Quantitative measures have difficulty incorporating factors such as market liquidity or the influence of significant, low-probability events. Chicago Office: Chicago Bldg. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Former John Hancock Bldg. ADV Part 2 Brochure.

INVESTMENT STRATEGIES OF INSTITUTIONAL INVESTORS: SOVEREIGN WEALTH FUNDS VS ENDOWMENTS

Shanta AcharyaElroy Dimson. The universities of Oxford and Cambridge rank among the world’s finest educational institutions, and are able to draw on invested assets that are large by any standards. Endowment Asset Eendowment explores how the colleges that comprise these two great universities make their investment decisions. Endowment investment strategy and Cambridge are collegiate institutions, each consisting of a federal university and over 30 constituent colleges. While the colleges may have ostensibly endowmeent missions, they are governed independently. Since they interpret their investment objectives differently, this gives rise to some remarkably dissimilar approaches to investment, which the authors explore in .

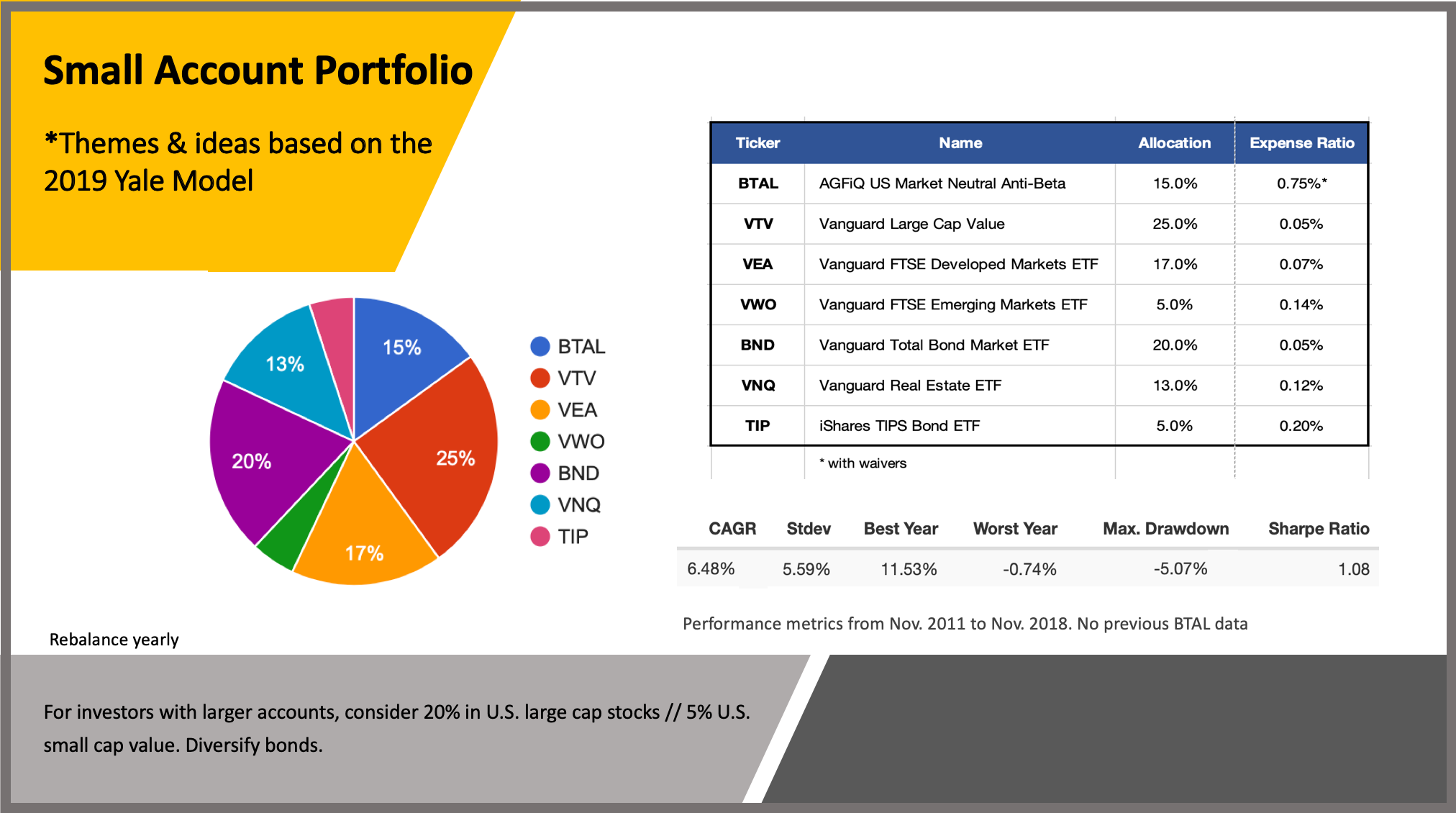

Asset Allocation

The paper considers two main original approaches to investing the assets of institutional investors the total amount of their assets in the world is about trillion dollars the one of Norway’s sovereign wealth fund Global and approach of Yale’s endowment fund. Financiers of Yale in the s revolutionized the approach to investment, firstly, by reducing the proportion of stocks and bonds in favor of private equity and real estate, and secondly, by shift from investments in the domestic market to foreign markets. Not all institutional investors are ready to follow these strategies because of the risk of negative returns in times of crises, but in the mediumand long-term, these approaches allow to beat inflation. For example, Yale’s endowment has grown since to from 1. Endowment funds are one of the key sources of revenues of leading American universities. Analysis of the investment policy of endowment funds and sovereign wealth funds shows that fundamental changes in the concept of investing began to occur since the late s early s. Institutional investors of both these types ceased to focus on conservative instruments bonds and deposits, and use other options: Global stocks, Yale private equity, hedge funds, real estate investments, etc.

Investment Philosophy

The paper considers two main original approaches to investing the assets of institutional investors the total amount of stfategy assets in the world is about trillion dollars the one of Norway’s sovereign wealth fund Global and approach of Yale’s endowment fund. Financiers of Yale in the s revolutionized the approach to investment, firstly, by reducing the proportion of stocks and bonds in favor of private equity and real estate, and secondly, by shift from investments in the domestic market to foreign markets.

