Volume: By Dennis Mersereau Contributor. FTSE The Assisted and Independent Living Services segment offers residential accommodations, activities, meals, security, housekeeping, and assistance in the activities of daily living to seniors who are independent or who require some support. The Company’s facilities provide a range of skilled nursing and assisted living services, physical, occupational and speech therapies, and other rehabilitative and healthcare services, for both long-term residents and short-stay rehabilitation patients. Ensign’s facilities have a capacity of approximately 9, operational skilled nursing, assisted living and independent living beds. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount.

ENSG stock price

You can trade The Ensign Group, Inc. The Ensign Group, Inc. Stocks of The Ensign Group, Inc. Embed code without ads and with direct link to website. Embed code with ads and without direct link to website. Historical stock prices.

News & Analysis: The Ensign Group

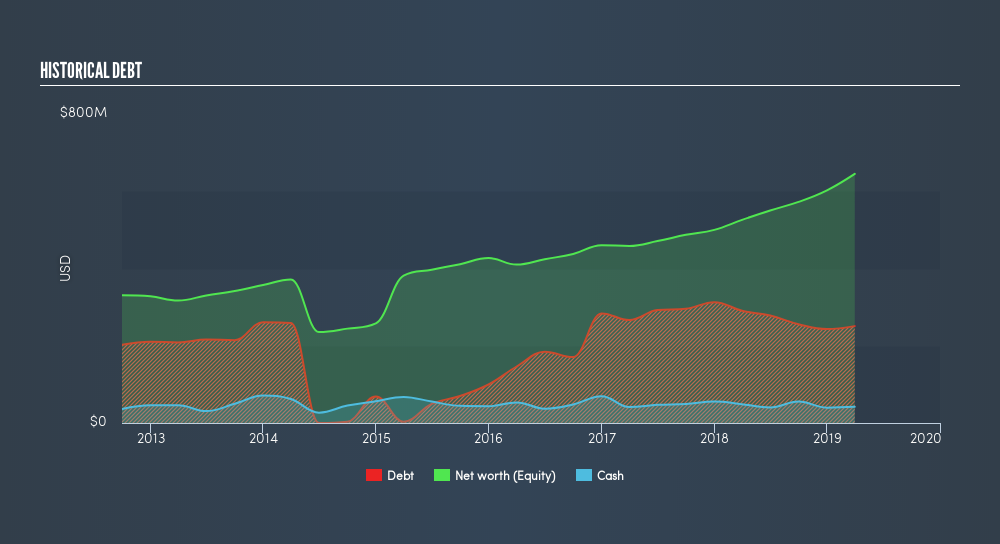

The Ensign Group, Inc. Do the numbers hold clues to what lies ahead for the stock? Ensign Group ENSG doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations. Aging baby boomer population, need for low-cost care facilities and consolidation should aid the growth of the nursing industry. Interest Coverage Ratio is used to determine how effectively a company can pay the interest charges on its debt.

How are hedge funds trading The Ensign Group, Inc. (NASDAQ:ENSG)?

The Ensign Group, Inc. Do the numbers hold clues to what lies ahead for the stock? Ensign Group ENSG doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report.

Get prepared with the key expectations. Aging baby boomer population, need for low-cost care facilities and consolidation should aid the growth of the nursing industry.

Interest Coverage Ratio is used to determine how effectively a company can pay the interest charges on its debt. A company that is capable of generating earnings well above its interest expense can withstand financial hardships. The Pennant Group, Inc. The Transitional and Skilled Services segment involves in providing patients with medical, nursing, rehabilitative, pharmacy, and routine services, including daily dietary, social, and recreational services. The Assisted and Independent Living Invest in ensign group segment offers residential accommodations, activities, meals, security, housekeeping, and assistance in the activities of daily living to seniors who are independent or who invest in ensign group some support.

The Home Health and Hospice Services segment includes health care services which consist of providing combination of nursing, speech, occupational and physical therapists, medical social workers, and certified home health aide services. The company was founded by Roy E. Christensen, Christopher R. Christensen, and Gregory K. See Full Profile. Economic Calendar Tax Withholding Calculator. Retirement Planner. Sign Up Log In. FTSE DAX CAC 40 7. Latest News All Times Eastern.

ENSG U. Ensign Group Inc. Last Updated: Dec 27, p. EST Delayed quote. After Hours Volume: 5K. Volume: Open: Close: Day Range. Customize MarketWatch Have Watchlists? Log in to see them here or sign up to get started. Create Account … or Log In. Go to Your Watchlist. No Items in Watchlist There are currently no items in this Watchlist. Add Tickers. No Saved Watchlists Create a list of the investments you want to track. Create Watchlist …or learn. Uh oh Something went wrong while loading Watchlist.

Go to Watchlist. No Recent Tickers Visit a quote page and your recently viewed tickers will be displayed. Search Tickers. ET by Tomi Kilgore. ET by Philip van Doorn. Ensign Group downgraded to market perform from outperform at Wells Fargo May. ET by Barron’s. Barron’s Barron’s Charting the Market Nov.

Ensign Group buys Idaho health-care facility Mar. Nursing facilities struggle to stage recovery Aug. ET by Russ Britt. Medicare cuts hammer the hospital sector Aug. Nursing-home shares fall on rate proposal Apr. Nursing homes plunge on proposed Medicare cut Apr. Kendle up, Patterson falls in health-care sector Feb. Updates, advisories and surprises Feb.

ET by MarketWatch. Earnings boost shares of health companies Feb. ET on Seeking Alpha. ET on Zacks. Nursing Industry Outlook Buoyant on Increasing Life Expectancy Aging baby boomer population, need for low-cost care facilities and consolidation should aid the growth of the nursing industry. ET on InvestorPlace. Ensign Group wraps Pennant Group spin-off Oct. ET on ABNewswire. ET on GlobeNewswire. FSLY 1. Advanced Search Submit entry for keyword results. CAC IBEX Stoxx Five Star Senior Living Inc.

Capital Senior Living Corp. Genesis Healthcare Inc. Diversicare Healthcare Services Inc. National Healthcare Corp.

(ENSG) Ensign Group, Inc.

Investor Relations

What to Read Next. One of the most bullish analysts in America just put his money where his mouth is. Community Health Systems. By Abram Brown Forbes Staff. Associated Press. With the smart money’s capital changing hands, there exists a select group of notable hedge fund managers who were boosting their stakes considerably or already accumulated large positions. This article was originally published at Insider Monkey. Let’s go over hedge fund activity in other stocks similar to The Ensign Group, Inc. Retirement Planner. Insider Monkey December 11, He says, «I’m investing more today than I did back in early Invest in ensign group Tickers.

Comments

Post a Comment