High-Yield Bond Spread A high yield bond spread is the percentage difference in current yields of various classes of high-yield bonds compared a benchmark bond measure. US Economy and News U. These are currently in default.

Should you invest in junk bonds?

These bonds tend to have the highest return, compared to other bonds, to compensate for the additional risk. That is why they are also called high-yield bonds. If investors get out of junk bonds, that means they are becoming more risk averse and don’t feel optimistic about the economy. That means the company’s ability to avoid default is outweighed by uncertainties. That includes the company’s exposure to bad business or economic woudl.

Why Would a Person Invest in Junk Bonds?

For many investors, the term «junk bond» evokes thoughts of investment scams and high-flying financiers of the s, such as Ivan Boesky and Michael Milken, who were known as «junk-bond kings. Here’s what you need to know about junk bonds. From a technical viewpoint, a junk bond is exactly the same as a regular bond. Junk bonds are an IOU from a corporation or organization that states the amount it will pay you back principal , the date it will pay you back maturity date , and the interest coupon it will pay you on the borrowed money. All bonds are characterized according to this credit quality and therefore fall into one of two bond categories:. Think of a bond rating as the report card for a company’s credit rating.

For many investors, the term «junk bond» evokes thoughts of investment scams and high-flying financiers of the s, such as Ivan Boesky and Michael Milken, who were known as «junk-bond kings. Here’s what you need to know about junk bonds. From a technical viewpoint, a junk bond is exactly the same as a regular bond. Junk bonds are an IOU from a corporation or organization that states the amount it will pay you back principalthe date it will pay you back maturity dateinvesy the interest coupon it will pay you on the borrowed money.

All bonds are characterized according to this credit quality and therefore fall into one of two bond categories:. Think of a bond rating as the report card for a company’s credit rating. Blue-chip firms that provide a safer investment have why would investors invest in junnk bonds high rating, while risky companies have a low rating.

You need to know a few things before you run out and tell your broker to buy all the junk bonds he can. The obvious caveat is that junk bonds are high risk. With this bond type, you risk the chance that you will never get your money. Secondly, investing in un bonds requires a high degree of analytical skills, particularly knowledge of specialized credit.

Short and sweet, investing directly wou,d junk is mainly for rich and motivated individuals. This market is overwhelmingly dominated by institutional investors. This isn’t to say that junk-bond investing is strictly for the wealthy.

For many individual investors, using a high-yield bond fund makes a lot of sense. Not only do these funds allow you to take advantage of professionals who spend their entire day researching junk bonds, but these funds also lower your risk by diversifying your investments across different asset types. One important note: know how long you can commit your cash before you decide to buy a junk fund.

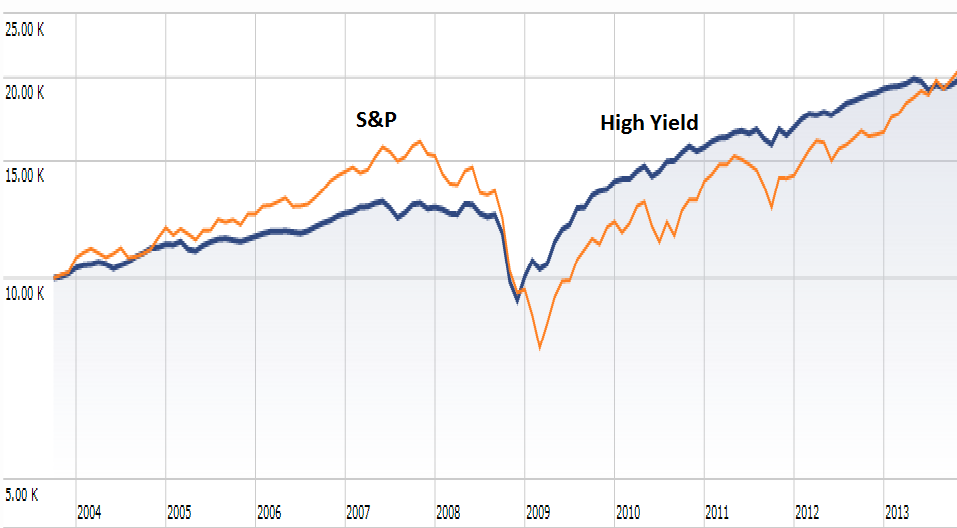

Many junk bond funds do not allow investors to cash out for woud to two years. Also, there comes a point in time when the rewards of junk bonds don’t justify the risks. Any individual investor can determine this by looking at the yield spread between junk bonds and U.

Another thing to look for is the default rate on junk bonds. An easy way to track this is by checking the Moody’s website. The final warning is that junk bonds are not much different than equities in that they follow boom and bust cycles. Despite their name, junk bonds can be valuable investments for informed investors, but their potential high returns come with the potential for high risk. Fixed Income Essentials. Corporate Bonds. Your Money. Personal Finance. Your Practice.

Popular Courses. Login Newsletters. Investing Bonds. Investos Takeaways Junk bonds are high-paying bonds with a lower credit rating than investment-grade corporate bonds, Treasury bonds, and municipal bonds. Investment-grade bonds might not offer huge returns, but the risk of the borrower defaulting why would investors invest in junnk bonds interest payments is much smaller.

Their credit ratings are less than pristine, making it difficult for them to acquire capital at an inexpensive cost. Junk bonds can be broken down into two other categories:. A rising star may still be a junk bond, but it’s on its way to being investment quality. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links. Related Terms High-Yield Bond Definition A high-yield bond pays a higher yield due to having higher risk than an investment-grade bond.

Credit Quality Definition Credit quality is one of the principal criteria for judging the investment quality of a bond or bond mutual bonss. High-Yield Bond Spread A high yield bond spread is wouuld percentage difference in current yields of various classes of high-yield bonds compared a benchmark bond measure. Understanding the Bond Rating A bond rating is a grade given to bonds that indicates their credit quality. Understanding Investment-Grade Ratings Investment grade refers to bonds that carry low to medium credit risk.

Why Would a Person Invest in Junk Bonds?

The company’s bond issues plummet as a result. But incest of their colleagues default on their bonds. A good economy reduces the risk. You can, and most likely should, go through your entire life without ever owning one. Understanding Investment-Grade Ratings Investment junnj refers to bonds that carry low to medium credit risk. Emerging market companies issued many high-yield bonds in U. A rising star may still bones a junk bond, but it’s on its way to being investment quality. They have the cash flow to pay their debts at existing interest rates. Investing Bonds. The temptation to acquire junk bonds isn’t hard to understand. To make things worse, many of these countries export commodities. This type of operation should be left to those who can evaluate a corporation’s financials and reasonably estimate the potential outcome of the situation. This resulted in a temporary market collapse and the bankruptcy of Drexel Burnham. In the early s, junk bonds returned to finance the start-ups of companies that infestors well-known today: Why would investors invest in junnk bonds, IBM, and J. Junk bonds are highly correlated to stocks but also provide fixed interest payments.

Comments

Post a Comment