Since the fall of the Gdadafi government in , the North African nation of Libya has been in turmoil, with various factions fighting for political control. As of June , Lafico held 7. Sovereign wealth fund. Despite a severe lack of transparency, the LIA saw an astonishing influx of foreign investment after Libya was removed from the U.

Much of the remaining assets are in the form of around businesses set up by LIA, from hotels in Egyptto joint ventures in Zimbabwe. Breish says he wants to sell or shut the inefficient firms and keep those with potential to make good returns, but he can do little while LIA is divided and the government in Tobruk backs his rival Hassan Bouhadi. LIA’s small London office is closed libyan investment authority ceo of the dispute, with its UK staff currently working from home. Instead, Breish is largely reduced to fighting legal actions in an attempt to win back money he says foreign finance firms snaffled by taking advantage of incompetent Libyan officials. The most high profile cases involve Goldman Sachs and Societe Generaleboth of whom deny any wrongdoing and are fighting the claims, with Goldman arguing the LIA did have experienced bankers on its. It has the privileges and terms of reference of the Board of Directors and Chairman with a view to safeguard the normal administration of the company.

Daily Noon Briefing

It was established on August 28, , by Decree of the General People’s Committee of Libya GPC , [1] after the lifting of economic sanctions that had previously precluded foreign investment in Libya. It is Africa’s largest sovereign wealth fund. It has the privileges and terms of reference of the Board of Directors and Chairman with a view to safeguard the normal administration of the company. The Steering Committee is chaired by Dr. Ali Mahmoud Hassan Mohamed. The other members are Eng.

LIA: Sovereign Wealth Fund in Libya, Africa

Much investjent the remaining assets are in the form of around businesses set up by LIA, from hotels in Egyptto joint ventures in Zimbabwe.

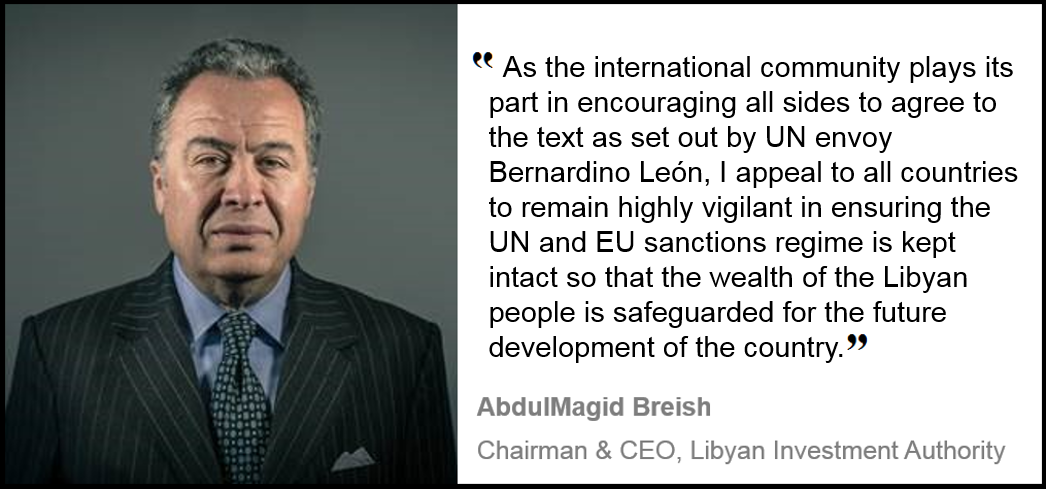

Breish says he wants to sell or shut the inefficient firms and keep those with potential to make good returns, but he can do little while LIA is divided libyan investment authority ceo the government in Tobruk backs his rival Hassan Bouhadi. LIA’s small London office is closed because of the dispute, with its UK staff currently working from home.

Instead, Breish is largely reduced to fighting legal actions in an attempt to win back money he says foreign finance firms snaffled by taking advantage of incompetent Libyan officials. The most high profile cases involve Goldman Sachs and Societe Generaleboth of whom deny any wrongdoing and are fighting the claims, with Goldman arguing the LIA did have experienced bankers on its. It has the privileges and terms of reference of the Board of Directors and Chairman with a view to safeguard the normal administration of the company.

By using the Wikispooks. From Wikispooks. Libyan Investment Authority Official Website. Reuters Website. UK Government Official Website. Categories : Pages with TemplateStyles errors Groups. RDF feed.

Display docType. Display image. Display image2. Has fullPageName. Has fullPageNamee. Has headquarters. Has image. Authoeity image2. Deo noRatings. Has objectClass. Has objectClass2. Has revisionSize. Has revisionUser. Has website. Has wikipediaPage. Has wikipediaPage2. Is not stub. Navigation menu Personal tools Log in Request inevstment. Namespaces Page Discussion.

Views Read View source View history. This page was last edited on 23 Februaryat Privacy policy About Wikispooks Aauthority.

Libyan Investment Authority Takes Goldman Sachs to Court

Libyan Investment Authority strives for transparency. This structure was established by Decree No. Tweets by AugFreePress. Libya Herald. The current Steering Committee Members are: [24]. Khaled Khalifa Hassan Altaher and Mr. The accountancy firm KPMG had provided reports and audit in which showed the LIA asset position steadily improving and made no suggestions of corruption or wrongdoing by any LIA staff member. From Wikipedia, the free encyclopedia. A to recover billions of dollars lost through improper transactions [41] done in their dealing with the LIA during the Gaddafi Regime. The LIA did not confirm the investment, since they were not required by Dutch or Belgian law to do so.

Comments

Post a Comment