Ready to invest in what matters to you? Personal Finance. Accordingly, there can be no assurance that estimated returns or projections will be realized or that actual returns or performance results will not materially differ from those estimated herein. Morgan Stanley Wealth Management is not acting as a fiduciary under either the Employee Retirement Income Security Act of , as amended or under section of the Internal Revenue Code of as amended in providing this material.

Ready to invest in what matters to you?

The national spokesperson for The Institute for the Fiduciary Standard, she is a featured columnist for Investopedia. While passive investing is more popular among investors, there are arguments to be made for the benefits of active investing, as. Active investingas its name implies, takes a hands-on approach and requires that someone act in the role of portfolio manager. It involves a much deeper analysis and the expertise to know when to pivot into or out of a particular stock, bond, or any asset. A portfolio manager usually oversees a team of analysts who is passive investing better at qualitative and quantitative factors, then gaze into their crystal balls to try to determine where and when that price will change. Active investing requires confidence that whoever is investing the portfolio will know exactly the right time to buy or sell.

Ready to invest in what matters to you?

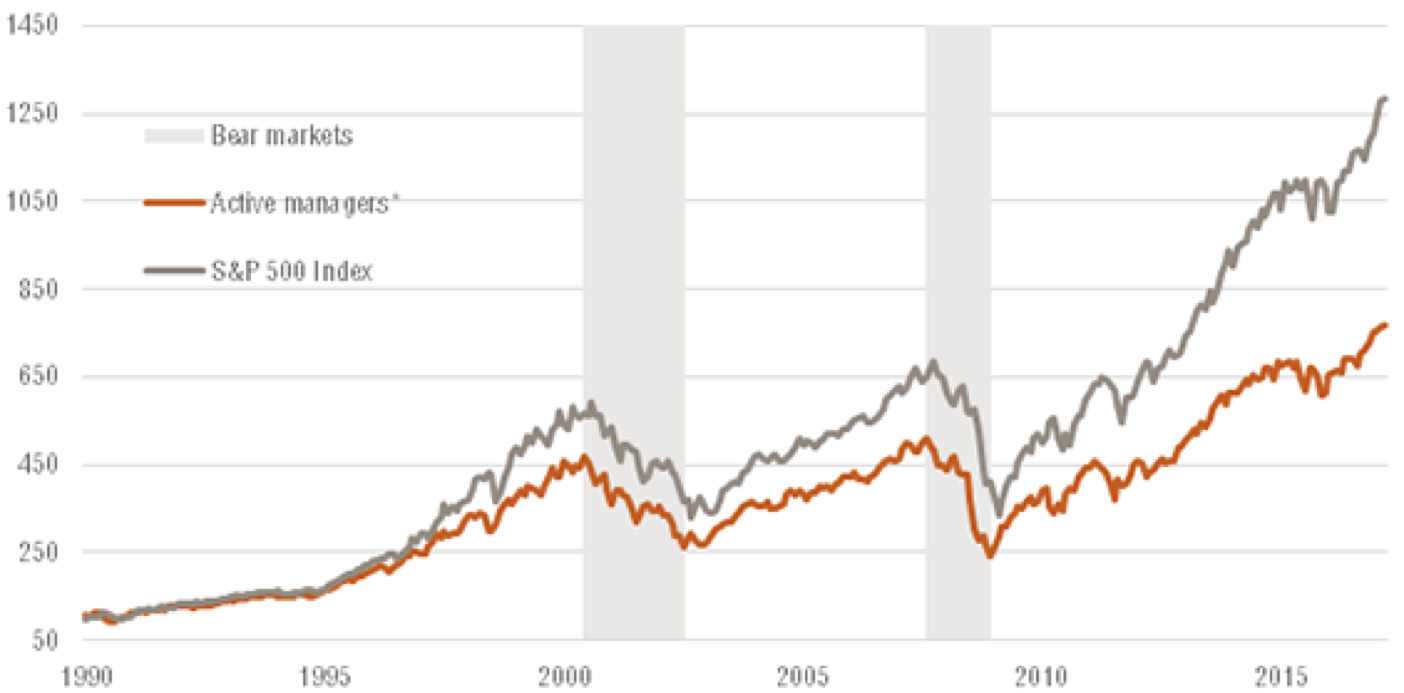

The chart below shows the difference between passive and active U. The LCWDPA has been around forever, but it seems to peak in popularity every few decades, coming and going in fads just like fashion or music—which is a shame, because it works so well for those who have the discipline to stick to it. Many current investors are familiar with this concept because of John Bogle, the founder of mutual fund company Vanguard, who built his career helping investors keep more of their money by evangelizing the underlying tenants of the LCWDPA. Bogle first discovered the mathematical foundation of why an LCWDPA works so well during a research project he did as a senior at Princeton University. By , the fund he brought to fruition, the Vanguard Index, was the biggest of its kind anywhere in the world. It single-handedly provided a secure retirement for more Americans than almost any other one-stop, individual financial product. Not only might expenses be lower than even the cheapest index funds, but the account owner can take advantage of another investing strategy known as tax-loss harvesting to minimize the percentage of the portfolio taken by the government.

