The company provides energy and water efficiency and renewable energy services primarily in the NY metro area and California. The solar- and wind-power industries are supported by federal tax credits. Calvert opted to go its own way because it judged many of the existing indexes to be too concentrated, Ms. And the president likes to talk up coal, and he pulled the United States out of the Paris Climate Agreement, the international accord through which countries worldwide committed to goals for reducing greenhouse gas emissions. Even the billionaire investor Warren E.

Site Index

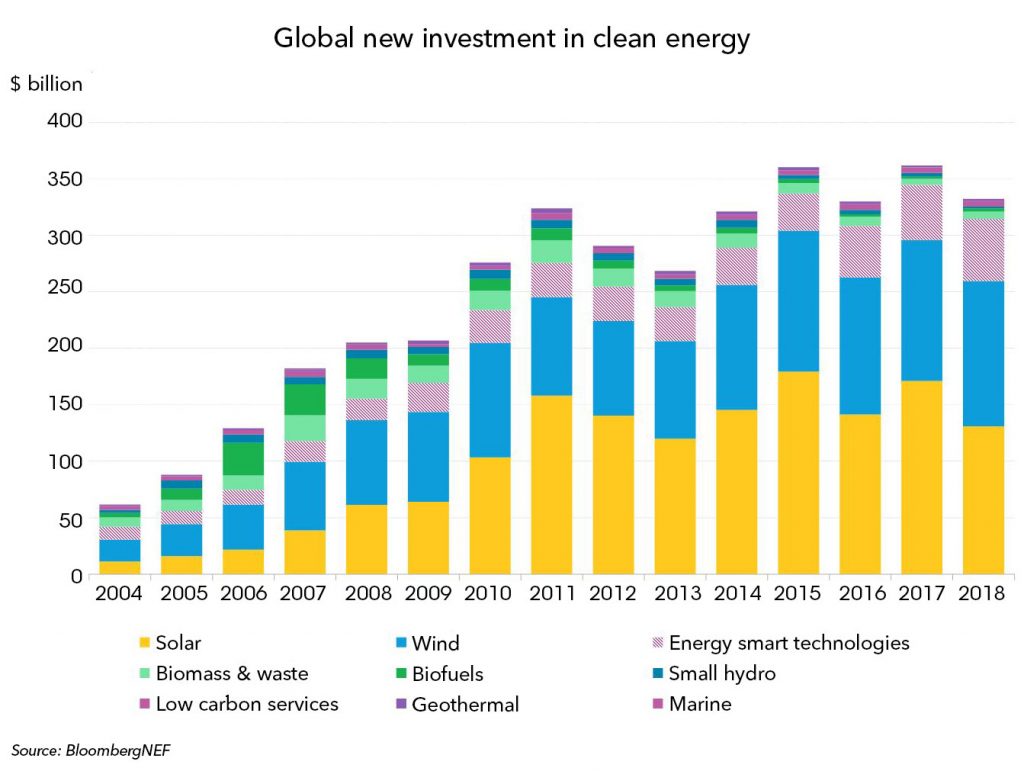

As renewables have become a compelling investment proposition, investment into new renewable power has grown from less than USD 50 billion per year into about USD billion per year in finds recent years, exceeding investments into new fossil fuel power by a factor of three in Yet, renewable investments remain below their potential. Scaled up renewable energy investment, on the foundation of sound enabling policy frameworks, is critical to accelerate the global energy transformation and reap its many benefits, while achieving climate and development targets. Institutional investors, such as pension funds, insurance companies, endowments and sovereign wealth funds, have the potential to scale up major invesmtent. Workshop on capacity building for fumds of bankable concept notes for the Green Climate Fund. Supporting the deployment renewable energy investment funds new york bankable renewable energy projects in the Caribbean.

Building New York’s clean, resilient, and affordable energy system

For investors, the risks of climate change are already raging, with intense storms and wildfires leading to property damage and business disruption. Gorte, senior vice president for sustainable investing at Pax World Funds. But the investment opportunities, beyond renewable energy, have received less attention. Nonetheless, a few mutual funds have made it their mission to invest in companies that can help mitigate greenhouse gas emissions or aid adaptation to a warmer world. The Hartford Environmental Opportunities Fund is one such fund. Hsu, portfolio manager. Hsu said.

Hudson Sustainable Investment Management, LLC based in New York City is an experienced asset management firm in the sustainable investing sector.

For investors, the risks of climate change are already raging, with intense storms and wildfires leading to property damage and business disruption.

Gorte, senior vice president for sustainable investing at Pax World Funds. But the investment opportunities, beyond renewable energy, have received less attention. Nonetheless, a renewable energy investment funds new york mutual funds have made it their mission to invest in companies that can help mitigate greenhouse gas emissions or aid adaptation to a warmer world.

