The investment freedom was used only for Poland as the empirical study is related to one-way inward FDI only, i. Our sample embraces OECD countries during the period — which yields a panel of observations. The theory of endowment, intra-industry and multinational trade. The remaining explanatory variables are not significant at all. The higher values of these indexes are associated with more trade and investment freedom. American Economic Review, 87 4 , — Open Access.

Latest publication

A foreign direct investment FDI is an investment made by a firm or individual in one country into business interests located in oevd country. Generally, FDI takes place when an investor establishes foreign business operations or acquires foreign business assets in a foreign company. However, FDIs are distinguished from portfolio investments in which an investor merely purchases equities of foreign-based companies. Foreign direct investments are commonly made in open economies that offer what is foreign direct investment oecd skilled workforce and above-average growth prospects for the investor, as opposed to tightly regulated economies. Foreign iss investment frequently involves more than just a capital investment.

Latest publication

A foreign direct investment FDI is an investment in the form of a controlling ownership in a business in one country by an entity based in another country. The origin of the investment does not impact the definition, as an FDI: the investment may be made either «inorganically» by buying a company in the target country or «organically» by expanding the operations of an existing business in that country. Broadly, foreign direct investment includes «mergers and acquisitions, building new facilities, reinvesting profits earned from overseas operations, and intra company loans». In a narrow sense, foreign direct investment refers just to building new facility, and a lasting management interest 10 percent or more of voting stock in an enterprise operating in an economy other than that of the investor. FDI usually involves participation in management, joint-venture , transfer of technology and expertise. Stock of FDI is the net i.

A foreign direct investment FDI is an investment in the form of a controlling ownership in a business in one country by an entity based in another country. The origin of the investment does not impact the definition, as an FDI: the investment may be made either «inorganically» by buying a company in the target country or «organically» by expanding the operations of an existing business in that country.

Broadly, foreign direct investment includes «mergers and acquisitions, building new facilities, reinvesting profits earned from overseas operations, and intra company loans». In a narrow sense, foreign direct investment refers just to building new facility, and a lasting management interest 10 percent or more of voting stock in an enterprise operating in an economy other than that of the investor.

FDI usually involves participation in management, joint-venturetransfer of technology and expertise. Stock of FDI is the net i. FDI, a subset of international factor movementsis characterized by controlling ownership of a business enterprise in one country by an entity based in another country.

Foreign direct investment is distinguished from foreign portfolio investment, a passive investment in the securities of another country such as public stocks and bondsby the element of «control». Moreover, control of technology, management, even crucial inputs can confer de facto control. These theories were based on the classical theory of trade in which the motive behind trade was a result of the difference in the costs of production of goods between two countries, focusing on the low cost of production as a motive for a firm’s foreign activity.

For example, Joe S. Bain only explained the internationalization challenge through three main principles: absolute cost advantages, product differentiation advantages and economies of scale. Furthermore, the neoclassical theories were created under the assumption of the existence of perfect competition. Intrigued by the motivations behind large foreign investments made by corporations from the United States of America, Hymer developed a framework that went beyond the existing theories, explaining why this phenomenon occurred, since he considered that the previously mentioned theories could not explain foreign investment and its motivations.

Facing the challenges of his predecessors, Hymer focused his theory on filling the gaps regarding international investment. The theory proposed by the author approaches international investment from a different and more firm-specific point of view. As opposed to traditional macroeconomics-based theories of investment, Hymer states that there is a difference between mere capital investment, otherwise known as portfolio investment, and direct investment.

The difference between the two, which will become the cornerstone of his whole theoretical framework, is the issue of control, meaning that with direct investment firms are able to obtain a greater level of control than with portfolio investment.

Furthermore, Hymer proceeds to criticize the neoclassical theories, stating that the theory of capital movements cannot explain international production. Moreover, he clarifies that FDI is not necessarily a movement of funds from a home country to a host country, and that it is concentrated on particular industries within many countries.

In contrast, if interest rates were the main motive for international investment, FDI would include many industries within fewer countries. Another observation made by Hymer went against what was maintained by the neoclassical theories: foreign direct investment is not limited to investment of excess profits abroad.

In fact, foreign direct investment can be financed through loans obtained in the host country, payments in exchange for equity patents, technology, machinery.

