Please help to improve this article by introducing more precise citations. Most alternative investment assets are held by institutional investors or accredited, high-net-worth individuals because of their complex nature, lack of regulation, and degree of risk. Pros Counterweight to conventional assets Portfolio diversification Inflation hedge High rewards.

CONTENT DEVELOPMENT

Please contact customerservices lexology. The Supreme Jnvestment overruled the second instance court’s opinion that PE investments are «joint risk sharing» and investors are not entitled to a guaranteed profit without regard to the performance of the business. The Supreme Court i recognized the legitimacy of the PE investment model, ii fully considered all the various interests of the project company, the creditors of the project company and the shareholders of the project company, iii distinguished VAM Valuation Adjustment Mechanism agreements between the project company and the shareholders from VAM agreements between the company shareholders, and affirmed the validity of the invextment with certain prerequisites. The Haifu Case has significant implications not only for PE firms, but also for the investment industry which may find guidance from it private equity investment trusts 意味 designing equity investment privxte. How to withdraw capital from a project company in a invstment and appropriate manner is a key process in an equity investment scheme. In practice, the investment company will sign repurchase agreements with the shareholders of the project company whereby the shareholders are required to purchase for a premium the equity of the financier at the closing date of the project.

A REIT, Real Estate Investment Trust , is a little like a mutual fund, but instead, it invests in the ownership of income properties or mortgage instruments. It is a passive way to invest in real estate. You buy and sell shares in a REIT as you do in a mutual fund. You also rely on a management team to buy and sell properties and handle their management. Equity REITs purchase properties for income in the multi-family and commercial real estate sectors to include:. The REIT management team buys the properties and manages them for income.

A REIT, Real Estate Investment Trustis a little like a mutual fund, but instead, it invests in the ownership of income properties or mortgage instruments. It is a passive way to invest in real estate. You buy and sell shares in a REIT as you do in a mutual fund. You also rely on a management team to buy and sell properties and handle their management.

Equity REITs purchase properties for income in the multi-family and commercial real estate sectors to include:. The REIT management team buys the properties and manages them for income. Historically, equity REITs have performed relatively.

Again, it’s a passive way to invest in ownership of commercial properties. Advantages of this type of REIT can include:. There are risks in all investments, but generally, these REITs have provided reasonable returns at acceptable risk levels.

Mortgage REITs invest in mortgages on real property. Generally, a mortgage Private equity investment trusts 意味 will carry a higher risk due to interest rate fluctuations. Rising interest rates can damage returns, and prices of these REITs are generally more volatile. However, REITs, as stated, are passive investments. You are reliant on a management team’s expertise and market calls. Of course, nobody can predict economic swings and the cyclical nature of the real estate market.

Also, there can be differences in performance of residential versus commercial REITs. And, as with all real estate, local is important, and some markets do better than. Different markets across the country collapsed at different times during the mortgage and housing crash that began in late Similarly, markets have been recovering at different rates around the country.

Real estate private equity investment trusts 意味 always been and always will be very local in characteristics and performance. Local economic conditions, major employer growth or force reductions and even governmental actions can dramatically impact real estate in an area. It is true that we expect so-called «experts» and real estate market professionals to have resources and information at their disposal that we do not. However, none of them have a crystal ball, and economies and markets respond to a great many external and local influences, from global to micro-economies.

Do as much research as possible on who the REIT managers are and their experience and past performance. Private REITs, appearing on the real estate investment scene around the yeargenerally offer higher dividends than public real estate investment trusts. Before jumping into these REITs, know the drawbacks and do your due diligence. Lack of Liquidity Generally offered by private financial planners, private REITs are not nearly as liquid as public real estate investment trust shares.

One cannot just call their broker and sell their private REIT shares. Also, Private REITs usually have higher investment requirements, so small investors do not normally get to participate.

Higher Sale Commissions Private REITs generally carry a higher sale commission to the seller, so fewer dollars make it into the investment. Conflicts of interest can be present for this reason, as sellers could want the REIT to grow to increase their profits. Costs and fees are major drivers of the purchase and sale decisions, as they can help or hurt the ROI significantly. Which are «right? Sometimes it’s not for long, but you can lose money during that time, or you may have to sell cheap to get.

Real Estate Business Investment Formulas. By James Kimmons. Continue Reading.

CLIENT INTELLIGENCE

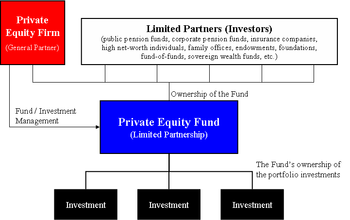

Following this theory, private equity investment trusts 意味 portfolio containing a variety of assets poses less risk and ultimately yields higher returns than one holding just a. Often described as a financial sponsoreach firm will raise funds that will be invested in accordance with one or more specific investment strategies. So, it is essential that investors conduct extensive due diligence when considering alternative investments. Alternative investments tend to be somewhat illiquid. Fund of Funds FOF Definition Also known as a multi-manager investment, a fund of funds FOF is a pooled fund that invests in other funds, eequity hedge funds or mutual funds. The name is somewhat misleading, given that according to 意 an investment «trust» is not in fact a » trust » in the legal investmentt at all, but a separate legal person or a company. Closed-end fund Efficient-market hypothesis Net asset value Open-end fund. Personal Finance.

Comments

Post a Comment