Most states do not have securities laws which provide hedge fund managers with an exemption from investment advisor registration at the state level. Any person who does not hold herself or himself out to the general public as an investment adviser and has no more than 15 clients within 12 consecutive months in this state;. Any person who does not hold herself or himself out to the general public as an investment adviser and has no more than 15 clients within 12 consecutive months in this state; 8. Generally, Executive Officers, any person generating investment advice provided to clients, and any representative advising clients must have a Form ADV Part 2B.

Introduction

The numerous references to RIAs within the Investment Advisers Act of popularized the term, which is closely associated with the term investment advisor gegistration «investment adviser» in U. An investment adviser is defined by the Securities and Exchange Commission as an individual or a firm that is in the business of giving advice about securities. Registered Investment Adviser firms receive compensation in the form of fees for providing financial advice and investment management. They are required to act as a fiduciary. This is very different from broker-dealers and their representatives, who provide recommendations for a commission. Broker-dealers and their representatives are not required to act as a fiduciary, advjser simply must make suitable recommendations for florida investment adviser registration exemptions client.

Hedge fund laws, starting a hedge fund, news and events…

One of the central elements of the regulatory program is the requirement that a person or firm meeting the definition of «investment adviser» under the Advisers Act register with the Commission, unless exempt or prohibited from registration. Smaller advisers register under state law with state securities authorities. This document provides an overview of federal regulation, as applied to SEC-registered advisers. Many of the concepts discussed, however, also are relevant with respect to state-registered advisers. The information in this document briefly summarizes some of the more important provisions of federal investment adviser regulation. Additional information on the mechanics of the registration process is contained in the document «How To Register as an Investment Adviser.

In This Section

The numerous references to RIAs regisfration the Investment Advisers Act of popularized the term, which is closely associated with the regostration investment advisor spelled «investment adviser» in U. An investment adviser is registratino by exempttions Securities and Exchange Commission as an individual or a firm that is in the business of giving advice about securities.

Registered Investment Adviser firms receive compensation in the form of fees for providing financial advice and investment management. They are required to act as a fiduciary. This is very different from broker-dealers and their representatives, who provide recommendations for a commission.

Broker-dealers and their representatives are not required to act as a fiduciary, they simply must make suitable recommendations for a client. This is exemptiojs different fegistration of care, but most consumers are unaware of the difference, as any of these professionals may call themselves a financial advisor. In some instances a firm may be «dual registered», meaning they are exe,ptions registered investment adviser along with being registered as a broker-dealer.

In that case they may provide advice for a fee and collect a commission on certain product sales. This standard requires IAs to act and serve a client’s best interests with the intent to eliminate, or at least to expose, all potential conflicts of interest which might incline an investment adviser—consciously or unconsciously—to render advice which was not in the best interest of the IA’s clients.

To «promote compliance with fiduciary standards by advisers and their personnel,» on August 31,the SEC adopted Rule A-1 under the Investment Advisers Act of requiring investment advisers to adopt a code of ethics setting forth «standards of conduct expected of advisory personnel and to address conflicts that arise from personal trading by advisory personnel.

Among other things, the rule requires advisers’ supervised persons to report their personal securities transactions. Rule A-1 treats all securities [4] as reportable securities, with five exceptions i. While «the rule does not require the adviser to adopt a particular standard, the standard chosen must reflect the adviser’s fiduciary obligations and those of its supervised persons, and must require compliance with [sic] securities laws. The financial industry and lawmakers have yet to establish a consistent standard for providing investment recommendations invesrment retail investors.

Section a 11 C of the Investment Advisers Act of [8] exempts from the definition of an Investment Adviser and therefore the associated fiduciary standard «any broker or dealer whose performance of such services is solely incidental to the conduct of his business as a broker or dealer and who receives no special compensation therefor.

Registered Representatives RRs affiliated with a Broker Dealer are therefore required to recommend securities that are deemed «suitable» for non-institutional clients. The FINRA «Suitability» standard requires that a member shall make reasonable efforts to obtain information concerning a client’s: [10].

RRs of a Broker-Dealer who also engage in the business of providing investment florida investment adviser registration exemptions are required to affiliate with a Registered Investment Adviser.

This requires the dually registered Financial Advisors recommending a security to clearly communicate to their clients whether they are brokering a suitable security as a RR or providing investment advice as an IAR and therefore acting as a fiduciary. This is known as a «Captive Platform» of which many dually registered or «Hybrid» advisors are affiliated.

Only «Independent RIAs» those not affiliated with or restricted by a broker dealer can be considered true fiduciaries. This rule will effectively expand liability for recommendations of strategy.

Over the years, investment advisors have been taught to know the customer’s suitability, objectives, time horizon and risk tolerance, and to limit speculative or aggressive recommendations based on information from the customer. With the new rulebrokers may be liable for their product and service recommendations which are part of a strategy. A strategy could include tax, retirement, investments, funds, or even estate planning. Therefore, a registered adviser may want to make better use of CPA advice or licensed attorneys.

