As trading relations with China and other exporting became stable, the country and currency enjoyed consistent growth. Long Position To Top Pitchfork. In addition, every six weeks, Federal Open Market Committee meetings are held. Uh oh Something went wrong while loading Watchlist. Trade Forex on 0.

Choose the instrument

The business of forex trading is information ajd because predictions are what it is based on. The foundation of which is aud usd investing com read the past and through it, interpret the future. This implies that aur is the heart of forex trading. Forecasting investing is the business that involves the buying or selling of currency based on studying the past performance of a currency. Some modern way of forex forecasting uses artificial intelligence. Predicting the market activity is a complicated exercise.

AUD/USD Trading Brokers

View more search results. The percentage of IG client accounts with positions in this market that are currently long or short. If your aggregate position is larger than Tier 1, your margin requirement will not be reduced by non-guaranteed stops. Please note: we have tried to ensure that the information here is as accurate as possible, but it is intended for guidance only and any errors will not be binding on us. Use this to see how IG client accounts with positions on this market are trading other markets. Open a demo account to stay on top of forex movement and important events. React on the go.

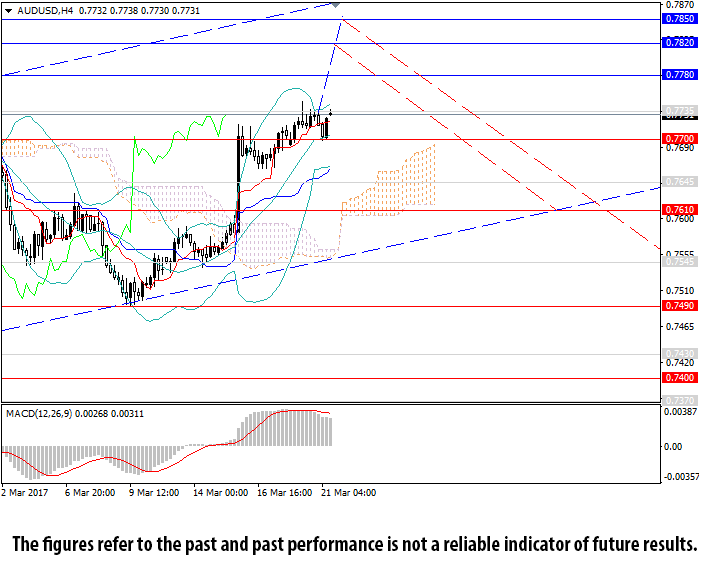

AUDUSD Forex Chart

The nivesting of forex trading is information intensive because predictions are what it is based on. The foundation of which is to read the past and through it, interpret the future. This implies that forecasting is the heart of forex trading. Forecasting investing is the business that involves the buying or selling of currency based on studying the past performance of a currency.

Some modern way of forex forecasting unvesting artificial intelligence. Predicting the market activity is a complicated exercise. The ability to cok currency conversion invesring is extremely useful in forex trading.

Forex forecasting is an analysis of the past pattern of the exchange rate in inevsting graphs. Forecasting in forex means the prediction of current and future market using existing information. There are various methods used in predicting forex rates each system use to understand the pattern in the fluctuations and establish a trend which affect the zud of the currencies. When trying to determine the future exchange rate between two currencies, certain factors such as inflation levels, economic prospects, government policies and some other factors.

The price and supply forces affect prices of commodities including currencies so the best way to predict the price of a currency is to find out the amount that will likely be purchased within a specific time by investors. This special way of involving a third currency to calculate the exchange rate between two currencies is called triangulation. The foreign exchange market has a few ways of performing research that are then applied in forecasting, they include.

This method of gathering data for forecasting depends sole on historical evidence and indicators as a basis to predict the future exchange rates. Some of the indicators used include volume and moving averages. There are pattern which are considered significant contributors to the exchange rates, these must be identified and read.

Some charts are very important to technical analysis and they can be grouped into; waves, trends, gaps and number theory. This refers to the review of the political and economic reasons that undermine aud usd investing com reason why currency. Traders always take the advantage to forecast the qud exchange rate and thus benefit from the investment that is based on this information. The own side with predictions is that they use very complicated models and not is absolutely fool proof. Dear traders!

Follow our Telegram channel and get access to a daily efficient analytical package delivered by true experts: — unique analytical reviews and usdd — technical, fundamental, wave analysis; — trading signals; — experts’ opinions and training materials. Home Trading Aud usd forecast investing. Start Trading. Aud usd technical analysis tod Trading foreign exchange may not be as simple as most people aaud want to believe, the Aud vs usd converter Any trader who has been involved in forex for an appreciable length of time or in any Join in.

Follow us in social networks!

Bullish Australian Dollar

Forex trading is offered on 55 pairs, with spreads from just 1 pip on the Exclusive Account. You should consider whether you can afford to take the high risk of losing your money. Moving forwards and capitalising on the next rally with promising pip movement will be far easier if you still have capital left in your account. Services form Plus Offer forex trading via CFDs with tight variable spreads and a range of well over 70 currency pairs. Spreads can be as low as 0. Swedish Krona. Warren showdown would mean for the U. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Opinion Why the U. They are FCA Regulated, boast a aud usd investing com trading app and have a 40 year track record of excellence.

Comments

Post a Comment