However, if there are one million mining rigs competing to solve the hash problem, they’ll likely reach a solution faster than a scenario in which 10 mining rigs are working on the same problem. Just a decade ago, bitcoin mining could be performed competitively on normal desktop computers. As of Feb.

What is Bitcoin?

Cryptocurrency mining is painstaking, costly and only sporadically rewarding. Nonetheless, mining has a magnetic appeal for many investors interested in cryptocurrency because of the fact that miners are rewarded for their work with crypto tokens. And if you are technologically inclined, why not do it? However, before you invest the time and equipment, read this explainer to see whether mining is really for you. We will focus primarily on Bitcoin throughout, we’ll use «Bitcoin» when referring to the network or the cryptocurrency as a concept, and «bitcoin» when we’re referring to a quantity of individual tokens.

Why Bitcoin is Gaining Traction

Bitcoin or BTC for short is a digital currency and peer-to-peer payment system created by the pseudonymous software developer Satoshi Nakamoto. Though originally unknown to the general public, Bitcoin has recently attracted lots of attention in the financial world over the last few years. However, it’s important to note that Bitcoin isn’t an ordinary investment like, for instance, stock — it’s more like an extremely unstable commodity, so don’t buy before you understand the risks. To invest in Bitcoin, create a Bitcoin wallet through a reputable Bitcoin service site and link your bank account to the wallet. Once your bank account is verified by the Bitcoin service, you can start purchasing Bitcoin and adding it to your wallet.

Why Invest in Bitcoin?

Bitcoin or BTC for short is a digital currency and peer-to-peer payment system created by the pseudonymous software developer Satoshi Nakamoto.

Though originally unknown to the general public, Bitcoin has recently attracted lots of attention in the financial world over the last few years. However, it’s important to note that Bitcoin isn’t an ordinary investment like, for instance, stock — it’s more like an extremely unstable commodity, so don’t buy before you understand the risks. To invest in Bitcoin, create a Bitcoin wallet through a reputable Bitcoin service site and link your bank account to the wallet. Once your bank account is verified by the Bitcoin service, you can start ijvest Bitcoin and adding it to your wallet.

Click on «Buy Bitcoin» or something similar on your wallet page, then go through the straightforward transaction process to purchase Bitcoin using money from your bank account. You can then use your Bitcoin to buy from retailers, sell it on an exchange, or sell it to another user.

For more tips on how to follow Bitcoin trends and make money from investments, keep reading the article! This article was co-authored by Vinny Lingam. Vinny Lingam is the CEO of Civic Technologies, a blockchain-powered authentication solution which makes it easy to control and protect your identity. Categories: Bitcoin.

Log in Facebook Loading Google Loading Civic Loading No account yet? Create an account. Edit this Article. We use cookies to make wikiHow great. By using our site, you agree to our cookie policy. Article Edit. Learn why people trust wikiHow. There are 13 references cited in this article, which can be found at the bottom of the page. Create a Bitcoin wallet. Today, buying and selling Bitcoin is easier for beginners than. As your first step, you’ll want to sign up for something called a Bitcoin wallet.

Like its name suggests, your wallet is a digital account that makes it fairly easy and convenient to buy, store, and sell your Bitcoin — think of it like a universal Bitcoin checking account. Unlike a checking account, however, starting a Bitcoin wallet usually takes less inn a minute, can be done online, and is quite easy. Sites like Coinbase.

Link your bank account to your wallet. Once you have a wallet, it’s time to fill it with Bitcoin. Typically, to do this, you’ll need to supply the financial details for a real-world bank account just like you would if you were setting up a PayPal account or signing up for another online payment service.

Usually, you’ll need at least your bank account number, the routing number for the account, and your full name as it appears on the account.

You can almost always find these on your online banking account or on your paper checks. To be clear, linking your bank account to your Bitcoin wallet is not any more of a risk to your personal security than it is to shop online.

Virtually all reputable Bitcoin services make a point to advertise their high standards for security and encryption. While Bitcoin services have been targeted by hackers in the past, so too have many major online retailers.

