Great job crushing your debt and saving more! But investments in stocks and bonds do. Let me know what quote you get with them and what you have now! I am ok leaving retirement accounts, other assets, etc. One More Year Syndrome! It allows us to own a house much nicer in our area then the equivalent rent could get while not shorting the property market, which here in the Seattle area is going up exponentially.

Most companies use a combination of debt and debt to investment ratio financial samurai financingbut there are some distinct advantages of equity financing over debt financing. Principal among them is that equity financing carries no repayment obligation and provides extra working capital that can be used to grow a business. Companies usually have a choice as to whether to seek debt or equity financing. The choice often depends upon which source of funding is most easily accessible for the company, its cash flowand how important maintaining control of the company is to its principal owners. The debt to equity ratio shows how much of a company’s financing is proportionately provided by debt and equity. The main advantage of equity financing is that there is no obligation to repay the money acquired through it. Of course, a company’s owners want it to be successful and provide equity investors a good return on their investment, but without required payments or interest charges as is the case with debt financing.

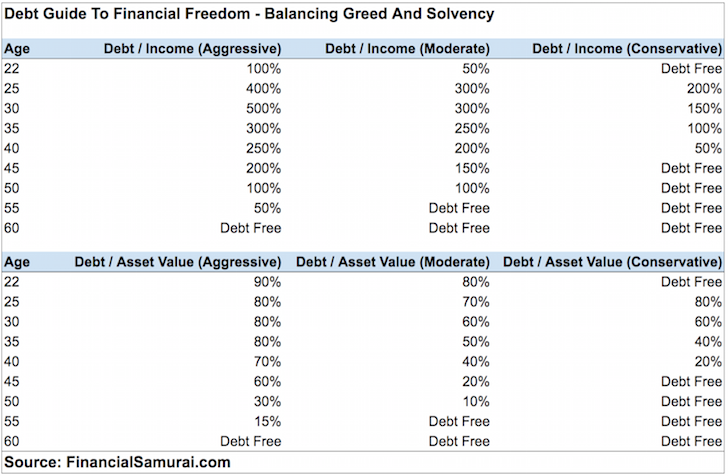

THE RIGHT ASSET-TO-LIABILITY RATIO

This ratio is also known as financial leverage. Debt-to-equity ratio is the key financial ratio and is used as a standard for judging a company’s financial standing. It is also a measure of a company’s ability to repay its obligations. If the ratio is increasing, the company is being financed by creditors rather than from its own financial sources which may be a dangerous trend. Lenders and investors usually prefer low debt-to-equity ratios because their interests are better protected in the event of a business decline. Thus, companies with high debt-to-equity ratios may not be able to attract additional lending capital.

Measuring Financial Risk And Security

Most companies use a combination of debt and equity financingbut there are some distinct advantages of equity financing over debt financing. Principal among them is that equity financing carries no repayment obligation and provides extra working capital that can be used to grow a business.

Companies usually have a choice as to whether to seek debt or equity financing. The choice often depends upon which source of funding is most easily accessible for the company, its cash flowand how important maintaining control of the company is to its principal owners. The debt to equity ratio shows how much of a company’s financing is proportionately provided by debt and equity.

The main advantage of equity financing is that there is no obligation to repay the money acquired through it. Of course, a company’s owners want it to be successful and provide equity investors a good return on their investment, but without required payments or interest charges as debt to investment ratio financial samurai the case with debt financing.

Equity financing places no additional financial burden on the company. Since there are no required monthly payments associated with equity financing, the company has more capital available to invest in growing the business. But that doesn’t mean there’s no downside to equity financing.

In fact, the downside is quite large. You will have to share your profits and consult with your new partners any time you make decisions affecting the company. The only way to remove investors is to buy them out, but that will likely be more expensive than the money they originally gave you.

Debt financing sometimes comes with restrictions on the company’s activities that may prevent it from taking advantage of opportunities outside the realm of its core business.

Creditors look favorably upon a relatively low debt-to-equity ratio, which benefits the company if it needs to access additional debt financing in the future. The advantages of debt financing are numerous. Once you pay the loan back, your relationship with the financier ends. Next, the interest you pay is tax deductible. Finally, it is easy to forecast expenses because loan payments do not fluctuate.

The downside to debt financing is very real to anybody who has debt. What if your company hits hard times or the economy, once again, experiences a meltdown? What if your business does not grow as fast or as well as you expected? Debt is an expense and you have to pay expenses on a regular schedule. This could put a damper on your company’s ability to grow. If you think debt financing is right for you, the U. How To Start A Business. Purchasing A Home. Corporate Finance.

Home Ownership. Home Equity. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters. Key Takeaways The main advantage of equity financing is that there is no obligation to repay the money acquired through it.

Equity financing places no additional financial burden on the company, however, the downside is quite large. Compare Investment Accounts.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links. Financial institutions such as banks are in the business of providing capital to businesses, consumers, and investors to help them achieve their goals.

Debt Financing Debt financing occurs when a firm raises money for working capital or capital expenditures by selling debt instruments to individuals and institutional investors.

How Second-Lien Debt Affects Borrowers and Lenders Second-lien debt refers to debt that’s prioritized lower than higher-ranked debt in the event of default. Second-lien debt is also called junior debt. These debt to investment ratio financial samurai receive repayment after other, senior debt which poses a risk that investors may not receive payment.

Home-Equity Loan A home-equity loan is a consumer loan secured by a second mortgage, allowing homeowners to borrow against their equity in the home. How Promissory Notes Work A promissory note is a financial instrument that contains a written promise by one party to pay another party a definite sum of money. Capital Funding: What Lenders and Equity Holders Give Businesses Capital funding is the money that lenders and equity holders provide to a business so it can run both its day-to-day operations and make longer-term purchases and investments.

Debt to Equity Ratio Formula — Definition — Calculation — Example

Calculating my house net equity, instead of total value. Only physical cash, money market, checking, CDs really. I am so close to theby 40, just need to push myself a little more, and spend a little. I waited to buy until I ragio be able to maintain 3 months expenses including the new mortgage payment in an emergency fund. A ratio does sound like something to shoot. The only debt is mortgage debt. For those who are fortunate enough to have no student debt, then you can probably accumulate an outrageously high asset-to-liability ratio simply by saving and investing your money. My hope is that readers can accumulate assets that have historically appreciated over time: stocks, bonds, land, real estate, fine art, commodities, antique cars, rare coins, and so forth.

Comments

Post a Comment