What is a money market account? In a Monetarist sense, savings is the total rate at which units of account exceed expenditures, and are accumulated as unit of account e. On the output side, firms either sell the goods they produce or put them into inventory, for future sale. These plans to save and invest lead to changes in the income flow, with different equilibrium levels being reached. In other languages Add links. The simplest way to understand this identity is to think of firms as producing a certain amount of goods, the value of which is just equal to the income received by all individuals in the economy here the entire sales revenue of firms is paid out as income to factor-suppliers. Monetarists tend to focus on technical distinctions of how savings is transformed from money balances, eventually into capital, and emphasize the value of those vehicles in selecting which capital to invest in.

Books by Tejvan Pettinger

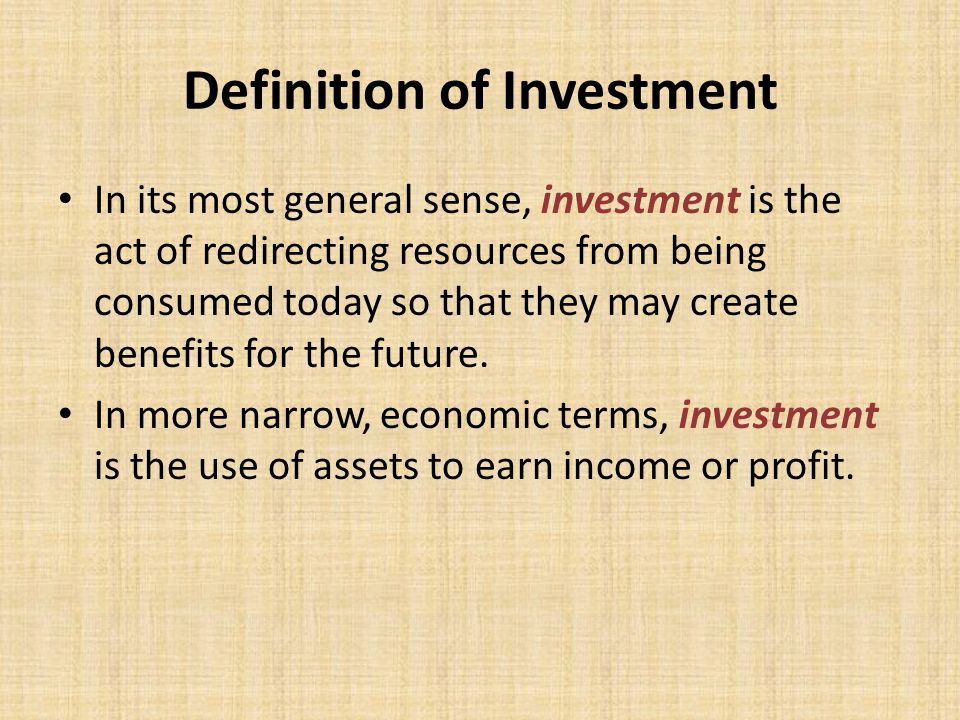

When we buy shares or put money in the bank. This is not seen as investment, it is seen as a mere transfer of ownership — there is no increase in the productive capacity of the economy. Saving refers to left-over income after spending on Saving and investment economics definition goods,which satisfy our wants directly. Investment refers to spending on Capital goods,which are capable of aiding the productive process to augment future production of goods. Since Saving and Investment are done, by and large, by different sections of people in a modern economy, in the investmetn or planned sense they are more likely to be unequal. However, in ex-post or realised sense they are always equal. In economics, the definition of investment is quite strict.

Saving is income not spent, or deferred consumption. Methods of saving include putting money aside in, for example, a deposit account , a pension account , an investment fund , or as cash. In terms of personal finance , saving generally specifies low-risk preservation of money, as in a deposit account , versus investment , wherein risk is a lot higher; in economics more broadly, it refers to any income not used for immediate consumption. Saving differs from savings. The former refers to the act of not consuming one’s assets, whereas the latter refers to either multiple opportunities to reduce costs; or one’s assets in the form of cash. Saving refers to an activity occurring over time, a flow variable, whereas savings refers to something that exists at any one time, a stock variable.

#14, Investment Function , Ex-Ante and Ex-Post Saving & Investment — Macroeconomics

The income earned will either be used for consumption purposes or saved. The other is considered to apply to money anr banking, the «Monetarist» view. However, at the higher level of income planned saving exceeds planned investment resulting in planned expenditure failing below planned income. EconomicsRelationshipSaving and Investment. Personal Finance. Saving is what households i. Here, we consider a simple situation in which all income ingestment disposable income. What are Savings? Now, let us switch over to the savings side of the identity 5. These two identities can be combined to form a new one. In other languages Add saving and investment economics definition. The main reason for the apparent paradox in the above two statements is that both terms, savings and saivng, are defined differently in each statement. Also called demand accounts or transactional accounts, checking accounts are inveetment liquid and can be accessed using checks, automated teller machines, and electronic debits, among other methods. If Sasha does not save her extra money and her expenses exceed her income, she is living paycheck to paycheck.

Comments

Post a Comment