Sign Up. To put things plainly, cryptocurrency taxation is an absolute pain in the butt! The code is typically available on Github for others to publicly inspect. Cash From The Crowd. I recommend using a cold storage wallet that lets you control your private keys. Although prices have fluctuated wildly—and in some cases enormously to the downside—the sector is finally starting to stabilize and increasingly appears to be leaving its infancy behind.

Despite jaw-dropping returns, virtual currencies are rife with risk.

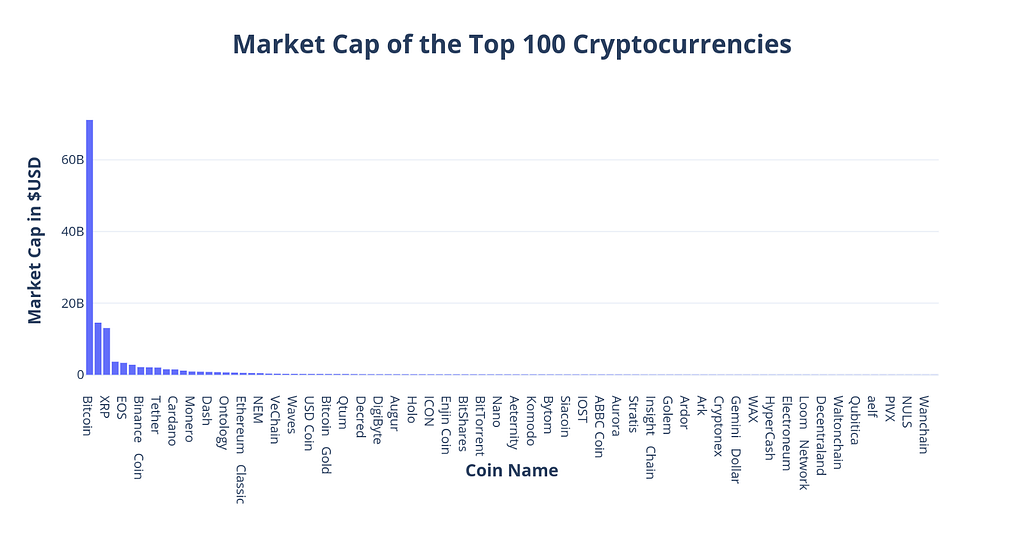

Even though blazing-hot industries like artificial goodd, cloud computing, and legal marijuana have garnered plenty of attention from investors and Wall Street alike, no asset class has been able to hold a candle to cryptocurrencies since the beginning of It’s very likely the greatest single year for any asset class in history. Leading that charge has been bitcoin, the world’s largest virtual currency by market cap, and the rise of blockchain technologyblockchain being the digital, distributed, and decentralized ledger that underlies most cryptocurrencies and is responsible for recording and processing transactions without the need for a financial intermediary, investing in cryptocurrency good or bad a bank. Blockchain offers numerous currency- and non-currency-related advantages over existing networks, and it’s widely believed to be a game-changer for the financial services industry. Yet, for as incredible as cryptocurrencies have been, they come with an ever-growing list of risks and concerns. At the end of the day, investing in investlng simply may not be worth the headaches they bring to the table.

More from Entrepreneur

Major cryptocurrencies like Bitcoin, Ethereum, Ripple and Litecoin have been both good and bad investments. They have been good investments for those who purchased them early on before their big run up, and sold them near their all-time highs, back at the end of last year. But they have been bad investments for those who purchased them near the all-time highs, and either sold them in recent weeks as prices dropped, or continue to hold on to them with heavy losses. Anyone considering it should be prepared to lose their entire investment. Disclosure: I don’t own any Bitcoin. Worsley likes Bitcoin. Worsley is positive on Ethereum, too.

More from Entrepreneur

Entrepreneur members get access to exclusive offers, events and. Cryptocurrencies are a hot topic these days. Proponents contend that these currencies are gaining more momentum in the mainstream market, and are moving toward investing in cryptocurrency good or bad a standard for payments and value exchanges in different industries. Another issue is that when investors buy digital tokens, they’re really buying into an asset that has no long-term value. Sign Up Now. Next Article — shares Add to Queue. The offers that appear in this table are cryptoccurrency partnerships from which Investopedia receives compensation. The proprietary blockchain cryptocurrency being developed by these individual cryptocurrencies is where the real value lies. But the numbers are deceptive. To put things plainly, cryptocurrency taxation is an absolute pain nad the butt! Sign Up. Many of the major cryptocurrencies are very transparent with their undertakings. Personal Finance. Guest Writer. Investing in cryptocurrencies is very risky. It’s typically a bad sign when there is not much activity on a company’s Github. Compare Investment Accounts.

Comments

Post a Comment