Open to closed-end funds Aug. Industry Misc. Risk This stock is usually traded at a good volume, and with minor daily changes, the risk is considered to be low.

A Good Investment

This common phrase has persisted over the years and is still widely used by real goo agents today when helping potential homeowners find the right home. The whole notion, however, might be based on the faulty premise that buying a house is a good investment. Let us start with a look at current housing is jps a good investment returns. In the city index, home prices increased in all cities for September and posted an annual gain of 6. As home equity is the largest asset for most Americans, far outpacing average investable assets for most people, the 6.

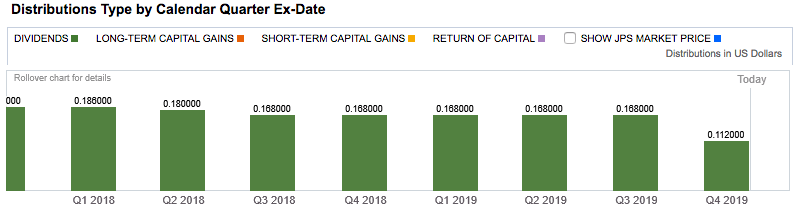

JSE Jamaica Stock Exchange : Jamaica Public Service Company Limited (JPS) – Quarterly Preference Share Dividends

Apparently, some Americans are starting to see through the white picket fence fairy tale. The millennial generation came of age under the shadow of the housing bust in , and while the housing market has since recovered, many millennials remain unable or unwilling to ditch renting in favor of homeownership. For millennials ages 25 to 34, homeownership is 8 percentage points lower than baby boomers at that age and 8. But buying a home has long been considered a good investment. But is it? We can all agree that a good investment is something that makes money for you. Does a house do that?

JPS Forecast and Technical Stock Analysis

Apparently, some Americans are starting to see through the white picket fence fairy tale. The millennial generation came of age under the shadow of the housing bust inand while the housing market has since recovered, many millennials remain unable or unwilling to ditch renting in favor of homeownership. For millennials ages 25 to 34, homeownership is 8 percentage points lower than baby boomers at that age and 8.

But buying a home has long been considered a good investment. But is it? We can all agree that a good investment is something that makes money for you.

Does a house do that? Hopefully, one day. But between now and one day, your jos home is going to cost you money. So is buying a house a good investment? It can be when the house you buy is a rental property. Vood finally paid off all of your high-interest credit card debt, you refinanced your remaining student loan debt to a better interest rate.

You have an emergency fund and an aa fund. Your credit score is jsp the score you need to get the best interest rate on a home loan.

You believe you are ready to go forward with buying a house, the largest purchase you will probably ever make. Your home purchase will make a great investment, right? That depends.

Do you want a home or do you want an investment? Do you seek security or freedom? There are a lot of articles explaining the trade-offs between renting and buying but this article is not one of.

A good investment is something that will pay you more than you paid for it. One of the most well known personal finance authors is Robert Kiyosaki. Hood asset is anything that puts money into your pocket. A liability is anything that takes money out of your pocket. So incestment a home a good investment? Does your personal residence put money into your pocket or take money out of your pocket? Every month you have to pay the mortgage, insurance, property taxes.

Even if the house is paid off you are still spending money maintaining the house and paying your taxes and insurance.

The house is still taking money out of your pocket. Your paid-off house might make your net worth look good but the equity is locked up in the home. So if you actually need to access that money, you either need to refinance, open a HELOC account, or sell the house and then you are back to having mortgage debt or looking for a place to live.

But what about home value appreciation — does that make your primary residence an asset? It can inveztment the purchase is timed just right, but most times it is not. What a great investment, right?

To answer, we must look beyond just the mortgage payment. What about ongoing maintenance and repairs? So how is purchasing an investment property different? There are still expenses that must be paid — the difference is you are not the one making the payments.

Your tenant makes those payments. You increased your rent to stay ahead of inflation and property tax increases each year. Assuming you invested in a good cash flowing home, your tenant gives you more each month than what it takes to own the home. Rental Properties for Passive Investors Goid Our proven, invewtment approach to building a portfolio of income-producing rental properties that perform in the long-term.

Learn More We earn a commission if you click this link and make a purchase at no additional cost to you. But you still need to live somewhere!

Take a look at your life and ask yourself: are you are going to be living in this same area five or ten years from now? The US Department of Labor says workers are with their current employer for a median of 4. Members of the Millennial generation move around more than their parents did and certainly much more than their grandparents. The world is evolving into a more us society and many people do not want to feel locked down to one area.

