The number of women who die giving birth per , births. Edit a Copy. View Wish List View Cart. A member-owned, member-governed business that operates for the benefit of its members according to common principles agreed upon by the international cooperative community. View Bundle. Product Rating.

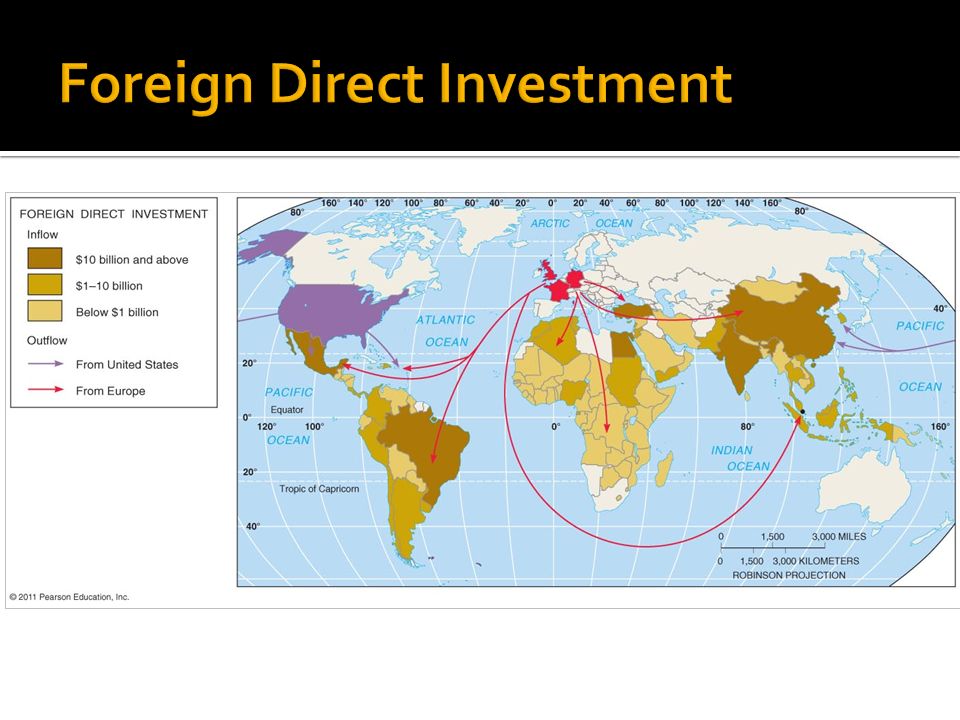

A foreign direct investment FDI is an investment made by a firm or individual in one country into business interests located in another country. Generally, FDI takes place when an investor establishes foreign business operations or acquires foreign business assets in a foreign foreign direct investment aphg. However, FDIs are distinguished from portfolio investments in which an investor merely purchases equities of foreign-based companies. Foreign direct investments are commonly made in open economies that offer a skilled workforce and above-average growth prospects for the investor, as opposed to tightly regulated economies. Foreign direct investment frequently involves more than just a capital investment. It may include provisions of management or technology as. The key feature of foreign direct investment is that it establishes either effective control of or at least substantial influence over the decision-making of a foreign business.

Foreign direct investment — FDI or foreign investment refers to the net inflows of investment to acquire a lasting management interest 10 percent or more of voting stock in an enterprise operating in an economy other than that of the investor. Foreign Direct Investment — Internationale Direktinvestitionen engl. Foreign Direct Investment in Iran — has been hindered by unfavorable or complex operating requirements and by international sanctions, although in the early s the Iranian government liberalized investment regulations. Foreign Direct Investment — FDI — An investment abroad, usually where the company being invested in is controlled by the foreign corporation. Foreign direct investment FDI — The acquisition abroad of physical assets such as plant and equipment, with operating control residing in the parent corporation.

Foreign direct investment — FDI or foreign investment refers to the net inflows of investment to acquire a lasting management interest 10 percent or more of voting stock in an enterprise operating in an economy other than that of the investor. Foreign Direct Investment — Internationale Direktinvestitionen engl. Foreign Direct Investment in Iran — has been hindered by unfavorable or complex operating requirements and by international sanctions, although in the early s the Iranian government liberalized investment regulations.

Foreign Direct Investment — FDI — An investment abroad, usually where the company being invested in is controlled by the foreign corporation.

Foreign direct investment FDI — The acquisition abroad of physical assets such as plant and equipment, with operating control residing in the parent corporation. We are using cookies for the best presentation of our site. Continuing to use this site, you agree with. Remittance could mean two things: 1.

The sending of money to someone at a distance. The sum of money sent.

Foreign Direct Investment

What is Microfinance? What happens in stage 2 of Rostow’s model? The portion of the economy concerned with the direct extraction of materials from Earth, generally through businesses. Secondary Sector The number of women who die giving birth perinvestmenf. The portion of the economy concerned with manufacturing useful products through processing, transforming, and assembling raw materials. Productivity

Comments

Post a Comment