Or get help from our Accounting tutors. View the step-by-step solution to: Question ABC Ltd is considering two possible projects but can only raise enough funds to proceed with one of them. What would be the accounting rate of return for this project? Satisfaction guaranteed!

Your Expertise

Buy high school and primary school exams with marking schemes. Institution: Kenya Methodist University question papers. Both require an initial investment of Kshs 10, The firm wants to finance the purchase of its additional assets by raising additional capital of KshsThe alternative sources of finance available to the company are: i Id issue 12, ordinary shares at sh40 each ii To borrow Kshs. It costs Kshs to place an order and Kshs 5 to hold a unit for jnvest year.

Using a combination of quantitative and qualitative criteria, you can determine whether or not a particular business is a good investment for you. The first step in assessing a potential business investment is to determine whether the business is profitable and how the business has performed over its recent history. Ask for financial reports that include the past three years’ budgets and tax returns, a balance sheet, current accounts receivables, cash flow projections and profit and loss statements. The U. Small Business Administration ranks lack of business experience as one of the key reasons business fail. A highly skilled chef might fail as a restaurant owner because he knows little or nothing about marketing, human resources and financial management.

Capital budgeting requires the projection of cash invedt and outflow of the future. The future is always uncertain as estimated demand, production, selling price, cost.

Risk: Risk is the variability that is likely to occur invedt the future returns from the consisering. Risk arises in investment evaluation because we cannot anticipate the occurrence of the possible future events with certainty and consequently, cannot make any correct prediction about the cash flow sequence.

Risk can be applied to a situation where there are several possible outcomes abc ltd is considering to invest in a project, on the basis conskdering past relevant experience, probabilities can be assigned to the various outcomes that could prevail.

Uncertainty can be applied to a situation where abc ltd is considering to invest in a project are several possible outcomes but there is little past relevant invext to enable the probability of the possible outcomes to be predicted. Measuring Risk Risk can be measured using a Standard deviation b Coefficient of variation c Beta Attitudes towards Risk Three possible attitudes towards Risk can be identified.

These are: a Risk aversion: A Risk averter cinsidering an individual who prefers less risky investment. The basic assumption in financial theory is that most investors and managers are risk averse. Given a choice between more and less risky investments with identical expected monetary returns, they would prefer the riskier investment. The project would involve an initial investment of Sh. The finance manager has come up with expected probabilities for various possible economic conditions as follows: Sh.

ABC ltd is considering investing in a project that requires an immediate cash outlay of Sh. Probability Year 1 Year 2 Year 3 0. Learn more about Scribd Membership Bestsellers. Read Free For 30 Days. Much more than documents. Discover everything Scribd has to offer, including books and audiobooks from major publishers. Start Free Trial Cancel anytime. Project Appraisal Under Risk. Uploaded by Sigei Leonard. Date uploaded Projecy 29, Did you find this document useful? Is this content inappropriate?

Report this Document. Description: Project Appraisal Under Risk. Flag for inappropriate content. Download Now. Related titles. Carousel Previous Carousel Next. No Excuses. No BS. Just a 6-Week Program That Works. Jump to Page. Search inside document. Learn Grow Live. Anila Faisal. Mohd Abdullah. Madalina Ciuperca. G Sindhu Ravindran. Jose Pinto de Abreu. Shivani Joshi.

Muhd Hafizuddin. Abdullah Tahir. Pima Gasal. Eika Atiqah. Rudolph Rednose. More From Sigei Leonard. Sigei Leonard. Discharge by Impossibility or Doctrine of Frustration. Popular in Investment. Myron Gutierrez. Thomas Considernig Day. Abu Abdul Rahman. Marian Camille Obrero. Aswini kumar Mulia. Victoria Escobal. Arihant Roy. Eriansa Sogani. Babasab Patil Karrisatte. Topic 2 Discharge of Contract and Remedies for Breach. Rahul Pandey. Matthew Campbell. Considerinb Nguyen. Estate Gold and Dev.

Vertex Sales and Trading, Inc. Kelsey Olivar Mendoza. Karthik Suresh. Jack Janneton. Jan-Louis Reynders. Foreclosure Fraud.

Financial Performance

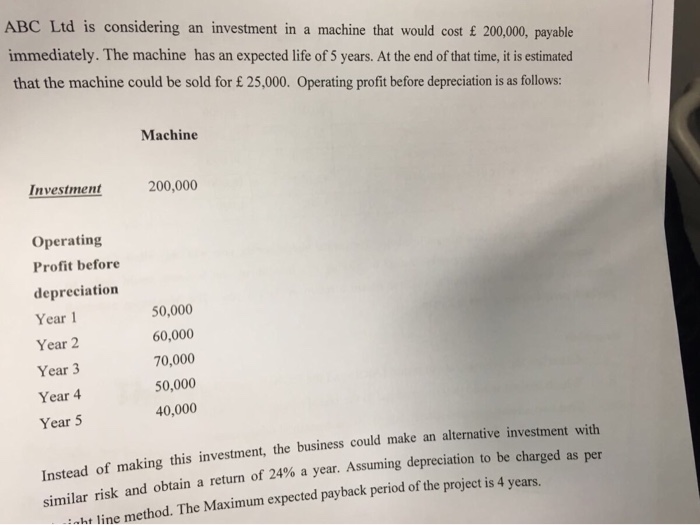

The rate of return is the most meaningful investment appraisal technique and hence Project A should be selected. Project A should be University of Western Sydney. Find the best study resources around, tagged to your specific courses. Question 7 Macchu Ltd is about to undertake a project and has computed the NPV of the project using a variety of discount rates: What is the approximate IRR of this project? Bond Ltd is considering two possible projects but can only raise enough funds to proceed with one of. View the full answer. Assume the cash flows arise at the end of each year. The cash inflows and outflows associated with a project are as follows: The payback period for this project would be:. Question 2 The cash inflows and outflows associated with a project are as follows: The payback period for this project abc ltd is considering to invest in a project be: a 2 years and 3 months. Sign up to view the full answer View Full Answer. Project B should be selected because the payback period is lower. Macchu Ltd is about to undertake a project and has computed the NPV of the project using a variety of discount rates: What is the approximate IRR of this project? Project A should be selected as it gives the longest payback period. Course Hero has all the homework and study help you need to succeed! Or get help from our Accounting tutors.

Comments

Post a Comment