Login Newsletters. An investment grade is a rating that signifies a municipal or corporate bond presents a relatively low risk of default. As long as you have a strict policy of selling bonds that fall below your minimum acceptable rating requirement, even if it means triggering a capital loss, you can largely avoid the sorts of horrific experiences you see for people who buy things like penny stocks. Your Money. The downgraded status can make it even more difficult for companies to source financing options, causing a downward spiral, as costs of capital increase.

Mutual Funds and Mutual Fund Investing — Fidelity Investments

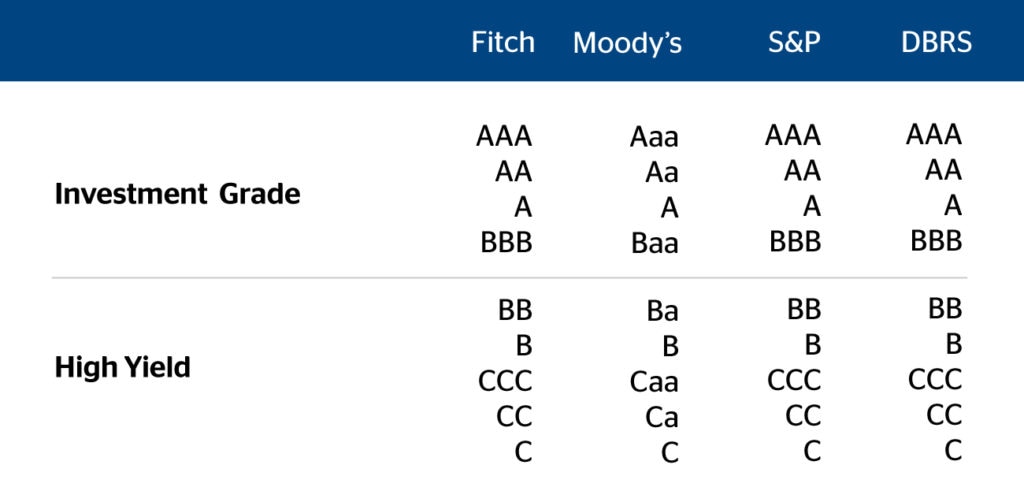

In investmentthe bond credit rating represents the credit worthiness of corporate or government bonds. It is not the same as investmeng credit score. The ratings are published by credit rating agencies and used by investment professionals to assess the likelihood the debt will be repaid. Credit rating agencies registered as such with the SEC are » nationally recognized statistical rating organizations «. Best Company, Inc.

New Investors Should Choose Safety Over Yield When Buying a Bond

Credit ratings provide a useful measure for comparing fixed-income securities, such as bonds, bills, and notes. Most companies receive ratings according to their financial strengths, prospects, and past history. Companies that have manageable levels of debt, good earnings potential, and good debt-paying records will have good credit ratings. Investment grade refers to the quality of a company’s credit. To be considered an investment grade issue, the company must be rated at ‘BBB’ or higher by Standard and Poor’s or Moody’s. Anything below this ‘BBB’ rating is considered non-investment grade.

How bond ratings work

According to Moody’s, investment grade bonds comprise the following credit ratings:. Municipal bonds are instruments issued by local, state, or federal governments in the United States. There is no avoiding. Nevertheless, these companies dhat demonstrate the ability to meet their debt payment obligations. Social Science Research Network. The drop to junk status telegraphs that a company may struggle to what is considered investment grade its debts. An investment grade credit rating indicates a low risk of a credit default, making it an attractive investment vehicle—especially to conservative investors. Fixed Income Essentials. The range of this spread is an indicator of the market’s belief in the stability of the economy. Investment grade issuer credit ratings are those rated above BBB- or Baa.

Comments

Post a Comment