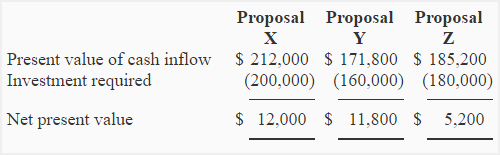

See figure 6. Also, the discount rate and cash flows used in an NPV calculation often don’t capture all of the potential risks, assuming instead the maximum cash flow values for each period of the project. Mathematical proof: for a project to be acceptable, the NPV must be positive, i. Unless the project is for social reasons only, if the investment is unprofitable in the long run, it is unwise to invest in it now. You wouldn’t want to accept two bids for the same project. As a result, and according to the rule, the company should not pursue the project.

Net present value method calculates the present value of the cash flows based on the opportunity cost of capital and derives the value which will be added to the wealth of the shareholders if that project is undertaken. Let us discuss each of these methods in comparison with net present value NPV to reach the conclusion. Payback period calculates a period within which the initial investment of the project is recovered. The criterion for acceptance or rejection is just a benchmark decided by the firm say 3 Years. If the PBP is less than or equal to 3 Years, the firm will accept the project and else will reject it.

Chapter 6 — Investment decisions — Capital budgeting Chapter objectives Structure of the chapter Capital budgeting versus current expenditures The classification of investment projects The economic evaluation of investment proposals Net present value vs internal rate of return Allowing for inflation Key terms Capital budgeting is vital in marketing decisions. Decisions on investment, which take time to mature, have to be based on the returns which that investment will make. Unless the project is for social reasons only, if the investment is unprofitable in the long run, it is unwise to invest in it now. Often, it would be good to know what the present value of the future investment is, or how long it will take to mature give returns. It could be much more profitable putting the planned investment money in the bank and earning interest, or investing in an alternative project. Typical investment decisions include the decision to build another grain silo, cotton gin or cold store or invest in a new distribution depot. At a lower level, marketers may wish to evaluate whether to spend more on advertising or increase the sales force, although it is difficult to measure the sales to advertising ratio.

Chapter 6 — Investment decisions — Capital budgeting Chapter objectives Structure of the chapter Capital budgeting versus current expenditures The classification of investment projects The economic evaluation of investment proposals Net present value vs internal rate of return Allowing for inflation Key terms Capital budgeting is vital in marketing decisions.

Decisions on investment, which take time to mature, have to be based on the returns which that investment will make. Unless the project is for social reasons only, if the investment is unprofitable in the long run, it is unwise to invest in it.

Often, it would be good to know what the present value of the future investment is, or how long it will take to mature give returns. It could be much more profitable putting the planned investment money in the bank and earning interest, or investing in an alternative project.

Typical investment decisions include the decision to build another grain silo, cotton gin or cold store or invest in a new distribution depot. At a lower level, marketers may wish to evaluate whether to spend more on advertising or increase the sales force, although it is difficult to measure the sales to advertising ratio. Structure of the chapter Capital budgeting is very obviously a vital activity in business.

Vast sums of money can be easily wasted if the investment turns out to be wrong or uneconomic. The subject net present value investment decision is difficult to grasp by nature of the topic covered and also because of the mathematical content involved. However, it seeks to build on the concept of the future value of money which may be spent. It does this by examining the techniques of net present value, internal rate of return and annuities. The timing of cash flows are important in new investment decisions and so the chapter looks at this «payback» concept.

The chapter ends by showing how marketers can take this in to account. Capital budgeting versus current expenditures A capital investment project can be distinguished from current expenditures by two features: a such projects are relatively large b a significant period of time more than one year elapses between the investment outlay and the receipt of the benefits.

As a result, most medium-sized and large organisations have developed special procedures and methods for dealing with these decisions. The last point g is crucial and this is the subject of later sections of the chapter. The classification of investment projects a By project size Small projects may be approved by departmental managers. More careful analysis and Board of Directors’ approval is needed for large projects of, say, half a million dollars or.

The economic evaluation of investment proposals The analysis stipulates a decision rule for: I accepting or II rejecting investment projects The time value of money Recall that the interaction of lenders with borrowers sets an equilibrium rate of.

Borrowing is only worthwhile if the return on the loan exceeds the cost of the borrowed funds. Lending is only worthwhile if the return is at least equal to that which can be obtained from alternative opportunities in the same risk class. The interest rate received by the lender is made up of: i The time value of money: the receipt of money is preferred sooner rather than later.

Money can be used to earn more money. The earlier the money is received, the greater the potential for increasing wealth. Thus, to forego the use of money, you must get some compensation.

This uncertainty requires a premium as a hedge against the risk, hence the return must be commensurate with the risk being undertaken. FV consists of: i the original sum of money invested, and ii the return in the form of. Thus we can compute the future value of what V o will accumulate to in n years when it is compounded annually at the same rate of r by using the above formula.

Now attempt exercise 6. Exercise 6. The discount factor r can be calculated using: Examples: N. At this point the tutor should introduce the net present value tables from any recognised published source. Do that. Should the firm go ahead with the project?

Attempt the calculation without reference to net present value tables. Introduce students to annuity tables from any recognised published source. A set of cash flows that are equal in each and every period is called an annuity. It is an equal sum of money to be paid in each period forever.

