Mike Luckovich: «There’s a whine in the air» more. Bush made fun of the antiquated weapon as he campaigned on the principle of a leaner, more efficient military built for modern wars. Bush visited Saudi Arabia on behalf of the Carlyle Group after his son became president. They got a sales tax exemption on all the items that were purchased for the stadium. Wealthy family friends and others invested millions with him, but with poor results. Most former presidents putter around their presidential libraries, getting in a game of golf or two while they shuffle papers for their memoirs.

Bush as businessman

Much has been written over the past month about President George W. This is, indeed, a significant history: in the early s Bush made hundreds of thousands of dollars in a deal that reeks of the same insider trading and accounting fraud the president now claims to oppose. If anything, this story is even more revealing. Where did all of geotge money come from and what did Bush do to get it? Much of the story was first reported nationally by Joe Conason in a February, article for Harpers Magazine. The same factors that propelled Bush virtually overnight from failed oil man to wealthy corporate executive—family connections and the desire of rich Texas businessmen to exploit the Bush name—opened the way for him to buy a stake in the professional baseball team.

Bush as businessman

May 13, Web posted at: p. Radio host Jim Hightower is one such Bush critic. Wealthy family friends and others invested millions with him, but with poor results. A disclosure shows Bush’s track record: Investors got back only 45 cents on the dollar, but few complained. Investors also got tax deductions averaging more than 80 cents on every dollar invested. Those early Bush ventures were mainly tax shelters. When his father was president, there were suspicions that the Persian Gulf nation of Bahrain tried to enrich the younger Bush.

Watch Next

Much has been written over the past month about President George W. This is, indeed, a significant history: in the early s Bush made hundreds of thousands of dollars in a deal that reeks of the same insider trading and accounting fraud the president now claims to oppose. If anything, this story is even more revealing. Where did all of this money come from and what did Bush do to get it? Much of the story was first reported nationally by Joe Conason in a February, article for Harpers Magazine. The same factors that propelled Bush virtually overnight from failed oil man to wealthy corporate executive—family connections and the desire of rich Texas businessmen to exploit the Bush name—opened the way for him to buy a stake how to invest like george bush million the professional baseball team.

In a deal was reached in which Richard Rainwater, a wealthy Texas financier, joined Bush and several other investors in buying the team. Bush used the proceeds from his questionable sale of Harken stock to repay this loan. The top priority for the new Rangers owners in increasing the value of their holdings was to acquire a new stadium.

They had no intention of paying for the stadium themselves, so they threatened how to invest like george bush million move the team if the city of Arlington did not foot the.

The city government readily agreed to a generous deal. The remainder was raised through a ticket surcharge. Thus, local taxpayers and baseball fans financed the entire cost of the stadium. The Rangers syndicate was also given a property tax exemption and sales tax exemption on products purchased for use in the stadium.

City residents ended up subsidizing these tax breaks for the Rangers owners by paying higher local rates. But the boondoggle did not end. As part of the deal, the Rangers syndicate got a sizable chunk of land in addition to the stadium. To oblige the owners, Ann Richards, the Democratic Governor of Texas at the time, signed into law an extraordinary measure that set up the Arlington Sports Facilities Development Authority ASFDAwhich was granted the power to seize privately owned land deemed necessary for stadium construction.

According to documents obtained by the Center for Public Integrity, the Rangers owners would locate a piece of land they wanted, offer a price far below the market value, and if the owners of the land parcel refused, bring in the ASFDA to condemn the land. On November 8,with the stadium being readied to open the following spring, Bush announced that he would be running for governor.

While he placed all his other assets in a blind trust, Bush held on to his stake in the Rangers until a man named Tom Hicks bought the team in Thomas Hicks is a rich Texas financier and leveraged buyout specialist. After Bush won the gubernatorial election, Hicks transferred his allegiance from the Democrat Richards to the Republican Bush. Richards had earlier named Hicks to the University of Texas Board of Regents, but this appointment had to be supported by Bush for it to go.

Not only did Bush agree to the appointment, he did something. While the Board of Regents as a whole technically had the power to oversee Hicks, it invariably went along with his decisions.

This was an unprecedented action. The investment decisions of UTIMCO were made largely in secret, though subsequent research has uncovered some of the areas to which the funds were directed.

George W. The Basses were also involved in Harken Energy. After Harken received an extraordinary deal granting it oil-drilling rights off the coast of Bahrain, it called in the Bass brothers to finance the preliminary exploration. When Hicks stepped down in and handed over the post to Donald Evans, the same investment pattern continued.

