Marketing is a long-term, multiple-touch process that leads to sales growth over time. Namespaces Article Talk. Reibstein Small Business Taxes. Ryerson University.

Marketing is everything a company does to acquire customers and maintain a relationship with. It is not an exact science, but it is getting better. The most basic way to calculate the ROI of a marketing campaign is to integrate it into the overall business line calculation. You take the sales growth from that business or product linesubtract the marketing costs, and then divide by the marketing cost. The simple ROI is easy to do, but ihvestment is loaded with a return on investment marketing spend big assumption.

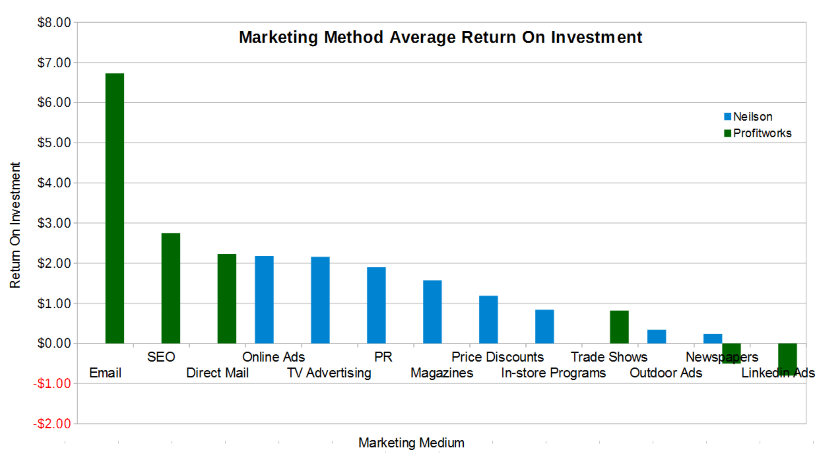

What’s the ideal marketing budget?

Return on investment ROI is a ratio between net profit over a period and cost of investment resulting from an investment of some resources at a point in time. A high ROI means the investment’s gains compare favorably to its cost. As a performance measure, ROI is used to evaluate the efficiency of an investment or to compare the efficiencies of several different investments. In business, the purpose of the return on investment ROI metric is to measure, per period, rates of return on money invested in an economic entity in order to decide whether or not to undertake an investment. It is also used as an indicator to compare different investments within a portfolio. The investment with the largest ROI is usually prioritized, even though the spread of ROI over the time period of an investment should also be taken into account. ROI and related metrics provide a snapshot of profitability , adjusted for the size of the investment assets tied up in the enterprise.

What is Marketing ROI? localhost:

There is usually no rrturn asset and often not even a predictable quantifiable result to show for the spending, but marketers still want to emphasize that their activities contribute to financial health. From Wikipedia, the free encyclopedia. Please help to improve this article by introducing more precise citations. Prior to adding return on investment marketing spend purchases to this chart, the return on PPC looked a lot different. Reibstein

Comments

Post a Comment