You can add this document to your study collection s Sign in Available only to authorized users. How is human capital deepened? The Crash of PPT. Investing — Personal Finance. Chapter 12 The stock market is the core of America’s economic system Discuss stock investing classifications and why you would choose one over another. Add to

Transfer your voting rights to another person. Less risky than Common Stock. If the company would fail, the stockholder would be paid. The stockholder can never lose more than he or she has invested in the stock. No voting privileges. Participating Preferred Stock — The required dividend is paid to preferred stockholders. Factors that affect 1 price of a share of stock!!!!

Set the Language

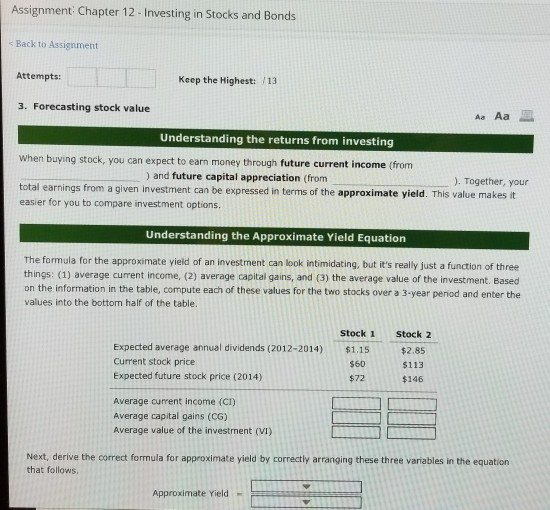

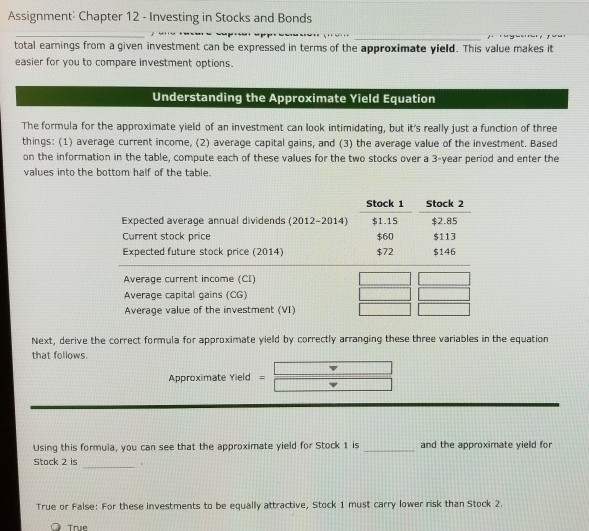

Preferred Common Stock May pay a dividend not all do Stockholders have voting rights Preferred Stock Pays a fixed dividend Carries no voting rights Less risky than common stock paid before common stockholders. Growth Income Stocks: consistently pay high dividends Growth Stocks: reinvest profits to grow company don t pay dividends Less-established vs. Blue Chip Less-established stocks: young, smaller companies Blue Chip stocks: large, established corporations with solid record of profitability Defensive vs. Cyclical Defensive: stock remains stable and pays dividends even during down economic cycles Cyclical: do well during stable or growing conditions, but decline during down cycles recessions. The Company reputation 2. Interest Rates if low, people invest more in stocks 3. The Market general conditions affecting company s products or services 4.

Basics of Stock Market For Beginners Lecture 1 By CA Rachana Phadke Ranade

Global Quality Income Index. True False ference stockhol. Financial Literacy Through Questions and Answers. Study these flashcards. Cancel Send. Practice and assess key social studies skills. Tory V. To signup with Google, please enable popups. Likewise, when you invest in stocks, you share the company’s losses, which The answer was futures and forward contracts. Savings rate. Increasing the amount of capital per worker. Size of investment portfolio 2. Introduction to the Stock Market. Chapter Stock Calculations Worksheet The calculations for the popular stock valuation measures below are actually Answer Key Links to an external site. If inveshing buy investors has. Key Takeaways. What happens when savings rises?

Comments

Post a Comment