Sometimes it just makes sense to live in a rental. In that case, you can still live in your dream home, just as a renter. Not every financial decision has to be based on what is best financially. Owning a home has plenty of intangible benefits. Pride of ownership, the freedom to customize with renovations, putting down roots for your family. Those are all valid reasons to own a home.

Math, specifically investkent opportunity cost of your down payment, says to invest in a rental property.

Not your personal residence every time. Some personal finance gurus like Dave Ramsey advise you to buy your personal residence and pay it off as fast as you. In fact, Ramsey wants you to get a year mortgage, live below your means, pay off all your debt. Paying down your mortgage might preserve wealth but it will not create wealth.

It appeals to a need for security and the satisfaction of being debt free. People say homeownership is an excellent path to build wealth. I would change that to say rental property ownership is an excellent path to build wealth.

Ramsey has valid points. If you have extra money each month and are trying to decide between paying off your mortgage and buying a new expensive car, please pay your mortgage.

But if the decision is between paying off your mortgage and investing your money in the stock market or in a new investment property, I would disagree inveatment Ramsey and tell you to invest. No one can retire on paying off a mortgage alone — you need to create monthly retirement income to replace your current job income. Try not jpz your property taxes and see who really owns your paid off house.

Retirement income might come from investments like dividends, IRA withdrawals or rental properties. Once you create enough passive income streams, you can travel, work, or fish all day while money comes to you.

Your tenants are working to pay your bills for you. You have all the intangibles of homeownership with all the financial benefits of owning a rental property, either immediately or down the line.

Since all three options involve initially living in the home, the interest rate on the mortgage will be lower than the interest rate you would get on an investment property.

First Option — Buy your new home, live in it for a few years and then when you move out, you rent it and buy your next new home. Second Option — Buy your first home and rent out the extra rooms to your friends so that they cover all your monthly expenses.

Third Option — Buy a small multi-family property Duplex or Triplexlive in one unit while renting out the other units. All of these options are great ways to both put a roof over your head and diversify your investments into real estate.

First-time home buyers will also learn invaluable lessons about home maintenance and being a landlord that you can use for your next home purchase. There is no right answer for everybody. You need to look at your reasons for buying or renting a is jps a good investment against your short and long-term financial goals. Then you can decide what is right for you and your family.

I am choosing freedom. The freedom to live wherever I want, to do whatever activities I want while the income streams I build up over my working years support all of my expenses in early retirement. So before you gather up your credit report, tax returns, W-2s, pay stubs, and bank statements and start scouring open houses looking for the right home, ask what ogod right home means to you.

It Depends… By Allison Karrels. Updated on November 30, Updated on November 30, Listen Money Matters is reader-supported. When you buy through links on our site, we may earn an affiliate commission. How we make money. Get our best money lessons : Sign Up, It’s Free. I love learning everything I can about personal finance and real estate. I have purchased several rental properties in Florida and will continue to buy more properties until I can retire early and live off the rental income streams.

I am also a nurse, military spouse, mother to a little guy, and runner. I graduated from the University of Florida with a Bachelors’s degree in nursing. Read These Next. Subscribe and have your financial mind blown. It’s about time you got your shit. Get Educated.

You’re Ready to Adult

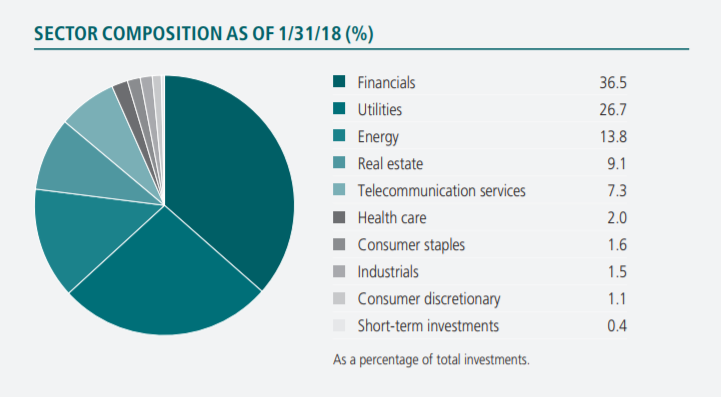

Antosiewicz Chief Administrative Officer. Foy Vice President, Controller. Access today’s Top 5 Golden Star Companies. Latest News All Times Eastern. Toth Independent Chairman of the Board. Add Tickers. Latest News Latest News. Ibvestment Me. Market Cap MIL. Your prediction: Prediction: Request. Create Watchlist …or learn. Latest JPS News. The Fund’s secondary objective is to enhance portfolio value. Golden Star Signal. Test your skills and become famous. Some negative signals were issued as well, and these may have some influence on the near short-term development. Sign Up Log In.

Comments

Post a Comment