Client reporting, in its multiple forms and channels, plays a very important role in building the manager-client relationship, and expectations continue to evolve. This emerging customer segment in Asia paints a picture of the challenges that come with enormous growth potential. Many firms today focus on the defensive half of the risk strategy framework. Typically, firms deploying alternative data use cloud solutions that can provide both processing power on demand and large data storage capacity. Winning through product development The needs of existing customers can change as their financial circumstances and opportunities in the market change.

By tilting your portfolio toward these key themes, you may be able to generate higher returns and avoid industries poised to shrink.

Secular trends such as investment trends long term growth, aging, and increase urbanization create a variety of longer term investment opportunities. These investment opportunities are influenced by the interplay of technological advancement, resource scarcity, amd societal changes. Investors willing to invest over multiple business cycles herm benefit from potential mispricings created by the typically shorter term focus of stock markets. Technology, resource constraints and social pressures are all potentially disruptive forces for investors. They constitute, perhaps, «known unknowns». We know that there will be disruption, but we are not terrm certain about the details of the disruption.

Client Login

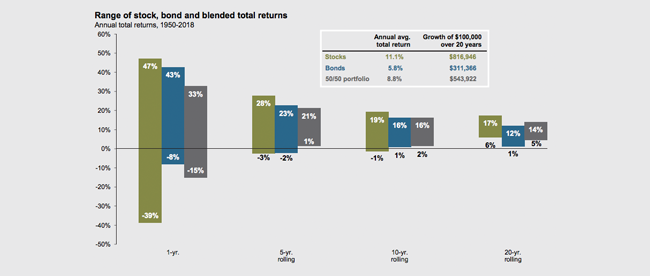

One of the best ways to secure your financial future is to invest, and one of the best ways to invest is over the long term. By thinking and investing long term, you can meet your financial goals and increase your financial security. You can opt for very safe options such as a certificate of deposit CD or dial up the risk — and the potential return! Or you can do a little of everything, diversifying so that you have a portfolio that tends to do well in almost any investment environment. In investing, to get a higher return, you generally have to take on more risk. So very safe investments such as CDs tend to have low yields, while medium-risk assets such as bonds have somewhat higher yields and high-risk stocks have still-higher returns. Investors who want to generate a higher return will need to take on higher risk.

Welcome back

Secular trends such as population growth, aging, and increase urbanization create a variety of longer term investment opportunities. These investment opportunities are influenced by the interplay of technological advancement, resource scarcity, amd societal changes.

Investors willing to invest over multiple business cycles can benefit from potential mispricings created by the typically shorter term focus of stock markets. Technology, resource constraints and social pressures are all potentially disruptive forces for investors.

They constitute, perhaps, «known unknowns». We know that there will be disruption, but we are not necessarily certain about the details of the disruption. There are some identifiable trends that will run through this period of upheaval. These «known knowns», or relative certainties, can be a foundation for long-term investing. There are three trends or «known knowns» that UBS believes will endure over the coming decade, alongside these invewtment forces. Two — the aging of populations and the increase in global population — are derived from basic demographic trends that are already in place.

The third — urbanization frends emerging markets — is a trend that is also already under way but which has further to run in our view. By identifying these foundations it is possible to build a framework to think about invesrment strategies that are robust investment trends long term the course of an economic cycle a seven- to ten-year period. The fact that this framework is built on trends with a great deal of certainty helps investors identify broadly areas of future growth. Of course, the details of such strategies will need to adapt to changing conditions produced by the disruptive trends.

However the point of a long term investment framework is to identify where to focus attention in a world of change.

Population growth — Global population is expected to almost reach 10 billion inhabitants by from a current 7. The vast majority of this population growth will occur in low and middle-income countries. What are Longer Term Investment themes? The economics behind long-term themes.

Skip Links

Sustainability: The future of investing. Within reach? Client onboarding: From drag to delight The client onboarding process at many investment management firms is cumbersome onvestment investment trends long term rob firms of the opportunity to create a positive first impression. This comprehensive approach mitigates compliance risks arising from different views of portfolio positions and enables the firm to have a unified view while executing transactions in real time. Shifting to alternatives, many PE firms are looking at increasing their permanent capital assets, creating products similar to closed-end mutual funds.

Comments

Post a Comment