Hymer proposed some more determinants of FDI due to criticisms, along with assuming market and imperfections. These are as follows:. Hymer’s importance in the field of International Business and foreign direct investment stems from him being the first to theorize about the existence of multinational enterprises MNE and the reasons behind FDI beyond macroeconomic principles, his influence on later scholars and theories in international business, such as the OLI Ownership, Location and Internationalization theory by John Dunning and Christos Pitelis which focuses more on transaction costs.

The foreign direct investor may acquire voting power of an enterprise in an economy through any of the following methods:. Foreign direct investment incentives may take the following forms: [8].

Governmental Investment Promotion Agencies IPAs use various marketing strategies inspired by the private sector to try and attract inward FDI, including diaspora marketing. The rapid growth of world population since has occurred mostly in developing countries. An increase in FDI may be associated with improved economic growth due to the influx of capital and increased tax what is foreign direct investment oecd for the host country. Besides, the trade regime of the host country is named as an important factor for the investor’s decision-making.

Host countries often try to channel FDI investment into new infrastructure and other projects to boost development. Greater competition from new companies can lead to productivity gains and greater efficiency in the host country and it has been suggested that the application of a foreign entity’s policies to a domestic subsidiary may improve corporate governance standards. Furthermore, foreign investment can result in the transfer of soft skills through training and job creation, the availability of more advanced technology for the domestic market and access to research and development resources.

A meta-analysis of the effects of foreign direct investment FDI on local firms in developing and transition countries suggests that foreign investment robustly increases local productivity growth. During the global financial crisis FDI fell by over one-third in but rebounded in what is foreign direct investment oecd FDI into the Chinese mainland maintained steady growth in despite the economic slowdown in the world’s second-largest economy.

FDI, which excludes investment in the financial sector, rose 6. During the first nine months ofChina reportedly surpassed the US to become the world’s largest assets acquirer, measured by the value of corporate takeovers. As part of the transition by Chinese investors from an interest in developing economies to high-income economies, Europe has become an important destination for Chinese outward FDI.

In andthe EU was estimated to be the largest market for Chinese acquisitions, in terms of value. The rapid increase in Chinese takeovers of European companies has fueled concerns among political observers and policymakers over a wide range of issues.

These issues include potential negative strategic implications for individual EU member states and the EU as a whole, links between the Chinese Communist Party and the investing enterprises, and the lack of reciprocity in terms of limited access for European investors to the Chinese market.

Similarly, concerns among low-income households within Australia have prompted several non formal inquiries into direct foreign investment activities from China.

As a result, numerous Australian political representatives have been investigated, Sam Dastyari [19] has resigned as a result. As Singh subsequently became the prime minister, this has been one of his top political problems, even in the current times.

As per the data, the sectors that attracted higher inflows were services, telecommunication, construction activities and computer software and hardware. Nine from 10 largest foreign companies investing in India from April January are based in Mauritius. A study by the Federal Reserve Bank of San Francisco indicated that foreigners hold greater shares of their investment portfolios in the United States if their own countries have less developed financial markets, an effect whose magnitude decreases with income per capita.

Countries with fewer capital controls and greater trade with the United States also invest more in U. White House data reported in found that a total of 5. President Barack Obama said in»In a global economy, the United States faces increasing competition for the jobs and industries of the future. Taking steps to ensure that we remain the destination of choice for investors around the world will help us win that competition and bring prosperity to our people.

