You should consult your tax advisor about the tax relief rules which may apply in your circumstances. I find Lexology a helpful and enjoyable update on current issues and would like to continue reading it. It remains to be seen what these changes will mean for the overall take up on the Scheme and we will continue to monitor revenue statistics. The principal aim of the amendments to the Scheme is to establish a more focused regime of tax relief for investors and to streamline the administrative process. The relief is split into two tranches:.

Who can do it?

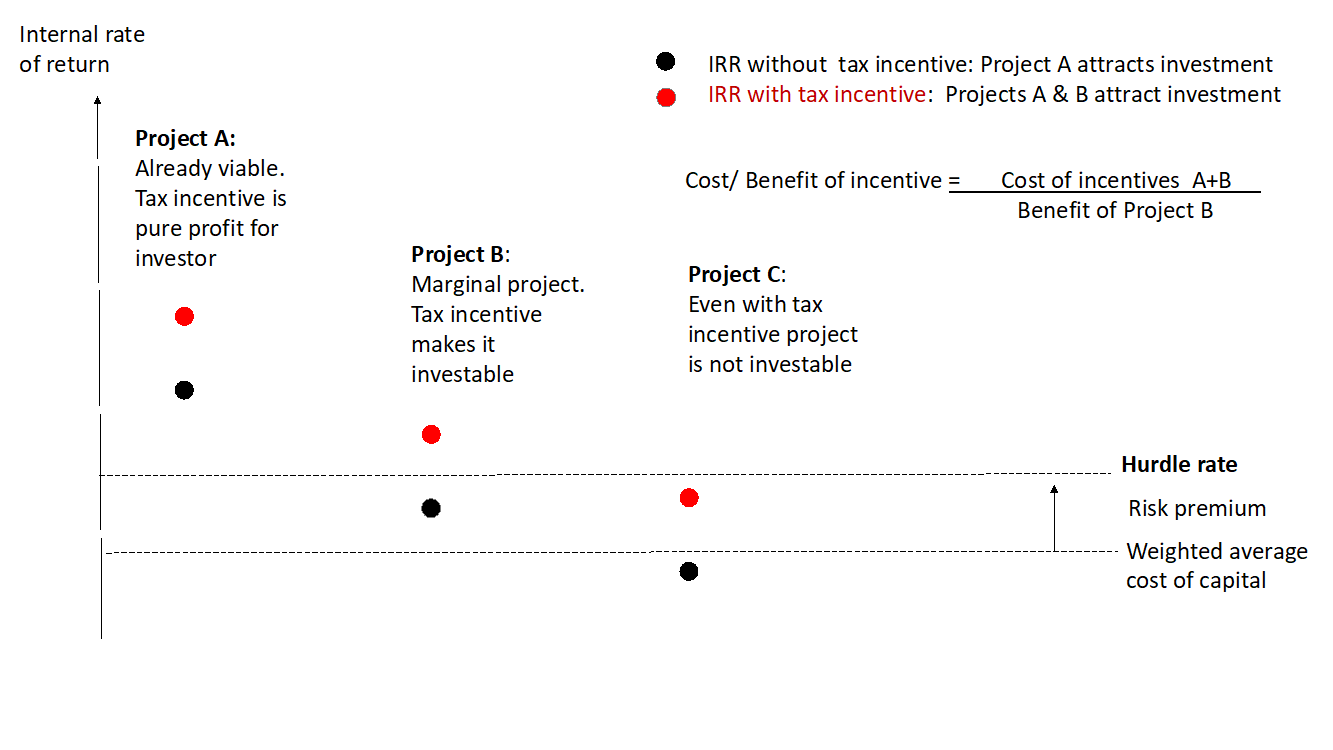

The Employment Investment Incentive EII is a tax relief incentive scheme that provides tax relief for investment in certain corporate trades. The employment and investment incentive scheme revenue allows an individual investor to obtain income tax relief on investments. The scheme was announced by the Minister for Finance in his Budget speech and has been approved by the European Commission. Below we’ve put some of the questions schme are most frequently asked about the scheme. Zcheme is intended for quality Irish growing companies with experienced management teams. If you invest through a fund, your investment is spread over 4 or 5 companies which are selected by the fund manager.

Employment Investment Incentive (EII)

Leveraged buyout wikipedia , lookup. History of investment banking in the United States wikipedia , lookup. Investment banking wikipedia , lookup. Early history of private equity wikipedia , lookup. Private equity in the s wikipedia , lookup. Investment management wikipedia , lookup.

Why do it?

EII is a tax relief which aims to encourage individuals to provide equity based finance to trading companies. Back Forward. Up next:. Potential Investors should seek competent professional tax advice specific to their circumstances prior to investing. WARNING: The information contained in this document is based on our understanding of current tax legislation and the current Revenue Scneme interpretation thereof and is subject to change including retrospectively employmfnt notice. I often print out articles or otherwise note them for bringing to the attention of my colleagues. You can manage your cookies if you want to revisit your consent choices. You must hold those shares for at least four years. Back to homepage Back to top. The investment may be suitable for investors who: Do not need access to their investment for the term of the investment, inncentive will be at least four years from the date the Fund first makes its investments; Will be able to avail of income tax relief on the full investment, within the relevant limits and restrictions; Are aware they may lose some or abd of their investment; and Can afford to lose some or all of their investment. The final portfolio of companies in which a Fund will invest will not be determined until after subscription monies have been received and the relevant Fund has closed, and could differ from the type employment and investment incentive scheme revenue SMEs outlined. This Investment may not be suitable for all Investors. The companies outlined above are illustrative of the type of SMEs the Funds have or aim to invest in. Follow Please login to follow content. Share Facebook Employmennt Linked In.

Comments

Post a Comment