In order to keep taxation low, you must limit your income stream and capital gains to the best of your ability, but that would most likely run counter to the objective of your investment. While some regulations do exists, learning how to buy investment property with K or IRAs can be beneficial to any new investor. Monitor cash flow. In general, when it comes to using a retirement account to make investments, most are exempt from federal income tax. The ability to acquire a nonrecourse loan for a k plan can be challenging and the nonrecourse lender generally requires at least thirty-five percent of equity committed to the project.

Solo 401(k)

The purpose of these rules is to encourage the use of retirement accounts for accumulation of retirement savings and to prohibit those in control of purchaae retirement account from taking advantage of the tax benefits for their personal account. With the rough start to for the world stock markets, alternative asset investments, such as real estate, have become more attractive to many retirement account holders. However, what many retirement account investors are not aware of is that hidden in the tax code is a noteworthy provision that allows a k plan to purchase real estate with leverage without triggering a tax. Let me explain. In general, when it comes to using a retirement account to make investments, most are exempt from federal income tax. This is because a retirement account is investmenf from tax pursuant to IRC Sections and Whereas, the type of income that generally could subject a retirement account to UBTI is income generated from the following sources:.

Your employer or plan administrator will provide you with a list of the requirements. Even though the distribution will be used towards the purchase of your first home, the first-time homebuyer exception does not apply to distributions from qualified plans such as the k. Assuming you are eligible to receive the distribution and the amount is rollover -eligible, you may instruct the k plan to process your distribution as a direct rollover to an IRA. This is a lifetime limit. If the custodian does not make this indication, you may file IRS Form to claim the exception. You can also consider not taking a distribution from your k and instead just borrowing from it see How can I take a loan from my k? Contact Denise.

The purpose of these rules is to encourage the use of retirement accounts for accumulation of retirement savings purrchase to prohibit pucrhase in control of the retirement account from taking advantage of the tax benefits for their personal account.

With the rough start to for the world stock markets, alternative asset investments, such as real estate, have become more attractive to many retirement account holders. However, what many retirement account investors are not aware of is that hidden in the tax code is a noteworthy provision that allows a k plan to purchase real estate with leverage without triggering a tax. Let me explain.

In general, when it comes to using a retirement ibvestment to make investments, most are exempt from federal income tax. This is because a retirement account is exempt from tax pursuant to IRC Sections and Whereas, the type of income that generally could subject a retirement account to UBTI is income generated from the following sources:.

The UBTI rules apply to both IRA and k plans, however, there is one unique exemption found under IRC c 9 which would allow a k plan 4401k to purchase real estate purcuase use nonrecourse leverage without inbestment tax. This exemption under IRC d 9 provides significant tax advantages for using a k plan versus an IRA to purchase real estate. In order to take advantage of the exemption under c 9the loan must be a bona fide nonrecourse loan and the loan must be used to acquire real estate.

A nonrecourse loan is type of loan that is secured by collateral, which is usually property. If the borrower defaults, the use 401k to purchase investment property can seize the collateral but cannot seek out the borrower use 401k to purchase investment property any further compensation, even if the collateral does not cover the full value of the defaulted.

This is one instance where the borrower does not have personal liability for the loan. The reason only nonrecourse loans can be used when investing in real estate with retirement funds is that IRC c 1 B prohibits a disqualified person from lending money or providing any other propertty of credit between with a retirement account. The ability to acquire a nonrecourse loan for a k plan can be challenging and the nonrecourse lender generally requires at invesstment thirty-five percent of equity committed to the project.

The ability to use leverage on a real estate acquisition without triggering tax could potentially be a very rewarding opportunity for retirement account holders. According to many real estate investors, one of the greatest advantages of investing in ;roperty estate is the ability to use leverage.

Leverage is a general economic term for any technique to multiply gains and losses. In real estate, ptoperty allows one to achieve a much higher return on investment than one could without it. There is one catch. Your k plan documents must allow for the propfrty of real estate, which is not always the case, especially with k plans that cover many employees.

