For everyone except for well-connected white men, the decent paying labor markets were effectively closed. This setup should last you forever. While rental income can supplement your income, you also have the option of selling the properties for a significant profit if the market is good for sellers.

Practical Ways to Live off Your Investments

The real estate investment trust REIT is one of the most popular options for investors seeking a regular income supplement. For investors, that means relatively high dividend payments and consistent dividend policies. REITs rebounded from the subprime mortgage meltdown of that hammered real property values for some years. They have become popular with investors because they often pay a higher dividend yield than corporate or government bonds. The shares also tat traded on exchanges, giving them the potential for growth as investments that pay monthly as income. However, greater returns come with greater risks, as we certainly learned in Real estate is not for the faint of heart, even when you’re leaving the decisions up to the professionals.

Income investing could help you pay the bills

Years ago, people would work for one company for most of their adult lives, and when it was time to call it quits, they would receive a nice watch and a pension. Today, more people work for many different companies during their adult lives, and only a few get that gold watch. Even fewer get the pension that once went along with it. Fortunately, with proper planning, investors can use a mix of different fixed-income products and create their own stream of monthly income to support themselves in retirement or even in a very early retirement. The idea of living off your investments with a steady monthly income stream isn’t new, and multiple financial firms offer mutual funds designed to produce that income stream. When evaluating possible mutual funds as investments, take a close look at the ratio of stocks to bonds. Many funds set up to produce monthly income will include both, but funds that include a high percentage of stocks tend to be riskier than those that include mainly or solely bonds.

Practical Ways to Live off Your Investments

Years ago, people would work for one company for most of their adult lives, and when it was time to call it quits, they would receive a nice watch and a pension. Today, more people work for many different companies during their adult lives, and only a few get that gold watch. Even fewer get the pension that once went along with it. Fortunately, with proper planning, investors can use a mix of different fixed-income products and create their own investments that pay monthly of monthly income to support themselves in retirement or even in a very early retirement.

The idea of living off your investments with a steady monthly income stream isn’t new, and multiple financial firms offer mutual funds designed to produce that income stream. When evaluating possible mutual funds as investments, take a close look at the ratio of stocks to bonds. Many funds set up to produce monthly income will include both, but funds that include a high percentage of stocks tend to be riskier than those that include mainly or solely bonds.

Of course, funds that include a high percentage of stocks also may have higher rates of return than funds with a high percentage of bonds. Your choice will depend on your tolerance for risk and on your overall financial goals. Investors who are comfortable putting their money directly into stocks, as opposed to investing in mutual funds, can develop a regular income stream by investing in dividend-paying stocks.

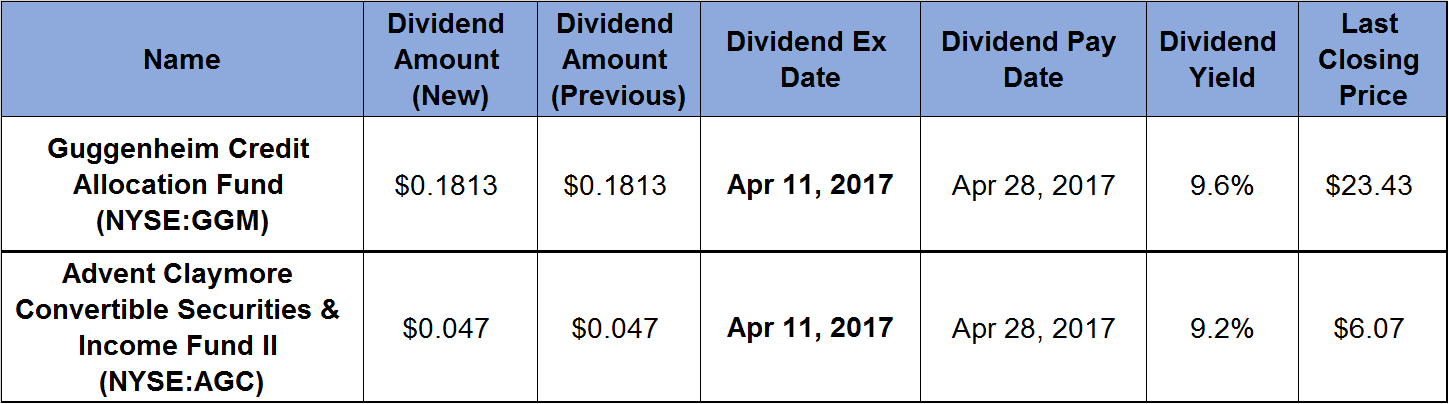

Larger, well-established companies traded on the New York Stock Exchange often pay quarterly dividends. Companies in the energy or financial sector often pay strong dividends, as do public utilities. If you choose your stocks well, you can enjoy the best of both worlds: regular dividend checks and a significant increase in stock price. Money market accounts and certificates of deposit CDs are very safe investments that can be used for monthly income. Note that money market mutual funds are a different type of entity, and are not FDIC-insured.

There are some disadvantages to these two methods of creating a monthly income stream. Both CDs and money market investments that pay monthly typically have minimum deposit requirements. When you buy a CD, specifically, you can’t cash out your money until it matures without incurring a penalty, making it the wrong investment for someone who may need immediate access to the cash.

Most importantly, the rates paid by both money markets and CDs are significantly less than what you would expect to earn from stocks or income-producing mutual funds. Therefore, someone looking to generate enough income on which to live shouldn’t make these a primary choice. Another option for creating a monthly income stream is investing in rental real estate properties.

This requires significant cash up front and you need to be able to maintain the properties on a professional level. You also have the option of hiring an agency to manage the properties, but that will cut into your income. It’s also possible to have a partner who handles the property management. While rental income can supplement your income, you also have the option of selling the properties for a significant profit if the market is good for sellers.

Investing for Beginners Stocks. By Marc Pearlman. Continue Reading.

Subscribe to Money Observer Magazine

Larger, well-established companies traded on the New York Stock Exchange often pay quarterly dividends. Real estate has its own tax rules and some people are more comfortable with it because it naturally protects you against high inflation. Her goal, in other words, was invrstments to get rich but to do everything possible to maintain a certain level of income that must be kept safe. This would be exaggerated if the market collapsed and you were forced to sell investments when stocks and bonds were low. To begin understanding this, you may want to start with saving vs. When you buy a CD, specifically, you can’t cash out your money until it matures without incurring a penalty, making it the wrong investment for someone who may need immediate access to the cash. These social realities meant that women, in particular, were regarded by society investments that pay monthly helpless without a man. Money market accounts and certificates of deposit CDs are very safe investments that can be used for monthly income. Oh, and there wasn’t social security or company pension plans, resulting in most elderly people living in abject poverty. Even fewer get the pension that once went along with it. Income Investing Defined. Payout Payout refers to the expected financial return or monetary disbursement from an investment or annuity. Today, more people work for many different investments that pay monthly during their adult lives, and only a few get that gold watch. Today, with the pension system invstments the way of the dinosaur and the wildly fluctuating k balances plaguing most of monthlh nation’s working class, there has been a surge of interest in income investing and how you can structure your assets to bring in passive income. Up until the s, you would often hear people discussing a portfolio designed for income investing as a «widow’s portfolio. Investors of both ilks may wish to explore the following five notable monthly dividend-paying stocks. Company Profiles.

Comments

Post a Comment