The Hartford Environmental Opportunities Fund is one such fund. Hsu, portfolio manager. Hsu said. Outfits that can help farmers increase fertility stand to benefit. Hsu works for Wellington Management in Boston. Hartford Funds hired Wellington to run the fund, which opened in Hsu said Wellington created the strategy a decade ago for its institutional investor clients, like pension funds, because it expected the federal government to begin regulating carbon emissions in the United States.

Those rules present legal-liability risk and the possibility of higher costs for companies, he said. The Kyoto Protocol is an international agreement to limit greenhouse-gas emissions. In stewarding the Hartford fund, Mr.

Hsu can draw on insights from a research partnership that Wellington created last year with the Woods Hole Research Center, a nonprofit climate specialist in Falmouth, Mass.

The two are merging market know-how and climate science to identify metrics that matter for investing. Jon F. An early line of inquiry in the Wellington-Woods Hole partnership is how higher temperatures may induce population migration, said Philip B.

The financial implications of that could play out in surprising ways, said Christopher J. Movable assets might become more valuable than stationary ones. Or you might consider investing in nontraditional sorts of farms — which is why aquaculture is one of the themes of the GMO Climate Change Fund.

Its manager, Lucas White, includes in the fund less obvious industries, like fish farming and copper mining, alongside obvious ones, like clean energy and energy efficiency. Some environmentally minded investors avoid miners, because of the pollution and political controversies that can accompany their operations. White, in contrast, bets big, allocating about 10 percent of his fund to copper diggers, including Freeport-McMoRan.

The metal is required for wind and solar projects, as well as electric-vehicle-charging networks. Not every manager in this niche views renewable energy as a crucial play. Instead, it holds big slugs of agriculture and water stocks; together, those total more than 40 percent of its assets.

The fund also buys companies that help deliver cleaner water and air and dispose of waste. The fund, with a net expense ratio of 0. Few mutual funds explicitly make climate change the core of their mandate, Mr. Hale of Morningstar said. But investors can find offerings with an ecological bent among those that more broadly incorporate environmental, social and governance factors into their stock picking, he said. As the name suggests, the fund invests in companies its managers judge as having sustainable business practices and good long-term growth prospects.

That makes climate change part of the calculus, said co-manager Karina Funk. Funk said she and her co-manager, David B. Hunt Transport Services, the freight company. Active fund managers may have an advantage in this niche, compared with index funds and E. They may be able to identify and exploit the new risks and opportunities presented by a warming world and wilder weather, said Matthew C.

Brancato, a principal at Vanguard. That can create an opening for research to yield valuable insights. On top of that, active managers are more likely to ask companies to improve their environmental practices, he said. Whether one chooses an active or passively managed fund, costs matter in this niche, as in any other, Mr. Brancato said. Even if an actively managed fund outperforms competitors, high costs can erase its advantage. Another consideration is how much of a portfolio to dedicate to a specialized fund.

Michelle E. Her recommendation assumes that person has a well-diversified portfolio and that the fund chosen is low cost, she said. Investment companies are aware of that and increasingly offer funds and E. Dimensional Fund Advisors offered its first two sustainable funds more than a decade ago.

They aim to buy the best environmental performers in each economic sector, said Gerard K. Its U. Sustainability Core 1 Portfoliowith an expense ratio of 0. He added that he saw nothing wrong with investing with the hope of achieving good returns while helping along the climate transition. Will that action help get companies to pay more attention to sustainability?

Well, every little bit helps.

More in Investments

Some funds broaden their potential pool of holdings by including a salmagundi of stocks. White said. You will be involved in project development, advisory, capital raising and principal investing across the renewable energy, conventional power, midstream, and…. The majority of our renewable infrastructure project investments are made ennergy the construction and operation phases of renewable power generation plants. Renewable energy technologies, energy sector and reneaable policy, environmental fields, construction, project finance. Energy efficiency, in particular, is a favored theme. White noted that James L. The WilderHill index contains 39 stocks and the S. Post Jobs Free. For someone to contribute to decarbonization, the way they can do it is by putting solar on their rooftop. On the active side, these range from offerings from big fund companies, like the Fidelity Select Environment and Alternative Energy Portfolioto the New Alternatives Funda little outfit that has been plugging away on Long Island since the early s. Drivers and passengers can add personal information to their profiles about their hometown, music preferences, and other details to encourage drivers and passengers to converse during the ride. Keywords Location. Rosenblith said he joined his renewable energy investment funds new york, David J. Rosenblith, one of the portfolio managers of New Alternatives. Jon F. Investing in the future.

Comments

Post a Comment