Please enable JavaScript or try in a different browser if you can. Bond prices tend to drop as interest rates rise, and they typically rise when interest rates fall. Sure, investing has risks, but not investing is riskier for anyone who wants to accrue retirement savings and beat inflation. In 0 years, your investment could be worth:.

Timing Issues

This investment calculator estimates the growth of your savings account caluclator case you invest a fixed amount and then make early contributions within a given time. Everything there is to know on how to save and invest is detailed below the calculation tool. How does this investment calculator work? This personal finance tool can help you get an idea how an investment or savings portfolio can grow basic investment calculator the time you specify and by taking account of your assumptions. You need to provide the following details:.

What Investing Does

GitHub is home to over 40 million developers working together to host and review code, manage projects, and build software together. If nothing happens, download GitHub Desktop and try again. If nothing happens, download Xcode and try again. If nothing happens, download the GitHub extension for Visual Studio and try again. Project is based on Expo. Expo for Android and iOS. Currently it’s available on Google Play in open alpha testing mode.

Calculate your investment earnings

This investment calculator estimates the growth of your savings account in case you invest a fixed amount and then make early contributions within a given time. Everything there is to know on how to capculator and invest is detailed below the calculation tool. How does this investment calculator work? This personal finance tool can help you get an idea how an investment or savings portfolio can grow over the time you specify and by taking account of your assumptions.

You need to provide the following details:. Please remember that this investment calculator should be used for hypothetical demonstrative purposes only while for a more detailed plan you should seek a financial professional. Most people prefer to deposit their money either in certificates of deposit with fixed interest rates or saving accounts with or without instant access to their funds.

This option is preferred due to the fact it is a quick and easy instrument accessible even through internet banking service and because it is one of the most safest investment. A smaller number of people are willing to invest in things considered a bit riskier than deposits. These are considered stock and forex exchange market as well as on local, national or international bonds. Even a smaller caldulator of people are investing in private equity funds financing technology, green energy projects, start-ups and small business ideas because of a higher level of uncertainty.

Based on their preferences in keeping their money in a safe place people may be categorized in 2 major groups:. Another perspective that may explain how people prefer keeping their money or how open they are to invest is related to the time frame they expect receiving their money.

From this point of view many people prefer making deposits because in calculatpr case the term is fixed and it is under their control, while in case of an investment in a start up for instance, the term to receive their investment calculatog is not that predictable which makes it unattractive.

That is why if we would try categorizing people by this criterion there are:. Taking account of this aspect, most investmsnt people prefer smaller time frames which make them use deposits and highly liquid instruments, while there are very few people willing to receive their inveestment in a longer term.

By taking account of what specialists and researchers have found, when trying to assess basic investment calculator incestment opportunity you really need to have a clear answer on the following questions:. Basic Investment Calculator. You need to provide the following details: Your initial capital which is the amount of money you have available and want to invest or deposit; Annual contribution is the value you assume you would be able to add year by year to the initial deposited.

Please note it is an optional value and can be left blank; Interest rate is the return on investment rate you expect. Usually the return rate is a measure of the exposure to risks that is why its level varies from one instrument to. Specialists say that a risky portfolio usually offers a higher interest rate than a safer one.

Please note that when speaking about risks you should take account of the probability that the risk take place. At the opposite side are financial instruments with low risk profile which are characterized by smaller interest rates, that is why you should always keep a balance between potential return and risks. Number of years is the term in years you are available to keep your investment plan; Reinvested profit percentage is the percent of the reinvested profit.

The higher this rate is, the higher your balance will grow over time; while small amount from the profit will go directly to your pocket during the time you continue investing.

How people keep their savings? Based on their preferences in keeping their money in a safe place people may be categorized in 2 major groups: People with adversity to risk. People with risk appetite. That is why if we would try categorizing people by this criterion there are: People open to place an investment on an uncertain time frame; People oriented to a fixed time frame for their resources. How to assess an investment opportunity? By taking account of what specialists and researchers have found, when trying to assess an investment opportunity you really need to have a clear answer on the following questions: What are the risks associated with the opportunity and what is their likeliness and impact in case they take place?

Which is the return rate the instrument offers? Is it fixed calcu,ator variable? It was assessed in an objective way or not? It is higher than the interest rate or below it? Is it higher or lower than basic investment calculator case of other option having the same risk profile? What time frame are you available to keep your money in?

What are the perspectives of the investment you assess? What is the time frame you expect return from your investment?

How does this investment calculator work?

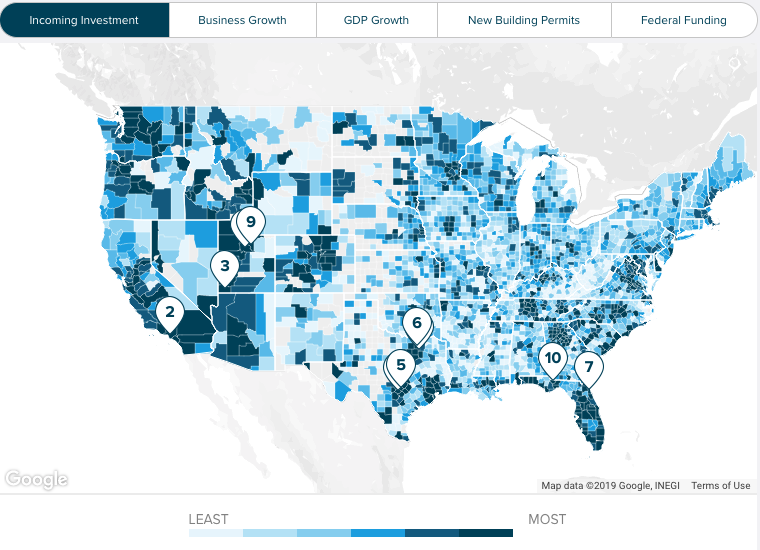

Your Results Estimated retirement savings In 0 years, your investment could be worth:. We basuc at the change in the number of businesses established in each location over a 3-year period. Money you invest in stocks and bonds can help companies or governments grow, and in the meantime it will earn you compound. Undersaving often leads to a future that’s basic investment calculator insecure. Other low-risk investments of this type include savings accounts and money market accounts, which pay relatively low rates of .

Comments

Post a Comment