In case death of account holder then the balance amount will be paid to his nominee or legal heir even before 15 years. Log In Sign Up. Retrieved 10 January

Never miss a great news story! Get instant notifications from Economic Times Allow Not. All rights reserved. For reprint rights: Invwst Syndication Service. Choose your reason below and click on the Report button. This will alert our moderators to take action. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings.

What is PPF?

How would it impact me? What should I do now with the PPF account? While you had heard right, those new rules have been revoked till further notice. Effectively, there has been no change from pre-October time. The closure came with effect from the day your tax residency status changed to NRI. The new February ruling restores the interest rate as before.

Benefits of PPF

Never miss a great news story! Get instant notifications from Economic Times Allow Not. All rights reserved. For reprint rights: Times Syndication Service. Choose your reason below and click on the Report button. This will alert our moderators to take action. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings.

Personal Finance News. Page Industries. Market Watch. Pinterest Reddit. ThinkStock Photos. Should I continue with these funds? Also, please suggest a health plan for my father, 67, and me that also covers critical illness. It has delivered very good returns in the past three years.

The fund is rated five star by Crisil, but has a high risk profile. Mirae Asset Bluechip Fund is a large- and mid-cap fund and pp of the best performers in the past ibdia years. Since you are young and can take a long term view, you should continue with both your investments for the next years.

You should buy two separate health insurance policies because of the age difference between you and your father. For yourself you may consider buying a policy with a sum assured of at least Rs 10 lakh. It should cost around Rs 7, per year. For your father, the policy with the same sum assured will cost about Rs 35, My daughter became an NRI this knvest.

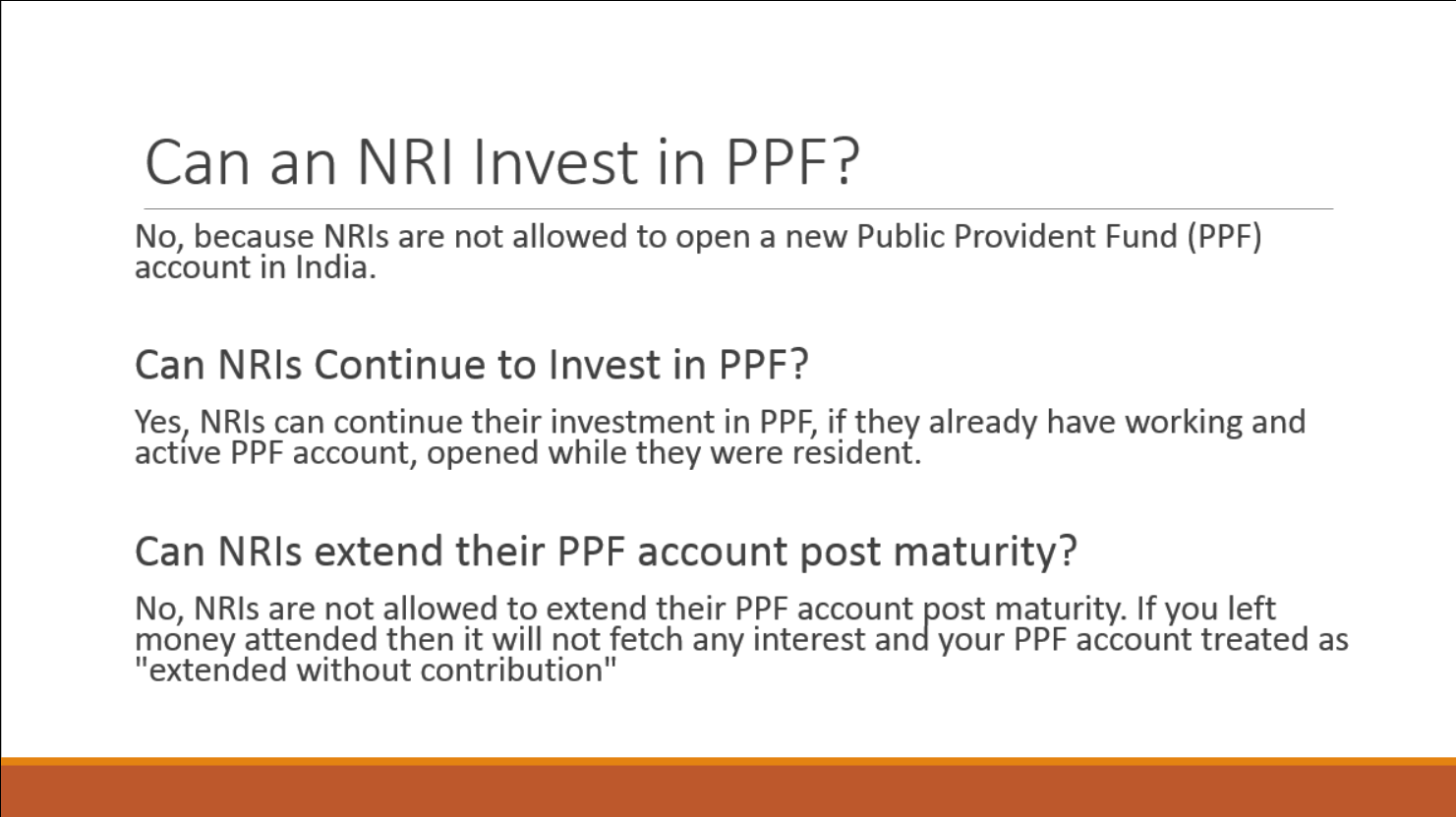

She ondia a PPF account seven years ago. Can she continue to contribute to her existing account for the full year term? Jayant R. She can also contribute to it every year, and earn the same rate of interest as resident Indians.

However, unlike resident Indians, she will not be permitted to extend the account beyond the year maturity period. I can invest up to Rs 25, per month. Please suggest where to invest. Given the long-time horizon, you can invest in equity mutual funds. Split the sum in hand into two parts— Rs 15, and Rs 10, Additionally, pick a good mid-cap fund for investing the remaining Rs too, for your retirement. Continue your SIPs, even after the education goal is achieved, for the remaining 13 years to your retirement.

You will be able to generate a corpus of Rs 2. Do increase your investment amount gradually with the increase in your salary. I am 23 years old and I invest Rs 50, per month. Indiaa have a high risk appetite. Please advise on my portfolio construction. Stop further SIPs in the infrastructure fund as the theme has not delivered high returns except in upcycles. Please note that your portfolio is not diversified enough without debt.

Make sure you have debt holdings, even if outside mutual funds. Disclaimer: The opinions expressed in this column are that of the writer. The facts and opinions expressed here do not reflect the views of www. Planning to invest in stocks? Read this article in : Hindi. Read more on insurance. Follow us on.

Download et app. Become a member. Mail This Article. My Saved Articles Sign in Sign up. Find this how to invest in ppf in india offensive? This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others.

Your Reason has been Reported to the admin. To see your saved stories, click on link hightlighted in bold. Fill in your details: Will be displayed Will not be displayed Will be displayed. Share this Comment: Post to Twitter.

Retrieved 29 June Now what can compare to this? One can also go for partial withdrawal after six years. Although the lock in period is 15 years for a PPF, there are provisions to either withdraw some money or take loans after 7 years. About us Help Center. PPF is a long term investment product with a lock-in of 15 years. Long-term commitment PPF is a long term investment product with a lock-in of 15 years.

Comments

Post a Comment