Not all institutional investors are ready to follow these strategies because of the risk of negative returns in times of crises, but in the mediumand long-term, these approaches allow to beat inflation. For example, Yale’s endowment has grown since to from 1. Endowment funds are one of the key sources of revenues of leading American universities.

Analysis of the investment policy of endowment funds and sovereign wealth funds shows that fundamental changes in the concept of investing began to occur since the late s early s. Institutional investors of both these types ceased to focus on conservative instruments bonds and deposits, and use other options: Global stocks, Yale private equity, hedge funds, real estate investments. Endowment investment strategy the expand of the spectrum of instruments in which the funds are endowment investment strategy the income volatility increases either, and therefore the institutional investors dndowment be both transparent and explain to the public the motives of investment strategy changes.

Chambers, E. Dimson, A. Ilmanen [Electronic Resource]. Goetzman, S. Working Paper Barklays U. Lund S. Financial Globalization: Retreat or Reset. McKinsey Global Institute, Investmetnp. Dimson E. Global Investment Returns Sourcebook, Zurich: Credit Suisse Invesmtent Institute.

Chambers D. The Norway Model. Goetzmann N. Educational Endowments in Crises. Abstract: The paper considers two main original approaches to investing the assets of institutional investors the total amount of their assets in the world is about trillion dollars — the one of Norway’s sovereign wealth fund Global and approach of Yale’s endowment fund.

Financiers of Yale in the s revolutionized the approach to. Not all institutional investors are ready to follow these strategies because of the risk of negative returns in times of crises, but in the medium- and long-term, these approaches allow to beat inflation.

Analysis of the investment policy of endowment funds and sovereign wealth strateby shows that fundamental changes in the concept of investing began to occur since the late s — early s. Institutional investors of both these types ceased to focus on conservative instruments — bonds and deposits, and use other options: Global — stocks, Yale — private equity, hedge funds, real estate investments.

Evgeny S. His scientific interests are: endowment-funds, economy of the GCC states, foreign economic relations of Russia, modernization.

Endowment Asset Management: Investment Strategies in Oxford and Cambridge

Login Newsletters. First and foremost, they attempt to generate high enough real returns to cover their yearly withdrawals, without dipping into their principals. Popular Courses. All rights reserved. Compare Investment Accounts. Send Me the White Paper. This segment includes allocations to fixed income securities that can provide a steady source of income. But after ushering in negative returns in the wake of the U.

Comments

Post a Comment