Compound interest can be a powerful tool for helping you achieve your financial goals. Instead, stay exact, and do the dividing off symbolically and exactly first:. Does it make enough of a difference to be a deciding factor when selecting a bank?

Calculate your earnings and more

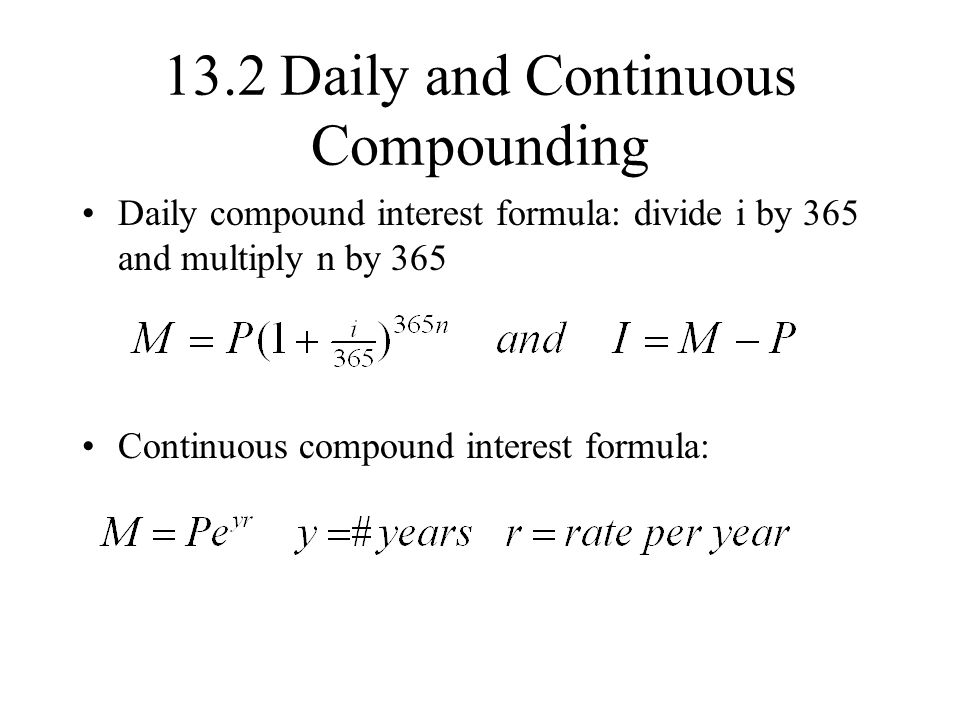

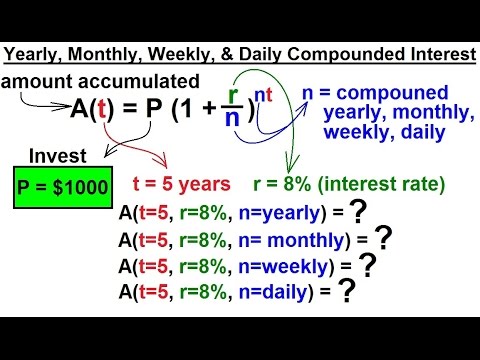

Exponential Invested compounded daily Compound Interest page 4 of 5. One very important exponential equation is the compound -interest formula:. Regarding the variables, n refers to the number of compoundings in any one year, not to the total number of compoundings over the life of the investment. Also, » t » must be expressed in years, because interest rates are expressed that way. Note that, for any given interest rate, the invesetd formula simplifies to the simple exponential form that we’re accustomed to.

Daily, monthly or yearly compounding

Compounding is the process in which an asset’s earnings, from either capital gains or interest , are reinvested to generate additional earnings over time. Compounding, therefore, differs from linear growth, where only the principal earns interest each period. This phenomenon, which is a direct realization of the time value of money TMV concept, is also known as compound interest. Compound interest works on both assets and liabilities. The generalized formula for compound interest is:.

COMPOUND INTEREST 📈 How To Get Rich! (From $10K to $452K)

Compounding of interest

Perhaps you could buy yourself lunch, but not much. Over time, compound interest can help generate additional income. Please share If you like my calculator, please help me spread the word by sharing it with your friends or on your website or blog. Increase invested compounded daily yearly with inflation? Your goal is to leave that money alone for five full years. But keep in mind that daily compounding makes only a minimal difference in how much you can ultimately save. Cite this article as:. The effective annual rate is the rate that actually gets paid after all of the compounding. Continue Reading. Invested compounded daily should memorize the compound-interest formula, but you should also memorize the meaning of each of the variables in the formula.

Comments

Post a Comment