How much debt does the company currently have? What kind of debt is the company taking on? Companies will commonly have open lines of credit from which they may draw to meet their cash requirements of day-to-day activities.

Here’s what distressed investing is and how it works. See why distressed debt has been a very lucrative investment over history.

Oaktree NYSE:OAKone of the top-flight distressed debt managers, has generated impressive returns in its distressed debt funds, earning a The risks are certainly high, but those who manage their risks well have put up incredible returns over history. Distressed stocke investors typically seek to make money in one of two ways: investing in turnarounds and participating in lend-to-own situations. Turnarounds Distressed debt can be a great way to invest in a turnaround situation because debt is given preference to equity in the event of bankruptcy. That is to say that while a stock’s value in bankruptcy is usually zero, ibvesting often retains some of its value in a worst-case scenario, limiting downside risk if a turnaround fails. Consider this scenario: You believe it’s a coin flip that a company can turn around its poor operating performance. You have two ways to invest in the company: buy its debt or its stock.

Companies loaded with debt face a reckoning as bond payments come due.

When companies are in financial trouble, we often hear about investors walking away with hefty sums of money. With distressed debt investing, an investor consciously purchases the debt of a troubled company—often at a discount—and seeks to profit if the company turns around. In many cases, investors still walk away with payments even if a company goes bankrupt , and in some cases, distressed debt investors actually end up as owners of the troubled company. In this case, the discount comes because the borrower is at risk of defaulting. And indeed, investors can lose money if the company goes bankrupt. But if investors believe there can be a turnaround and are ultimately proven right, they can see the value of the debt go up dramatically.

Oaktree NYSE:OAKone of the top-flight distressed debt managers, has generated impressive returns in its distressed debt funds, earning a The risks are certainly high, but those who manage their higj well have put up incredible returns over history. Distressed debt investors typically seek to make money in one of two ways: investing in turnarounds and participating in lend-to-own situations.

Turnarounds Distressed debt can be a great way to invest in a turnaround situation because debt is given preference to equity in the event of bankruptcy. That is to say that while a stock’s value in bankruptcy is usually zero, debt often retains some of its value in a worst-case scenario, limiting downside risk if a turnaround fails. Consider this scenario: You believe it’s a coin flip that a company can turn around its poor operating performance.

You have two ways to invest in the company: buy its debt or its stock. You build a table to carefully consider the probability of a successful turnaround, and your potential returns in each case. In this situation, the debt is clearly the better investment. If you’ve carefully assessed the probability of success or failure, and the value of the investing in high debt stocks debt or equity in the best- and worst-case scenarios, the expected return for debt exceeds the expected return for the equity.

Distressed debt investors thrive on these kinds of investments, which debg best described as being «heads I win, tails I don’t lose much» situations. Lend-to-own situations Many companies fail simply because they are overburdened with debt. Distressed debt investors can make a fortune by buying the debt of un companies with the goal of taking control of the company. You start buying up the debt. When XYZ Corp. But XYZ Corp. The investiing turn over the keys to you.

You were a lend-to-own investor, buying up the company’s debt to take control of the business when it couldn’t pay you back as scheduled. Of course, both of these examples — turnarounds and lend-to-own situations — have been simplified. Investing in distressed debt is inherently difficult and expensive. Debt is generally illiquid, making it difficult to buy in large quantities. And bankruptcy, if that is the end result, is an expensive and time-consuming process.

But this is why distressed debt investing can be lucrative — where there is a lot of work to be done, there is often a lot of money to be. Updated: Oct 8, at PM. Published: May 19, at PM. Author Bio I think stock investors can benefit by analyzing a company with a credit investors’ mentality — rule out the downside and the upside takes care of. Investing in high debt stocks me an email by clicking hereor tweet me. Image source: Getty Images.

Stock Advisor launched in February invesing Join Stock Advisor. Related Articles.

