Updated: Oct 2, at PM. Do you prefer going to the old favorite where you know you’ll get just what you ordered, are you in a more adventurous mood to try a new spot and tell the chef to prepare his favorite off-the-menu items — or is there a combination? Editorial Disclosure: This content is not provided or commissioned by the bank advertiser. Take advantage of retirement plans.

Start investing in 2020: A beginner’s guide to saving £10k, £100k or £1m by the end of the decade

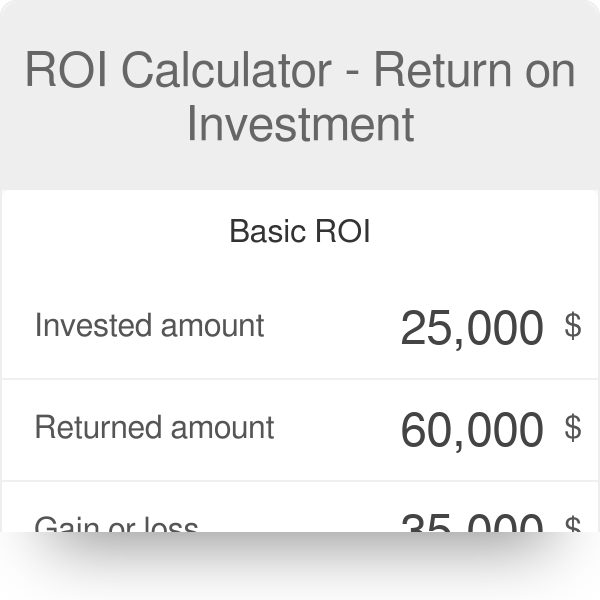

Are you ready to begin investing? While it’s an important step in being financially secure since regularly contributing to your investment portfolio can help you build wealth, it can be daunting. You may be afraid to invest because you do not understand the market or because you are intimidated by the initial investment options in many mutual funds. While it’s always better to begin investing sooner rather than later, there a few things you should consider before you begin building your investment portfolio. You should check where you are from a financial standpoint.

1. Save with an online bank

No matter how much money you earn, the amount you invest each year should be based on your goals. Your investment goals not only provide you with a target at which to aim, but they also provide the motivation to stick with your investing plan. Your investment goals should also be based on how much you can afford to invest. By following four key financial planning steps, you can determine how much to invest in the beginning and have a plan for achieving your goals through gradual increases in the amount you invest. At age 30, you may have several goals you want to achieve, which could include starting a family, having children, providing those children with a college education and retiring on time.

How much do you need to save monthly over the next decade?

The content that we create is free and independently-sourced, devoid of any paid-for promotion. Money market accountson the other hand, offer more liquidity. Crowdfunders connect investors with money to lend and d trying to fund new ventures. About the author Anne Dullaghan. Another option for starting small is an exchange-traded fund ETFmost of which require no minimum investment.

Comments

Post a Comment