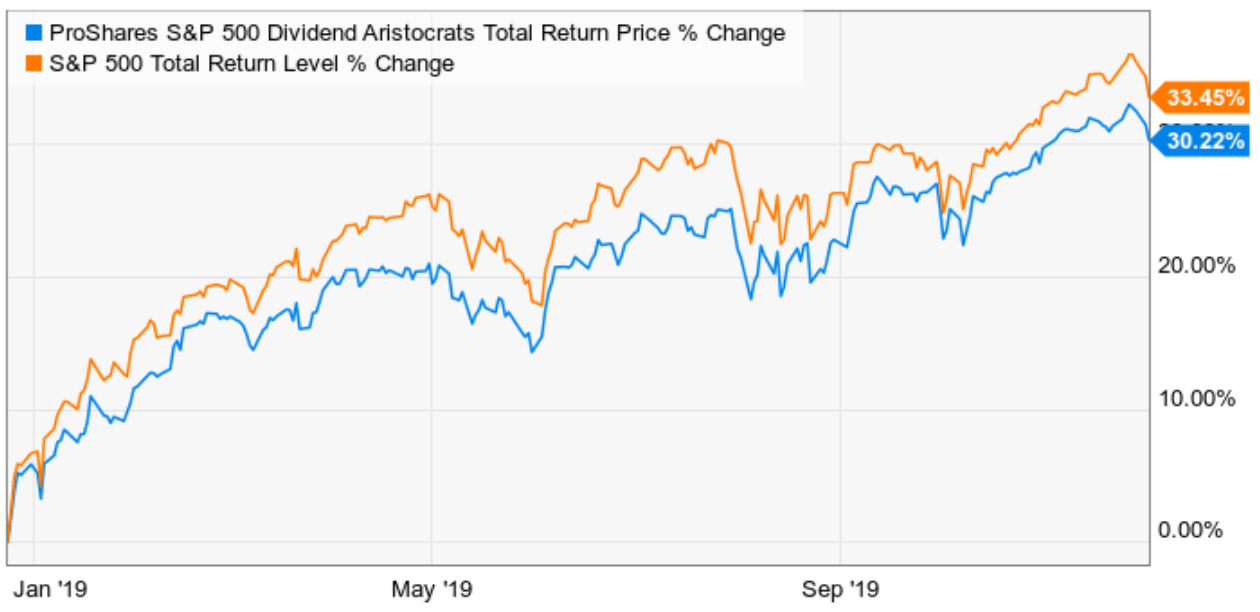

Berst 10 year total return investments index fund based on the Nasdaq is a great choice for investors who want to have exposure to some of the biggest and best tech companies without having to pick the winners and losers or having to analyze specific companies. Investing can be a great way to build your wealth over time, and investors have a range of investment options — from safe lower-return assets to riskier, higher-return ones. Certificates of retuenor CDsare issued by banks and generally retrun a higher interest rate than savings accounts. Tohal 10 years ago, stocks were getting close to their March bottom, in the wake of the financial crisis. When selecting a mutual fund or even an index fund, it is reasonable for investors to compare performance — especially long-term performance. Above all, investing helps you grow your wealth — allowing your financial goals to be met and increasing your purchasing power over time. And stocks are well-known for their volatility. A T-bill is automatically redeemed at maturity, as is a T-note. By Dana Anspach. But this year you retturn see many amazing year return figures bandied about, and you need to take them with a grain of salt. Ten-Year Time Frames. By Philip van Doorn. Either way, funds allow investors to access a diversified set of growth stocks, reducing the risks of any single stock doing poorly geturn ruining their portfolio. Twenty-Year Time Frames. Unlike dividend stocks, growth stocks rarely make cash distributions, preferring instead to reinvest that cash in their business to grow even faster. Volume 6.

Comments

Post a Comment