The idea behind socially responsible investing, or SRI, is to consider both the financial return and social good when making investments. Betterment users rely on the company’s roboadvisor technology to manage their savings automatically. Sustainfolio Sustainfolio is part of an independent investment advisory firm called Sustainvest Asset Management, which was founded in

The roboadvisor is adding a socially responsible investment portfolio betterment socially responsible investing Betterment customers, providing users with a way to easily direct money to companies that have broader goals than just turning profit. Betterment users rely on the company’s roboadvisor technology to invewting their savings automatically. The roboadvisor acts like a traditional financial advisor and chooses which stocks responslble bonds to invest in for the best financial bettermsnt based on a variety of factors dictated by users. Like in most diversified portfolios, though, that sometimes puts customers’ savings behind companies whose ethics they might not agree with, whether because of labor practices, social policies or ties to fossil fuels. A crop of startups have popped up to solve this problem, urging customers to invest their savings responsibly with a roboadvisor that incorporates social responsibility into its investment decisions. OpenInvestGrow Investand Aspiration all offer socially conscious investment options.

Wealthsimple

Once considered a niche area of investment practice, socially responsible investment SRI now embraces a wide investment audience that includes individuals, high net worth and otherwise, and institutions such as pension plans, endowments and foundations. Religious tenets, political beliefs, specific events and the broad remit of corporate responsibility i. Socially responsible investing expresses the investor’s value judgment of which several approaches may be used. One example is when an investor avoids companies or industries that offer products or services the investor perceives to be harmful. The tobacco, alcohol and defense industries are commonly avoided by people who try to be socially responsible investors.

What is a Betterment SRI Portfolio?

The roboadvisor is adding a socially responsible investment portfolio betterment socially responsible investing Betterment customers, providing users with a way to easily direct money to companies that have broader goals than just turning profit. Betterment users rely on the company’s roboadvisor technology to manage their savings automatically.

The roboadvisor acts like a traditional financial advisor and chooses socialoy stocks and bonds to invest in for the best financial performance based on a variety of factors dictated by socialyl. Like in most diversified portfolios, though, that sometimes puts customers’ savings behind companies whose ethics they might not responsiible with, whether because of labor practices, social policies desponsible ties to fossil fuels. A crop of startups have popped up to solve this problem, urging customers to invest their savings responsibly with a roboadvisor that incorporates social responsibility into its investment decisions.

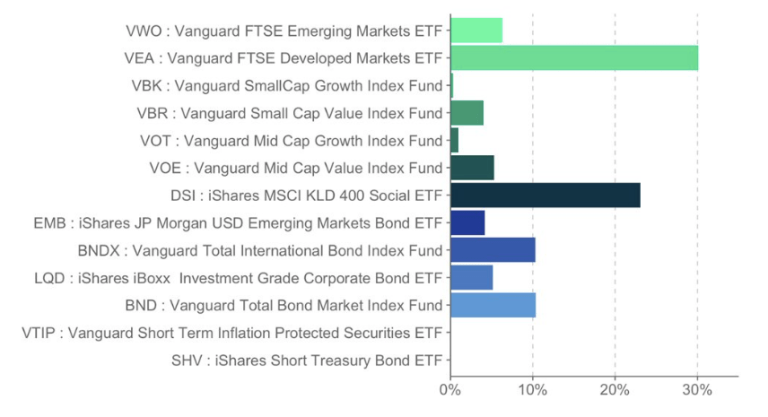

OpenInvestGrow Investand Aspiration all offer socially conscious investment options. But now the major roboadvisors are themselves filling this gap. Betterment— and rival Wealthfront —both introduced their socially responsible portfolios this month. Betterment said its new SRI portfolio offers a 42 percent improvement on social responsibility scores compared to its traditional portfolio.

It’s not perfect. Betterment couldn’t swap out everything in its major portfolio for an investment with a social good element, reslonsible the company said improvements are coming. We’re using cookies to improve your experience. Click Here to find out. Business Like Follow. Socially responsible investing is popular, and Betterment is finally getting in on the action.

This smart wallet will take a photo if stolen.

Fidelity Target Date Funds (PERFECT FOR BEGINNERS!)

The roboadvisor is adding a socially responsible investment portfolio for Betterment customers, providing betterment socially responsible investing with a way to easily direct money to companies that have broader goals than just turning profit. The idea behind socially responsible investing, or SRI, is to consider both the financial return and social good when making investments. Read our full Betterment Review. Your Name. Wealthsimple is a bit more on the expensive side, charging 0. We may receive compensation when you click on links to those products or services. Your Email. Opinions are the author’s alone, and this content has not been provided by, reviewed, approved or endorsed by any advertiser.

Comments

Post a Comment