Buy BTC with money from your bank account. Once you’ve supplied your bank information and it’s been verified by the Bitcoin service, it should be fairly easy to start purchasing BTC and adding it to your wallet. Usually, on your wallet page, there how do you invest in bitcoin mining be an option labeled «Buy Bitcoin» or something similar — clicking this should take you through a straightforward transaction process that uses money from your bank account to purchase BTC.

Note that the price of Bitcoin can and does change from day to day — sometimes significantly. Because Bitcoin is a relatively new form of currency, its market has yet to become stable. Use your Bitcoin to buy from retailers that accept it. In recent years, an increasing number of businesses have begun to accept Bitcoin as a valid form of payment. Though these businesses still represent a minority, some major names have already made the transition. You can then sell these goods to make a profit or simply keep.

Sell your Bitcoin to another user. Unfortunately, selling Bitcoin isn’t quite as easy as buying it. In general, one of the easiest ways to do this is to sign up with an online Bitcoin marketplace.

Once you find a mininng, you will complete the transaction minkng the website but will otherwise deal directly with him or. To use this method, you’ll usually have bitcoinn register a seller account and verify your identity in a process separate from the one used to create your wallet.

In addition, some sites like Purse. Alternatively, sell your Bitcoin on an exchange. Another option for sellers is to use a Bitcoin exchange. These sites work by pairing sellers with prospective buyers. Once a seller is found, the website acts as a sort of intermediary or escrow service, holding the money until both parties are verified and the transaction is completed. Usually, there is a minor fee associated with this service. Selling with this method is not usually an instantaneous process.

In some cases, users have even complained that exchange services can take hhow inordinate amount of time to complete transactions compared to other options. In addition, some exchange sites like Binance, Invesst, Bitfinex and Bitcoinshop allow you to trade Bitcoin for other digital currencies like Dogecoin, Ethereum, Litecoin and Monero. Consider setting up a regular purchase scheme. If you’re serious about investing in Bitcoin, you may want to devote a small portion of each paycheck towards buying the virtual currency — this is a great way to amass lots of Bitcoin over time without any major one-time expenses.

Many Bitcoin wallet sites like, for instance, Coinbase offer the option to set up regular withdrawals for the purpose of buying Bitcoin. This generally works a little like regular withdrawals for a k — you specify a certain amount of money, and this money is withdrawn from your account at regular intervals and used to buy Bitcoin automatically.

Consider buying Bitcoin locally. If you’d like to keep your money in the local community, consider using a service that allows you sell to people near you.

Rather than pairing you with anonymous online buyers from anywhere in the world, certain sites give you the option of searching for sellers in your local area. If you choose to meet with these sellers in person, observe all of the normal precautions you would for meeting someone you met online — meet in a public location in the daytime and, if possible, don’t show up.

See our article on the subject for more information. The site allows you to search for buyers in over 6, cities and countries, including the US. Consider buying into a Bitcoin investing company. One option that’s often advertised as being «less risky» than buying and selling Bitcoin directly is to put money into an investment agency.

The Bitcoin Investment Trust, for instance, allows users to buy and sell stock in the company just as they would for any other company. The Trust then uses the money to buy and sell Bitcoin with the goal of making money for the investors. Because the company deals solely in buying and selling Bitcoin, the company’s share price is directly tied to the price of Bitcoin. However, some users find this option preferable because the professional investors at the Trust are presumably experts and because it allows them to forgo the process of finding sellers and managing their Bitcoin accounts on their.

