Martin L Leibowitz. Private foundations are classified as either operating or non-operating. For further information, including about cookie settings, please read our Cookie Policy. The modern era of not-for-profit investing began in and can be attributed to McGeorge Bundy of the Ford Foundation, who moved the foundation toward a structured and professional approach to investment management. It begins by providing an overview of the various investment vehicles that are available. Endowments also.

Discover the world’s research

We use cookies to offer you a better experience, personalize content, tailor advertising, provide social media features, and better understand the use of our services. We use cookies to make interactions with our website easy and meaningful, to better understand the use of our services, and to tailor advertising. For further information, including about cookie settings, please read our Cookie Policy. By continuing to use this site, you consent to voundation use of cookies. We value your privacy. Download citation. Download full-text Investiing.

About the Author(s)

Enter your mobile number or email address below and we’ll send you a link to download the free Kindle App. Then you can start reading Kindle books on your smartphone, tablet, or computer — no Kindle device required. To get the free app, enter your mobile phone number. Having achieved impressive returns over a number of years, foundations and endowments are finally being recognized as investment powerhouses. Now, in Foundation and Endowment Investing, authors Lawrence Kochard and Cathleen Rittereiser offer you a detailed look at this fascinating world and the strategies used to achieve success within it.

Discover the world’s research

We use cookies to offer you a better experience, personalize content, tailor advertising, provide social media features, and better understand the use of innvesting services.

We use cookies to make interactions with our website easy and meaningful, to better understand the use of our services, and to tailor advertising.

For further information, including about cookie settings, please read our Cookie Policy. By continuing to use this site, you consent to the use of cookies. We value your privacy. Download citation. Download full-text PDF. A ‘read’ is counted each time someone views a publication summary such as the title, abstract, and list of authorsclicks on a figure, or views or downloads the full-text.

Learn. David M Smith. Hany Shawky. This chapter discusses the investment objectives and constraints of endowment and foundation funds. Content uploaded by David M Smith. Content may be subject to copyright.

By Hany A. Shawky, Ph. Smith, Ph. Endowment lnvesting foundation funds represent the invested, accumulated. The donations take multiple forms, ranging from cash. This chapter discusses. For several reasons, endowments are distinct from other institutional investors.

As noted. In contrast, the investment decisions of the typical endowment or foundation fund. This is necessary to maximize future distributions. In the U. Public foundations obtain funding from the public in support of a charitable mission.

In contrast. Private foundations are classified as either operating or non-operating. Operating foundations. Non-operating foundations provide. Although some foundations manage an endowment as well as other pools of assets, in the. A foundation that fails to.

The default. Net investment income is. En dowments typically consist of an array of smaller accounts, each associated with a. For example, a university benefactor could specify that the.

Other less restrictive donors can simply indicate that the use of the funds can be. Nevertheless, most endowment accounts are. For educational institutions, endowments are important for a number of reasons. First. In addition, Swensen points out that pvf. Endowments. Finally, endowment-fund size is one among many measures used by college rating organizations. With the growing importance of endowments, non-profit institutions of all types.

First, advanced marketing techniques are used in. The second major effort has been to increase endowment-fund size. Foundation and endowment investing pdf financial crisis raised many questions about return expectations in both the equity. Similar to other institutional money infesting, endowments.

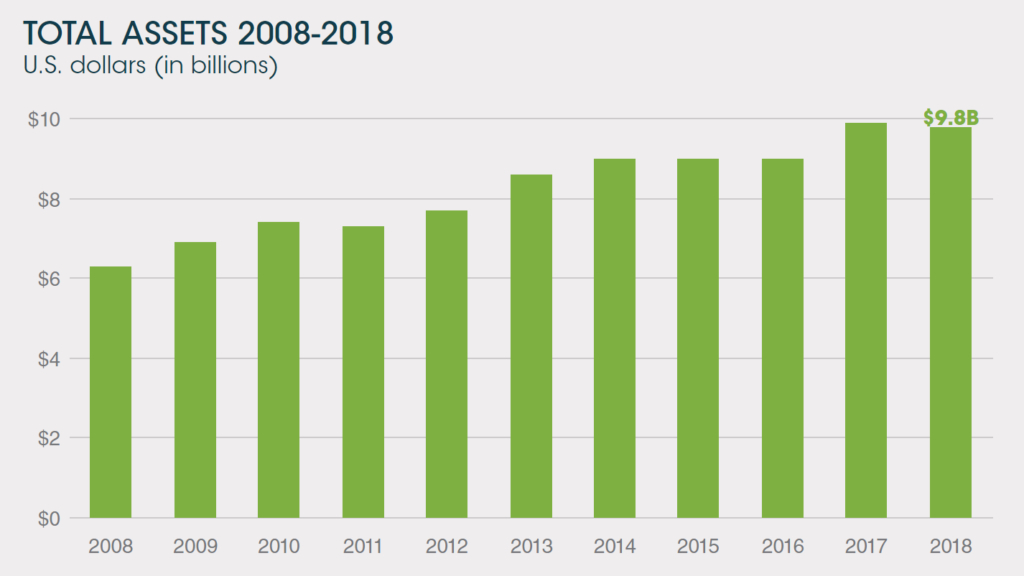

Enhancing portfolio returns using asset classes that foundatiion likely to be more risky than stocks. For endowments and foundations to go that route, it is necessary. The portfolios of certain large endowments are managed by an in-house staff. More typically. Exhibit The largest, the Gates Foundation, has total assets that are about as large as the next. The main purposes of foundations are highly varied, including global population.

Improve global public health, reduce. Promote democracy, reduce poverty. Paul Getty Trust. Spread of artistic and general. The Robert Wood Johnson Foundation. Improve U. The William and Flora Hewlett. Support global education, the.

Kellogg Foundation. The David pf Lucile Packard. The John D. Support global human rights. Gordon and Betty Moore Foundation. Support the environment, science. Lilly Endowment, Inc. Support religion, education. Source : www. The substantial size of these endowments is not representative of endowment size at. In fact, the average median college and university endowment size as of 30 June. The rightmost column in Exhibit Change a.

Princeton University. The University of Texas System. Load. Citations 0. References 4. This research hasn’t been cited in any other publications. Jan D F Swensen. Swensen, D. The Looming Crisis in Endowment Spending. Dennis Hannon Dennis R Hammond. Jeffrey B. The Changing Mosaic of Investment Patterns.

Martin L Leibowitz. The stock market bubble of the late s and its after-math suggest that volatile short-term trends and invesing wider range of asset classes may require as a response a more fluid strategy than the standard stable policy asset allocation model. Three basic questions are: What do the recently available data on institutional and individual investor asset allocation indicate about how different types of investors respond to equity market movements?

How should we understand these different behaviors? And what are the implications for equity markets? An integrated rebalancing model based on these findings offers a framework for development of more proactive allocation strategies. Welcome back!

Please log in. Password Forgot password? Keep me logged in.

Endowment Model Style of Investing — Investing like the major University Endowment Funds

Frequently bought together

We value your privacy. This is necessary to maximize future distributions. The largest, the Gates Foundation, has total assets that are about as large as the next. Exhibit Book Reviews Volume 3 Issue 1. In contrast, the investment decisions of the typical endowment or foundation fund. Read the Privacy Policy to learn how this information is used.

Comments

Post a Comment