Such was the manner in which George W. Bush acquired his fortune—a classic example of how political power and inside connections can be leveraged into personal wealth, at the expense of public assets.

We must expand our work and our influence in the international working class. If you agree, donate today. Thank you. World Socialist Web Site wsws. Contribute to the fight for socialism in has been a year of mass social upheaval.

Get Involved! Free Julian Assange and Chelsea Manning! Socialism and the centenary of the Russian Revolution: All lectures from the series.

Useful links

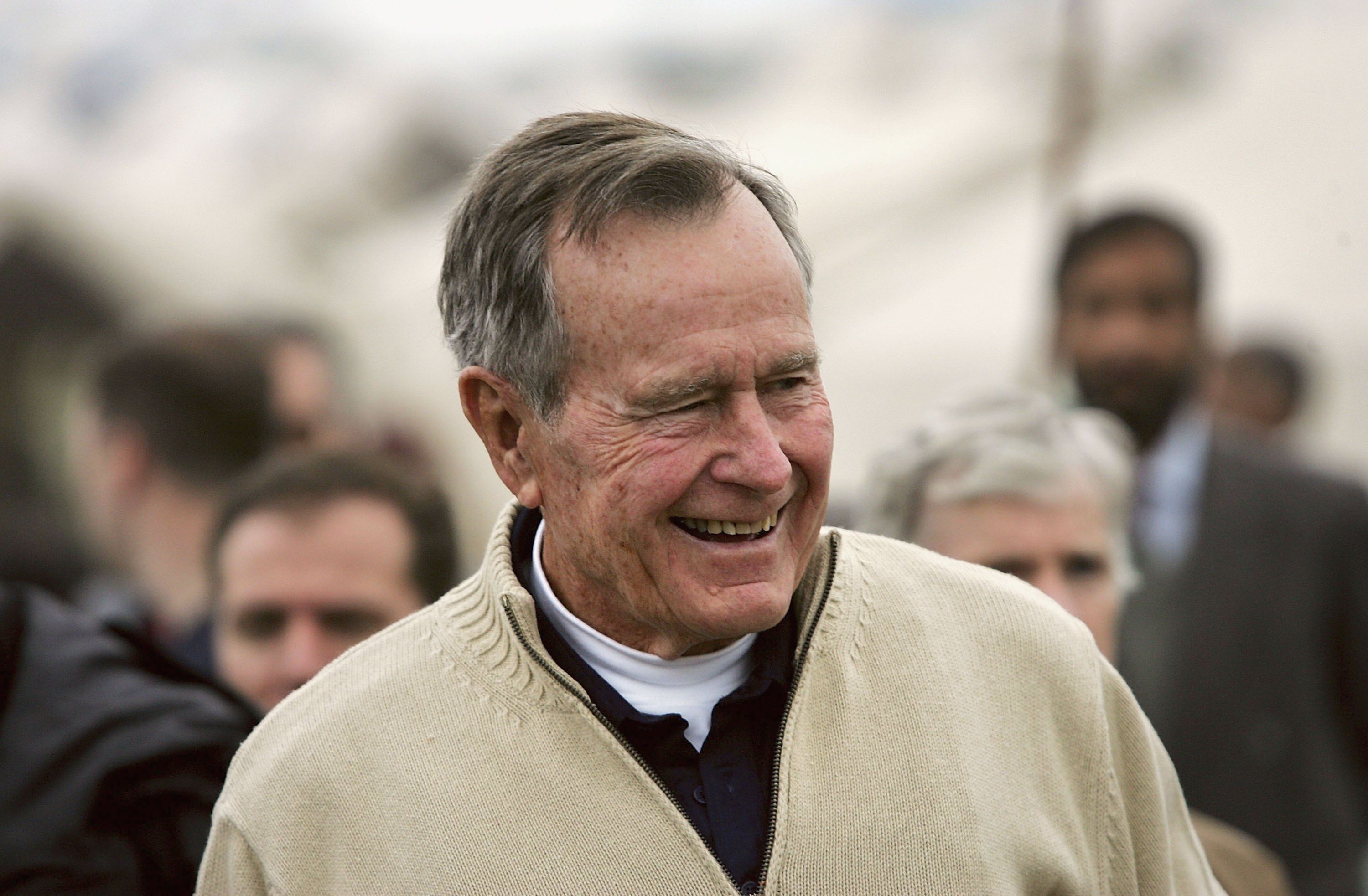

A jury found they were paid about one-seventh of what the land was worth. Grorge granted an exclusive drilling contract to Harken Energy Corporation, in which the younger Bush held stock. George W. Today’s Top Stories. Update: Former president George H.

Comments

Post a Comment