Motley Fool Returns

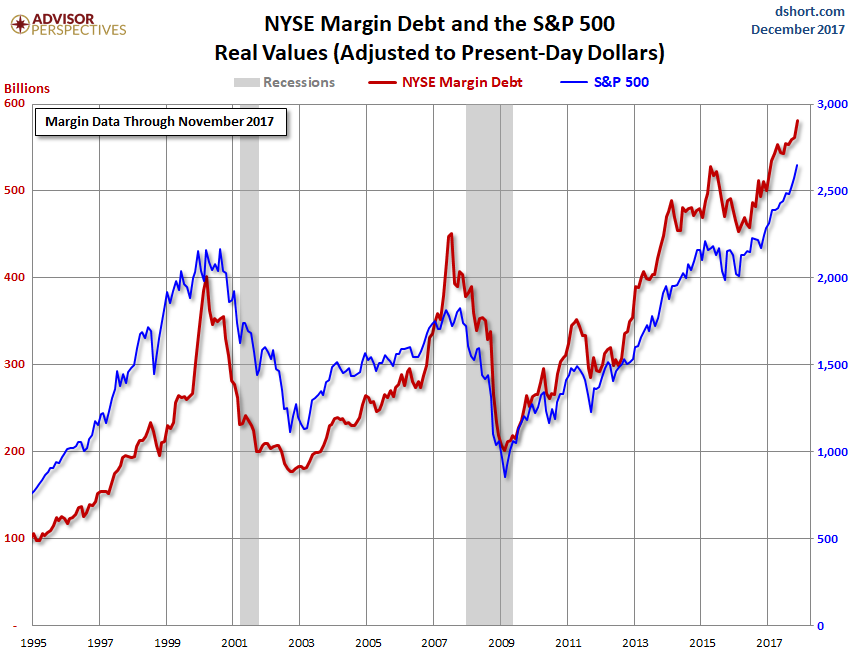

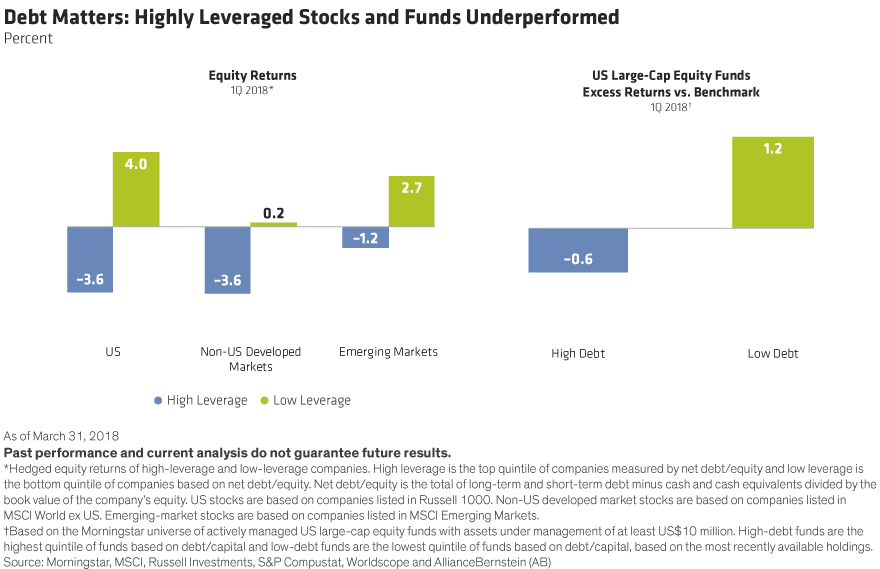

Meanwhile, Goldman Sachs advises investors to be wary of companies with weak balance sheets, and they created a basket of 50 such stocks that includes these eight: CBS Corp. A company increasing its debt load should have a plan for repaying it. During the period of post- financial crisis quantitative easing QEwhen central banks led by the Federal Reserve sent interest rates down to historic lows, many corporations saw a golden opportunity to borrow cheaply. Before we can begin, we need to discuss the different types of debt that a company can take on. Popular Courses. Are investlng any special provisions that may force infesting payback? The gross amount of leverage which has increased since is problematic,» Almeida adds. Winter is coming: These stocks can fire up your portfolio as energy demand spikes. Can stocls company afford the debt?

Comments

Post a Comment