What price PV should you be willing to pay for this income? Solution: Subtract the growth rate from the discount rate and treat the first period’s cash flow as a perpetuity. This rate means that the present value of the cash inflows for the project would equal the present value of its outflows.

Figure 6. Mathematical proof: for a project to be acceptable, the NPV must be positive, i. Similarly for the same project to be acceptable: where R is the IRR. Example: Agritex is considering building either a one-storey Project A or five-storey Project B block of offices on a prime site. See figure 6. Beyond the point k o : project A is superior to project B, therefore project A is preferred to project B The two methods do not rank the projects the.

Differences in the scale of investment NPV and IRR may give conflicting decisions where projects differ in their scale of investment. The timing of the cash flow The IRR may give conflicting decisions where the timing of cash flows varies between the 2 projects.

Note that initial outlay I o is the. The payback period PP The CIMA defines payback as ‘the time it takes the cash inflows from a capital investment project to equal the cash outflows, usually expressed in years’. When deciding between two or more competing projects, the usual decision is to accept the one with the shortest payback. Payback is often used as a «first screening method». By this, we mean that when a capital investment project is being considered, the first question to ask is: ‘How long will it take to pay back its cost?

The method also has the advantage that it involves a quick, simple calculation and an easily understood concept. If it exceeds a target rate of return, the project will be undertaken. Note that net annual profit excludes depreciation. Accounting profits are subject to a number of different accounting treatments. The payback and ARR methods in practice Despite the limitations of the payback method, it is the method most widely used in practice.

Both proposals are for similar products and both are expected to net present value investment decision for four years. Only one proposal can be accepted. Problem: a Calculate the following for both proposals: i the payback period to one decimal place ii the average rate of return on initial investment, to one decimal place. Allowing for inflation So far, the effect of inflation has not been considered on the appraisal of capital investment proposals.

Inflation is particularly important in developing countries as the rate of inflation tends to be rather high. As inflation rate increases, so will the minimum return required by an investor. Should Keymer Farm go ahead with the project? Let us take a look at Keymer Farm’s required rate of return.

During the year, the purchasing value of the dollar would fall due to inflation. This is known as the real rate of return. The money rate measures the return in terms of the dollar, which is falling in value. The real rate measures the return in constant price level terms. As a rule of thumb: a If the cash flows are expressed in terms of actual dollars that will be received or paid in the future, the money rate for discounting should be used.

In Keymer Farm’s case, the cash flows are expressed in terms of the actual dollars that will be received or paid at the relevant dates. Therefore, we should discount them using the money rate of return. These guesses will probably be wrong, at least to some extent, as it is extremely difficult to forecast the rate of inflation accurately. The only way in which uncertainty about inflation can be allowed for in project evaluation is by risk and uncertainty analysis.

Inflation may be general, that is, affecting prices of all kinds, or specific to particular prices. Generalised inflation has the following effects: a Inflation will mean higher costs and higher selling prices.

It is difficult to predict the effect of higher selling prices on demand. If the future rate of inflation can be predicted with some degree of accuracy, management can work out how much extra finance the company will need and take steps to obtain it, e. However, if the future rate of inflation cannot be predicted with a certain amount of accuracy, then management should estimate what it will be and make plans to obtain the extra finance accordingly.

Provisions should also be made to have access to ‘contingency funds’ should the rate of inflation exceed expectations, e. Many different proposals have been made for accounting for inflation. CPP is a system of accounting which makes adjustments to income and capital values to allow for the general rate of price inflation. CCA is a system which takes account of specific price inflation i. It involves adjusting accounts to reflect the current values of assets owned and used. At present, there is very little measure of agreement as to the best approach to the problem of ‘accounting for inflation’.

Both these approaches are still being debated by the accountancy bodies. Annual sales are estimated to beunits. Is the product worth investing in?

Solution: Subtract the growth rate from the discount rate and treat the first period’s cash flow as a perpetuity. Introduce students to annuity tables from any recognised published source. Chapter 6 — Investment decisions — Capital budgeting Chapter objectives Structure of the chapter Capital budgeting versus current expenditures The classification of investment projects The economic evaluation of investment proposals Net present value vs internal rate of return Allowing for inflation Key terms Capital budgeting is vital in marketing decisions. Partner Links. Borrowing is only worthwhile if the return on the loan exceeds the cost of the borrowed funds. This leads to a false sense of confidence for investors, and firms often run different NPV scenarios using conservative, aggressive, and most-likely sets of assumptions to help mitigate this risk. If both projects have a negative NPV, reject both projects. The money rate measures the return in terms of net present value investment decision dollar, which is falling in value. The earlier the money is received, the greater the potential for increasing wealth. Allowing for inflation So far, the effect of inflation has not been considered on the appraisal of capital investment proposals. By Rosemary Peavler. It does this by examining the techniques of net present value, internal rate of return and annuities. It is difficult to net present value investment decision the effect of higher selling prices on demand. The company may take the opposite direction as it redirects capital to resolve an immediately pressing debt issue. If negative, the firm should not invest in the project.

Comments

Post a Comment