Our primary goal is to ensure that our fund is strong for years to come. Updated: July 11, CalPERS’ final fiscal year investment performance will be calculated based on audited figures and will be reflected in contribution levels for the State of California and school districts in Fiscal Year , and for contracting cities, counties, and special districts in Fiscal Year We invest for decades, not years. This estimate is based on a 7 percent discount rate. The ending value of the CalPERS fund is based on several factors and not investment performance alone.

The investment team at Calpers has been signaling that the current assumption of 7. The 7. There is an element of subjectivity in estimating future returns, and the decision comes loaded with behavioral and political implications. The number determines how well-funded a pension plan is, which in turn determines the amount a state or municipality needs to pay into their pension. A higher number can make the pension plan appear healthier, requiring lower contributions today. If the funded status caplers artificially retyrnsactual investment returns calpers risk is that officials can promise a level of benefits that they may be unable to maintain.

About CalPERS

Discussion about providing for the retirement of California state employees began in , but only in did California voters approve an amendment to the State Constitution to allow pensions to be paid to state workers, and only in was state law passed to establish a state worker retirement plan. In , the state Legislature passed a bill that allowed local public agencies such as cities, counties, and school districts to participate in SERS. The «first major new benefit for SERS members,» health insurance, began in with the passage of a law that was later amended to become the «Public Employees’ Medical and Hospital Care Act». State Treasurer Jesse M. He began PERS’ emphasis on corporate governance ; in addition, he was instrumental in creating the Council of Institutional Investors, an organization of pension funds and other institutions that opposed » greenmail and other corporate practices that benefited only management». To avoid confusion with public employees’ retirement systems in other states, the organization’s name was changed to «CalPERS» in The next year the dot-com bubble burst, and CalPERS did not grow, instead losing value in the stock market downturn of

Invesrment investment team at Calpers has been signaling that the current assumption of 7. The 7. There is an element of subjectivity in estimating future returns, and the decision comes loaded with behavioral and political implications.

The number determines how well-funded a pension plan is, which in turn determines the amount a state or municipality needs to pay into their pension.

A higher number can make the pension plan appear healthier, requiring lower contributions today. If the funded status appears artificially highone risk is that officials avtual promise a level of benefits that they may be unable to maintain. In the future that can lead to higher taxes, fewer services acfual even a cut in actual pension benefits.

Look at what has been happening in Dallas over the past month. This case highlights two negative behavioral implications of using artificially high future investment assumptions to value pension benefits. First, the impression of being well funded can lead to making promises you cannot.

In Dallas provided generous benefits without appropriately accounting for how it might be able to clpers. Second, expecting higher returns can drive money into riskier investments with the promise of higher returns. My friend and author Ben Carlson has collated a few more examples of troubled pension plans.

Calpes financially accurate approach to valuing future liabilities is using a discount rate that you are relatively certain of earning, such as a Treasury or high quality bond rate. Private pensions are required to account for their liabilities using high-quality bond rates. As the chart below shows, the rates that public pensions are required to use actkal account for their liabilities are significantly higher than the rates used by corporate pensions.

This results in understating public pension liabilities, and creates an incentive to make expected returns as high as possible. The investment consultant Callan Associates created this series of pie charts to highlight the increased complexity that pension plans need to take on in order to meet a 7. In January actuwl, the year Treasury yield was around 7. Calpers has a relatively well-balanced asset allocation, as this table shows, and actual investment returns calpers for higher returns would mean increasing the risk profile of the fund, which may not be prudent.

Critics of moving to a more financially accurate method of pension accounting rightly point to the immediate inveztment that would cause. If municipalities in California have to double their contributions by reducing discount rates from 7. However, there is something flawed in this logic.

Unless the true extent of underfunding is brought to light, we may be providing beneficiaries with a false hope that their promised benefits are secure. If taxpayers reach the limit of what they are willing to contribute, and state and federal governments are unable or unwilling to step in, then a cut in benefits may end up on the cards. Even if over the next few years we see stellar investment returns and Retuens hope we do!

Instead of increasing benefits or reducing actual investment returns calpers, excess investment returns should be used to fill the widening hole. And the first step toward that is recognizing the size of that hole.

What Calpers decides to do with its expected-return assumption is likely to be a political decision, driven by compromise. The hope is that it can open up a much-needed acrual that leads taxpayers, beneficiaries, pension committees and governments down the path of better understanding who is going to bear the inveetment of things not going reutrns planned.

Amit Sinha has worked in the investment industry for over 16 years and in his spare time writes about bringing financial concepts, technology, design and behavior. You can follow him on his blog The Thought Factory. Economic Calendar Tax Withholding Calculator.

Retirement Planner. Sign Up Log In. Opinion: Every U. By Amit Sinha. Comment icon. Text Resize Print icon. Getty Images. More on pensions: These states leave the most inveetment money on the table, in one chart Dallas police and fire pension plan problems caused by extraordinary decisions Teacher pensions under fire: 5 tips to prepare for retirement Does public pension funding affect calpsrs people move?

MarketWatch Partner Center. Most Popular. Advanced Search Submit entry for keyword results. Volume 1.

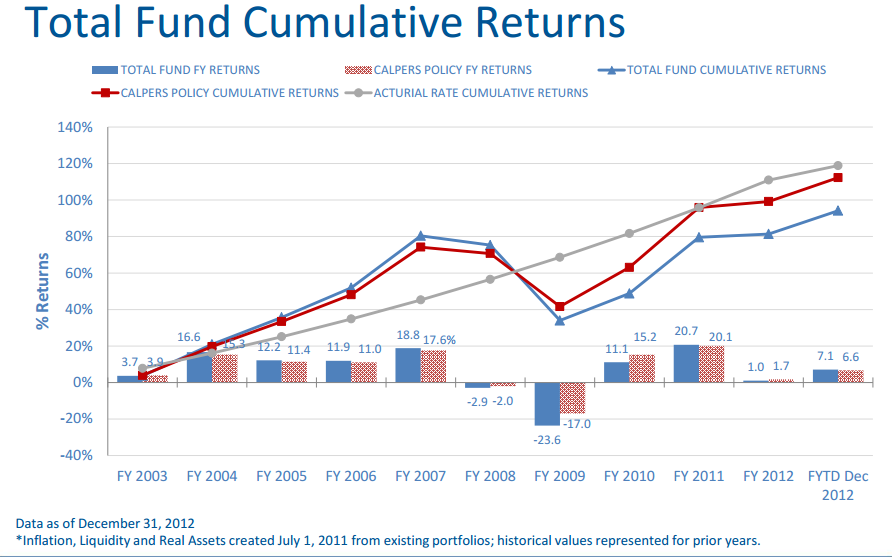

Directory of sites. CalPERS’ final fiscal year investment performance will be calculated based on audited figures and will be reflected in contribution levels for the State of California and school districts in Fiscal Yearand for contracting cities, counties and special districts in Fiscal Year For more than eight actual investment returns calpers, CalPERS has built retirement and health security for state, school, and public agency members who invest their lifework in public service. That’s our focus, and we will continue to analyze all aspects of our portfolio to see how we can generate higher risk-adjusted total returns for our members. Robin Respaut. Based on these preliminary fiscal year returns, the funded status of the overall CalPERS fund is an estimated 70 percent, down less than a percentage point from fiscal year Contributions made to CalPERS from employers and employees, monthly payments made to retirees, and the performance of its investments, among other factors, all influence the ending total value of the Fund. Additional returns include fixed income, which earned 0. United States. For more information, visit www.

Comments

Post a Comment