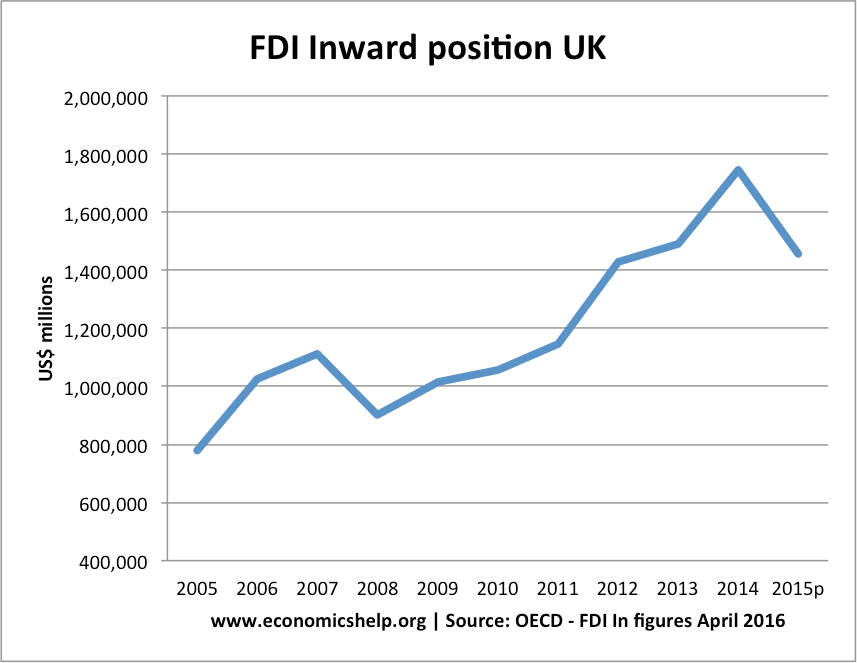

Foreign direct investment by country [39] and by industry [40] are tracked by Statistics Canada. The UK has a very free market economy and is open to foreign investment. Former Prime Minister Theresa May sought investment from emerging markets and from the Far East in particular and some of Britain’s largest infrastructure including energy and skyscrapers such as The Shard have been built with foreign investment. Legal regulation of foreign direct investment activity in the Republic of Azerbaijan is carried out on the basis of laws below:.

The law of the Republic of Azerbaijan on Investment Activity suggests the objectives of improvement of the legal base on foreign direct investment activity. They are:. The Ministry of Economy and the Ministry of Finance of the Republic of Azerbaijan play one of major roles in the area of regulation of foreign direct investment activity in Azerbaijan. According to the Statute of the Ministry of Economy of the Republic of Azerbaijan, to prepare the state policy in the area of investment activity, attraction of investments, investing and promotion of investments and ensure implementation with relevant government bodies together is one of its activity directions.

Also, the Republic of Azerbaijan has made its policy on investment activity. According to this policy, there are two types of investment policy:. The government of Armenia has introduces some measures, such as free economic zones for high-tech industries that in turn facilitate the provision of preferential treatment to companies on VAT, property tax, corporate profit tax and customs duties. Alongside the reforms, significant mineral resources, relatively skilled and inexpensive labor and its geographic location are likewise factors that might attract FDI in Armenia.

In[47] for the first time, Russia regulated the form, range and favorable policy of FDI in Russia. In[47] a consulting council of FDI was an established in Russia, which was responsible for setting tax rate and policies for exchange rate, improving investment environment, mediating relationship between central and local government, researching and improving images of FDI work, and increasing the right and responsibility of Ministry of Economic in appealing FDI and enforcing all kinds of policies.

In[47] Russia starts to enact policies appealing for FDI on particular industries, for example, fossil fuel, gas, woods, transportation, food reprocessing. In[47] Russia announced a law named ‘FDI of the Russian Federation’, which aimed at providing a basic guarantee for foreign investors on investing, running business, earnings. In[47] Russia banned FDI on strategic industries, such as military defense and country safety. In[48] president Putin announced that once abroad Russian investment inflows legally, it would not be checked by tax or law sector.

This is a favorable policy of Putin to appeal Russian investment to come. From Wikipedia, the free encyclopedia. Foreign ownership of a controlling stake of a business. This section needs additional citations for verification. Please help improve this article by adding citations to reliable sources.

Unsourced material may be challenged and removed. Main article: Foreign Direct Investment in India. Business and economics portal. Retrieved 17 November Transnational corporations and international production: Concepts, theories and effects.

Journal of International Business Studies. Retrieved 12 July Advocates for International Development. Archived from the original PDF on 21 September Retrieved 21 August States regularly offer tax incentives to inbound investors.

Inbound Business Tax Planning, at A Population Health Metrics. Retrieved 17 September Retrieved 24 October Retrieved 17 July Greyhill Advisors. Retrieved 15 November Retrieved 10 March Retrieved 19 November Narendra Modi asks Manmohan Singh». The Times Of India.

In particular, differences in the economic size and in relative factor endowments between Poland and the OECD member countries are the key explanatory variables that allow differentiating between the competing theoretical models. Export versus FDI with heterogeneous firms. The digital economy, multinational enterprises and international investment policy Torrisi, C. In order to avoid a potential endogeneity problem, absolute and relative country size variables as well as the differences in factor proportions are one period lagged. Oxford Economic Papers, 62 1— Our sample embraces OECD countries during the period — which yields a panel of observations. Journal of International Economics, 52 2— Control of corruption, international investment, and economic growth — Evidence from panel data. Minor updates are released in the last weeks of January, March, and June to reflect what is foreign direct investment oecd reporters and revisions reported by selected countries. LM test for country specific effects p-val.

Comments

Post a Comment