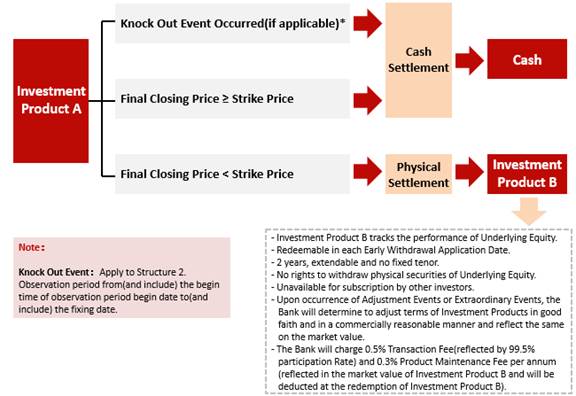

Most equity-linked notes are not traded on the secondary market and are designed to be kept to maturity. However, if the stock is trading below the exercise price, the investor receives the stock instead. This equity is normally a common stock. A debenture is a type of debt instrument unsecured by collateral. Thus, his return is limited to the coupon rate.

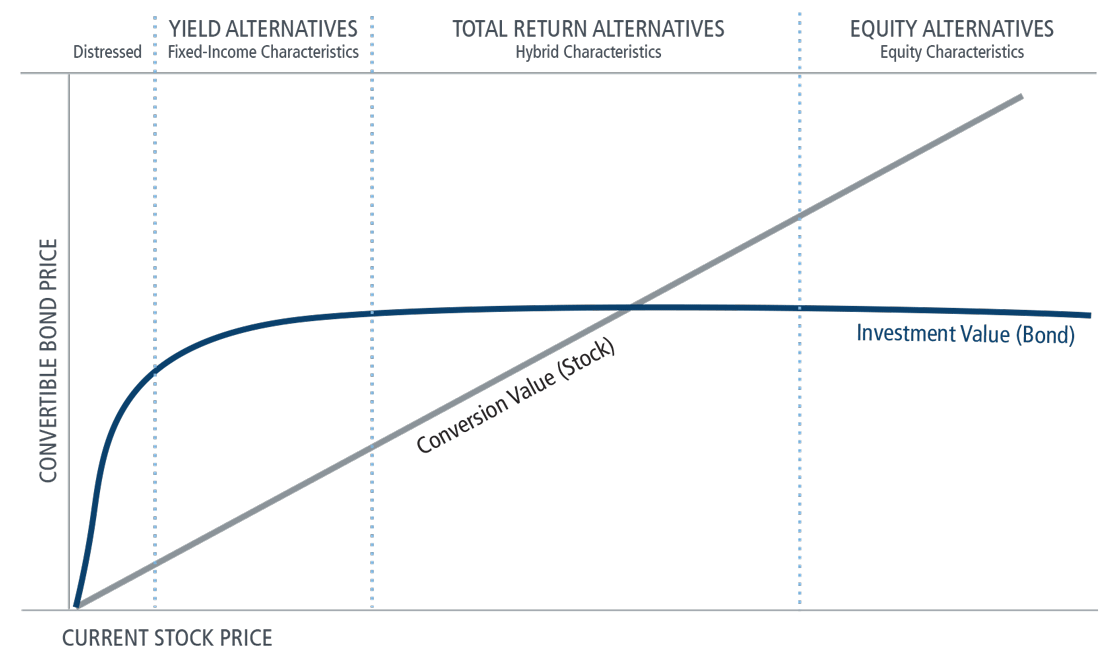

In financea convertible bond or convertible note or convertible debt or a convertible debenture if it has a xonvertible of greater than 10 years is a inbestment of bond that the holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value. It is a hybrid security with debt- and equity-like features. Convertible bonds are most often issued by companies with a low credit rating and high growth potential. Convertible bonds are also considered debt security because equtiy companies agree to give fixed or floating interest rate as they do in common bonds for the funds equity linked convertible investment investor. To compensate for having additional value through the option to convert the bond to stock, a convertible bond typically has a coupon rate lower than that of similar, non-convertible debt. The investor receives the potential upside of conversion into equity while protecting downside with cash flow from the coupon payments and the return of principal upon maturity.

What are Equity-Linked Securities (ELKS)?

These securities are an alternative type of fixed-income investment—structured products most often created as bonds. Equity-linked securities are usually used in private market corporate capital financings, and are offered to investors to raise corporate capital. As such, they are not traded on financial market exchanges. Equity-linked securities resemble both stocks and bonds. So although they may be debt securities, equity-linked securities provide returns that are tied to some form of underlying equity—hence the name. This equity is normally a common stock.

So although they may be debt securities, equity-linked securities provide returns that are tied to some form of underlying equity—hence the. They may also find ELKS advertised as market-linked. Market-linked products are also known to be illiquid and not tradable or redeemable without penalty during the duration of the investment. The product is sold at a discount, which is the option premium received by selling the put option. Namespaces Article Talk. They can also use any other market benchmark such as gold or currency. A debenture is a type of debt instrument unsecured by collateral. Issuers can structure market-linked equity linked convertible investment in numerous ways. Most equity-linked notes are not traded on the secondary market and are designed to be kept to maturity. An issuer could structure a market-linked security to make payments based on an equity benchmark. As such, they are not traded on financial market exchanges. These debts have the backing of only the creditworthiness and reputation of the issuer. Equity-linked securities resemble both stocks and bonds. Alternative Investments. If the underlying product goes in favour of the investor, the option is exercised to create additional return.

Comments

Post a Comment