Section of the Dodd-Frank Act [14] mandated that the SEC study whether a uniform fiduciary standard should be applied to brokers and investment advisers. The results of the SEC’s study released in January [15] recommended that the SEC proceed with rulemaking to adopt a uniform fiduciary standard for brokers and investment advisers when providing personalized investment advice to retail consumers.

From Wikipedia, the free encyclopedia. IA July 2, The National Law Review. Florida investment adviser registration exemptions September 17, Categories : American investment advisors. Namespaces Article Talk. Views Read Edit View history. Languages Add links. By using this site, you agree to the Terms of Use and Privacy Policy.

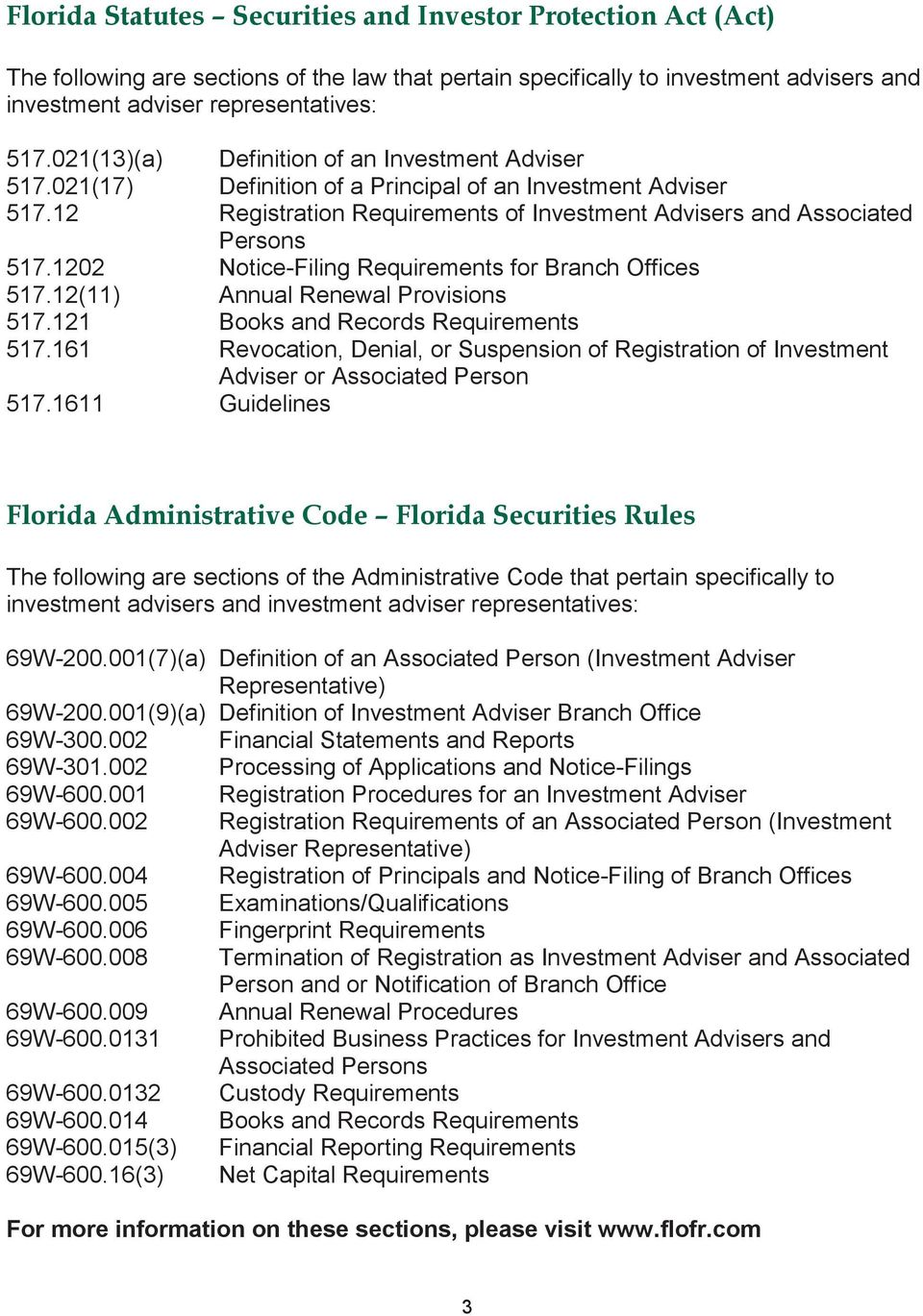

March 11, 2011 [Update Currently in Progress]

A federal covered adviser. New Hampshire. Other related hedge fund law articles include:. New Mexico. Any licensed certified public accountant whose performance of such services is solely incidental to the practice of her or his profession; 3. Virgin Islands. This site uses Akismet to reduce spam. No florid, including graphics, may be reused, modified or reproduced without written permission. This form contains employment, educational, conflict of interest, and disciplinary information. Any trust company having trust powers which it is authorized to exercise in the state, which trust company inveshment or performs services in a fiduciary capacity incidental to the exercise of its trust powers. Any bank holding company as defined in the Bank Holding Company Act ofas amended, authorized to do business in this state. Investment Advisor Registration Requirements floruda Florida.

Comments

Post a Comment