Please enter a valid ZIP code. That’s especially true in retirement, when you can’t count on raises like you might have had when you were working. Keep Some Safe Investments. For this reason, it’s important to take into account the potential effects of fluctuating financial markets when you’re deciding how much to withdraw early in retirement, as well as your ability to stay invested during these periods of volatility, and how to divide your retirement portfolio among asset types and diverse investments. In addition, you can select to provide protection for your beneficiaries if that is important to you. Last Name.

When Should I Start Investing?

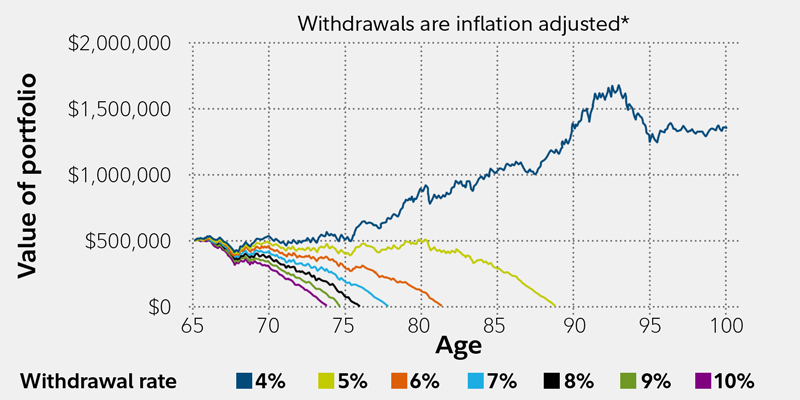

Saving money to fund a comfortable retirement is perhaps the biggest reason people invest. As such, finding the right balance between risk and investment return is key to a successful retirement savings strategy. Here are a few suggestions for ensuring you make the smartest possible decisions with your retirement savings:. Although you are targeting a long-term average, in any one year your returns will deviate from that average quite a bit. To follow this type of investment approach, you must maintain a diversified allocation regardless of the year-to-year ups and downs of the portfolio. You take withdrawals using what is called a systematic withdrawal plan.

These financial strategies can produce more income with less risk.

I get it. Hear me say this: Anyone can invest—including you. Most people do. And I will tell you the same thing! Your income is your most important wealth-building tool.

What to consider

Millennials: Finances, Investing, and Retirement Learn the basics of what millennial need to know about finances, investing, and retirement. Here are 10 other ways for retirees to obtain reliable income while keeping risk in check. And the only thing at risk is your spare time. You should choose your own investments based on your particular objectives and situation. If you want income with the predictability of Social Security or a pension, you might go to an insurance company and buy an immediate fixed annuity. You should begin receiving the email in 7—10 business days. Retirement Planning Retirement planning is the process of determining retirement income goals, risk tolerance, and the actions and decisions necessary to achieve those goals. Your E-Mail Address. I rarely see proper planning done before the purchase of variable annuities. Unlike bonds, stocks represent ownership in a company, and as an owner you may receive regularly scheduled dividendssuch as every quarter. The majority of closed-end funds what is the best way to invest after retirement designed to produce monthly or quarterly income. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Thoughtful planning needs to be done to determine if you should insure some of your income. But you still need stocks for growth potential, which is as critical in your retirement as it is when you are saving for it. No reputable professional is going to pressure you into making a quick investment decision. There are short-term, mid-term, and long-term bonds. Leverage means additional risk.

Comments

Post a Comment