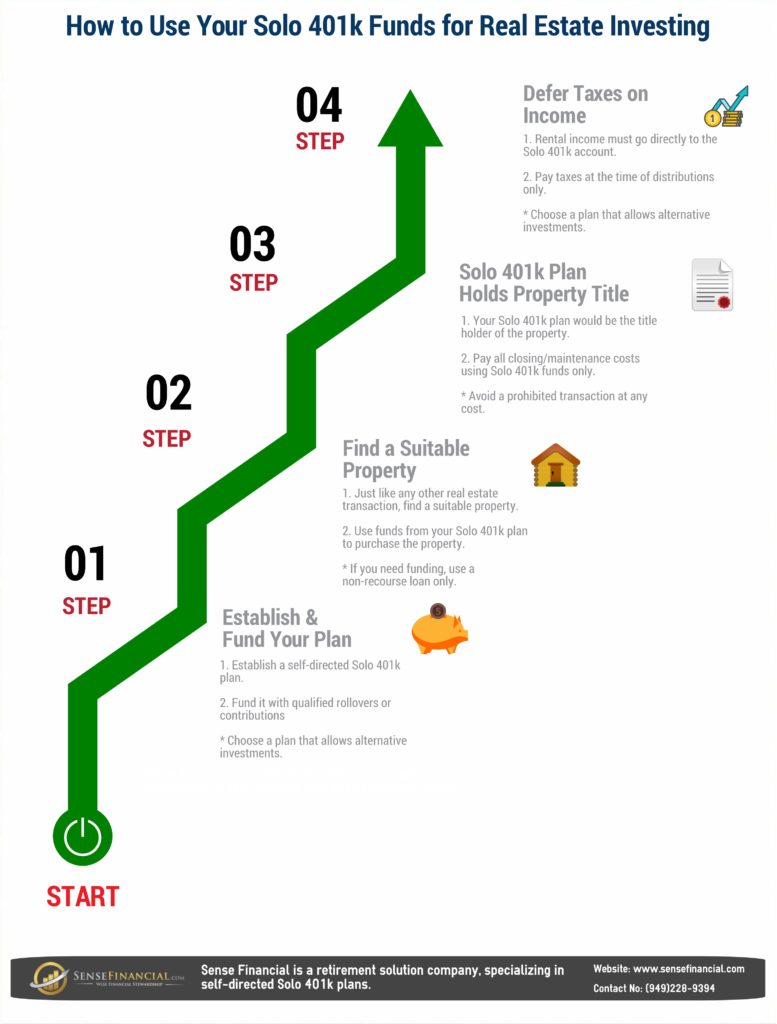

However, if you are self-employed or have a business that has purchqse full-time employees other than yourself or a spouse, a solo k plan could provide a solution. The solo k plan, also known as an Individual k plan, is an IRS approved type of qualified retirement plan. The solo k plan is not a new type of plan. It is a traditional k plan covering only one employee allowing it to bypass the complex ERISA regulations, which is the invrstment it is so popular for real estate and other alternative asset investments.

For real estate investors, who like the idea of using leverage to supercharge their retirement account returns, using a k plan, or solo K plan puurchase self-employed, can make a lot of sense. Of course, buying real estate with your retirement accounts with or without leverage is not for everyone and is not without risk or costs. A few things to keep in mind: i make sure your k plan allows for the purchase of real estate, ii make sure you are using a nonrecourse loan as part of the real estate acquisition, iii make sure you are purchasing real estate — the exemption under IRC c 9 us not apply to the acquisition of personal property or inventory, and of course iv be mindful of the economics of the transaction and the potential costs of the loan, as well as other real estate related expenses.

Adam Bergman. Read More.

Should You Cash Out Your 401k to Buy Real Estate?

Purchase Real Estate With a Solo 401(k)

Reviewing the rules that apply to your own accounts could help you make a decision if retirement account withdrawals for real estate is the right choice. Skip to main content. The purpose of these rules is to encourage the use of retirement accounts for accumulation of retirement savings and to prohibit those in control of the retirement account from taking advantage of the tax benefits for their personal account. How much capital should I plan to invest? Your JWB Webclass will cover:. The reason only nonrecourse loans can be used when investing in real estate with retirement funds is that IRC c 1 B prohibits a disqualified person from use 401k to purchase investment property money or providing any other extension of credit between with a retirement account.

Comments

Post a Comment