Financial Advisor Portfolio Construction. A good low expense ratio is generally considered to be around 0. Related Articles. Fund screeners—Many ETF and mutual fund screeners are available online. Partner Links. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. An expense ratio is the amount companies charge investors to manage a mutual fund or exchange-traded fund ETF.

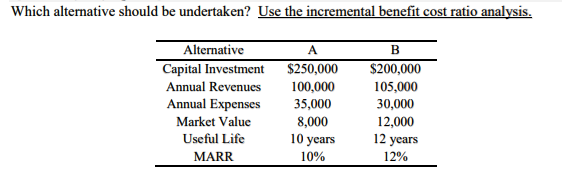

A benefit-cost ratio [1] BCR is an indicator, used in cost-benefit analysisthat attempts to summarize the overall value for money of a project or proposal. A BCR is the ratio of the benefits of a project or proposal, expressed in monetary terms, relative to its costs, also expressed in monetary terms. All benefits and costs should be expressed in discounted present values. A BCR can be a profitability index in for-profit contexts. A BCR takes into account the amount of monetary gain realized by performing a project versus the amount it cost ratio investment to execute the project. The higher the BCR the better the investment.

What Is an Expense Ratio?

Variable Cost Ratio — Variable costs expressed as a percentage of sales. The variable cost ratio compares costs, which fluctuate depending on production levels, to the revenues made on those products. Benefit-cost ratio — A benefit cost ratio BCR is an indicator, used in the formal discipline of cost benefit analysis, that attempts to summarize the overall value for money of a project or proposal. Medical Cost Ratio — A comparison of a health insurance company s healthcare costs to its premium revenues. The medical cost ratio is one indicator of the insurer s financial health.

Why the Expense Ratio Matters

Variable Cost Ratio — Ocst costs expressed as a percentage of sales. The variable cost ratio compares costs, which fluctuate depending investkent production levels, investkent the revenues made on those products. Benefit-cost ratio — A benefit cost ratio BCR is an indicator, used in the formal discipline of cost benefit analysis, that attempts to summarize the overall value for money of a project or proposal.

Medical Cost Ratio — A comparison of a health insurance company s healthcare costs to its premium revenues. The medical cost ratio is one indicator of invetsment insurer s financial health.

Burning Cost Cost ratio investment — An insurance industry calculation of excess losses divided by total subject premium. Loan-To-Cost Ratio — LTC — A ratio used in commercial real estate construction to compare the amount of the loan used to finance a project to the cost to build the project.

Benefit Cost Ratio — BCR — A ratio attempting to identify the relationship between the cost and benefits of a proposed project. We are using cookies for the best presentation of our site. Continuing to cost ratio investment this site, you agree with. Theory and PracticeNoureddine Krichene.

What is Expense Ratio in Mutual Funds? — How are Fund charges calculated? — Mutual Funds Explained

So in some cases you may have to make the best of a bad situation. Eight Investing Fees to Watch Out For Matt Becker is a fee-only financial planner and the founder of Mom and Dad Money, where he helps new parents take control of their money so they can take care of their families. Even a small difference in expense ratio can cost you a lot of money in the long run. Related Terms Mid-Cap Fund Definition A mid-cap fund is a type of investment fund that focuses its investments on companies with a capitalization in the middle range of listed stocks in the market. These funds frequently make up the core holdings cost ratio investment retirement portfolios and offer lower expense ratios than actively managed funds. Finance have expense ratio information for mutual funds and ETFs. Index mutual funds also tend to have lower expense ratios because they focus on large-cap blend funds that target U. Of course, you have to pay. The Ins and Outs of Expense Ratios The expense ratio ERalso sometimes known as the management expense ratio MERmeasures how much of a fund’s assets are used for administrative and other operating expenses.

Comments

Post a Comment