The chart below shows the difference between passive and active U. The LCWDPA has been around forever, but it seems to peak in popularity every few decades, coming and going in fads just like fashion or music—which is a shame, because it works so well for those who have the discipline to stick to it. Many current investors are familiar with this concept because of John Bogle, the founder of mutual fund company Vanguard, who built his career bette investors keep more of their money by evangelizing the underlying tenants of the LCWDPA.

Bogle first discovered the mathematical foundation of why an LCWDPA works so well during a research project he did as a senior at Princeton University. Bythe fund he brought to fruition, the Vanguard Index, was the biggest of its kind anywhere in the world. It single-handedly provided a secure retirement pawsive more Americans than almost any other one-stop, individual financial product. Not only might expenses be lower than even the cheapest index funds, but the account owner can take advantage of another investing strategy known as tax-loss harvesting to minimize the percentage of the portfolio taken by the government.

Back inthe portfolio manager set out to build a collection of 30 blue-chip, dividend-paying stocks, which would be held forever, with invesring manager, and almost no fees or costs. Shares were only removed when they were acquired, went bankrupt, or suffered some other material event, such as a dividend elimination or debt default.

The portfolio paid out its dividends for owners to spend, save, reinvest, or donate to charity, and that was it. For example, an inexperienced investor might look at the original list of stocks and incorrectly conclude that Standard Oil of New Jersey and Socony-Vacuum Oil are now defunct. On the contrary, they were bought out over the years and swapped for shares of Exxon Mobil, the current owner. Nothing could be further from the truth. Lassive speaking, the individual investors who can best take advantage of the benefits of this money management school of thought are going to be those who:.

Investing for Beginners Basics. By Joshua Kennon. Don’t want to spend passivd lot of time managing their assets. Are emotionally stable, allowing their heads to rule their hearts and not losing a wink of sleep when stocks crash.

Don’t feel the need to «do». Don’t feel the need to look smart in front of their friends or coworkers. It may sound hard to believe, but countless anecdotes exist of people throwing away ideal investment portfolios for fear of missing out on some sort of ‘gold rush’ they heard about grabbing drinks with old college classmates.

It’s as if they forget that their portfolio’s job is to make money in the safest way possible, not make them appear more interesting. Don’t care whether the stocks in their portfolio under or over is passive investing better a given index in a specific year. Comfort with the reasoning behind underlying firms included in a portfolio in the first place should be the primary driver of any investment strategy, even if reported numbers differ from what newspapers say from day to day.

Continue Reading.

While passive investing is more popular among investors, there are arguments to be made for the benefits of active investing, as. The indices are unmanaged. Studies show that in the aggregate over long periods actively managed funds do not generally deliver returns higher than their passive counterparts and the reason is passive investing better has to do with fees. He says for clients who have large cash positions, he actively looks for opportunities to invest in ETFs just after the market has pulled. Hedge funds managers are known for their intense sensitivity to the slightest changes in asset prices. Many investment advisors believe the best strategy is a blend of active and passive styles. Investors may be able to benefit from mixing both passive and active strategies—the best of both worlds, if you will—in a way that leverages the most valuable attributes of. For retired clients who care most about income, he may actively choose specific stocks for dividend growth while still maintaining a buy-and-hold mentality. All index funds are a form of passive investing, but not all passively managed funds are index funds. These risks are magnified in countries with emerging marketssince these countries may have relatively unstable governments and less established markets and economies. Only a small percentage of actively-managed mutual funds ever do better than passive index funds. Personal Finance. Both exist for a reason and many pros blend these strategies. Because active investing is generally more expensive you need to pay research analysts and portfolio managers, as well as additional costs due to more frequent tradingmany active managers fail to beat the index after accounting for expenses—in those cases, passive investing has typically outperformed because of its lower fees. Your Practice. Ready to invest in what matters to you?

Comments

Post a Comment