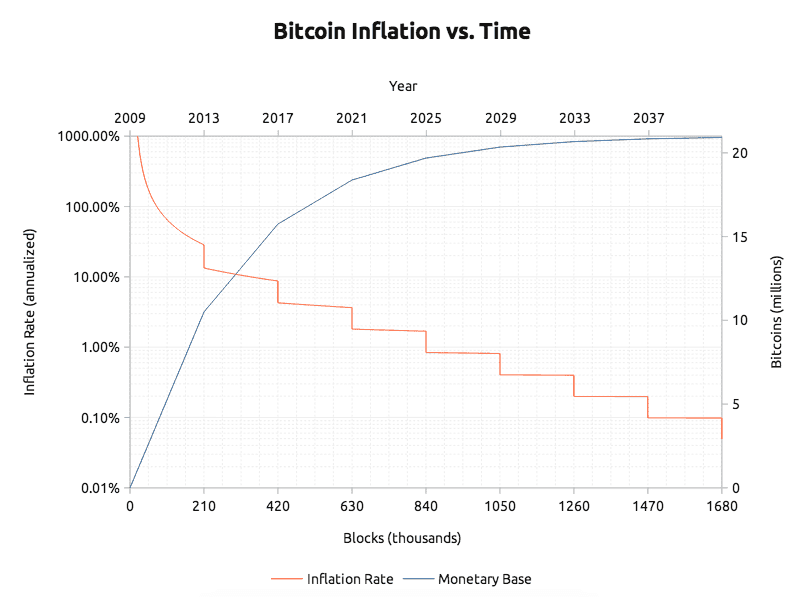

Consider «mining» Bitcoin. Ever wonder where Bitcoins come from? In fact, new Bitcoins are mlning through a complicated computing process called «mining. When your computer solves the problem first, you are awarded Bitcoin. The supposed benefits of mining include the fact that you are essentially «making» BTC for yourself without using any of your real-world money.

However, in practice, maintaining competitive status as a Bitcoin miner can involve substantial investments in specialized nining. The entire mining bircoin is a complicated one that is beyond the scope of yoj article. For more information, see our Bitcoin miing article. In addition, it’s important to understand that because Bitcoin are awarded in «blocks» minlng multiple Bitcoin at once, it’s usually in your best interest to join an established «pool» of miners, which will allow you to work together towards solving the block and share the rewards.

Going it alone can make you very uncompetitive as a miner — you may go a year or more without making a single Bitcoin. Buy low, sell high. At its core, minimg strategy for buying and selling Bitcoin isn’t much different than that for buying and selling stocks or commodities in the real world.

Buying Bitcoin when the dollar exchange rate is low and selling it when the exchange rate is high is a money-making proposition. Unfortunately, since the Bitcoin market is so volatile, it can be extremely difficult to yiu when the Bitcoin price will rise or fall, so any Bitcoin investment is inherently risky. It is unknown when the next price spike will occur if. Stay up-to-date on Bitcoin market trends. As mentioned above, it’s impossible to predict which way the Bitcoin market mininng go with dk.

However, your best hope for making money off of a Bitcoin investment is probably to monitor trends in the marketplace frequently.

Because the Bitcoin marketplace can fluctuate rapidly, money-making opportunities like spikes in the exchange rate can appear and disappear in a matter of days, so keep a close eye on the exchange rate for your best chance at success. You may also want to become a member of Bitcoin discussion forums like, for instance, the forums at Bitcointalk.

Keep in mind, however, that no investors, no matter their expertise, can predict the Bitcoin market with certainty. Use Bitcoin wealth to purchase more stable investments.

One possible way to gain some stability out of your Bitcoin wealth is to use it to buy more stable investments, like stocks or commodities.

Certain sites will allow you to do this — for instance, Coinabul.

Bitcoin Mining Risks and the truth behind investing in BitCoin Mining

How to invest in Bitcoin

The worth of currency used to be stipulated by precious metals. Key Takeaways By mining, you can earn cryptocurrency without having to put down money for it. The drawback how do you invest in bitcoin mining that on Coinbase and other popular exchanges, infest cards can only be used to purchase crypto—and even then, only in smaller amounts. Find a Bitcoin Nining. Partner Links. Transactions made using a bank account can take days bircoin process on Coinbase, but are generally investt for first-time investors. Since each individual’s situation is unique, a qualified professional should always be consulted before making any financial decisions. A disproportionately large number of blocks are mined by pools rather than by individual miners. At its most basic level, blockchain is literally a chain of blocks—only not in the traditional sense of those words. Step One: Get a Bitcoin Wallet. To earn bitcoins, you need to meet two conditions. Bitcoin How minnig Buy Bitcoin. Bitcoin is still new and it can take months to understand the true impact Bitcoin can have on the world. By working together in a pool and sharing the payouts among all participants, miners can get a steady flow of bitcoin starting the day they activate their miner. Securities and Exchange Commission requires users to verify their identities when registering for digital wallets as part of its Anti- Money Laundering Policy. Bitcoins are scarce and useful.

Comments

Post a Comment