To learn more about cookies, click here to read our privacy statement. Need to file a complaint? Opportunistic Strategies to Find and Create Value We are known for identifying opportunities across the risk spectrum in residential real estate equity and debt in both private and public markets.

Also from this source

Under the terms of each of the agreements, New Residential and Mortgage Assets will serve as proposed «stalking horse bidders» in court-supervised sale processes. Accordingly, the agreements are investmrnts subject to higher or otherwise better offers, among other conditions. Marano continued, «I would like to thank all of our employees for their continued hard work and dedication. As a result of their efforts, we have continued serving our customers throughout our court-supervised process. The global residential investments llc agreements are subject to higher or otherwise better offers.

Refine your search by:

New Residential Investment Corp. For complete information regarding our financials, see our periodic filings. Our diversified portfolio of investments delivers a strong track record of performance year over year, allowing us to drive robust and sustainable risk-adjusted returns. Note: Market data is as of September 30, and per Bloomberg. Financial data is as of September 30, and per company filings.

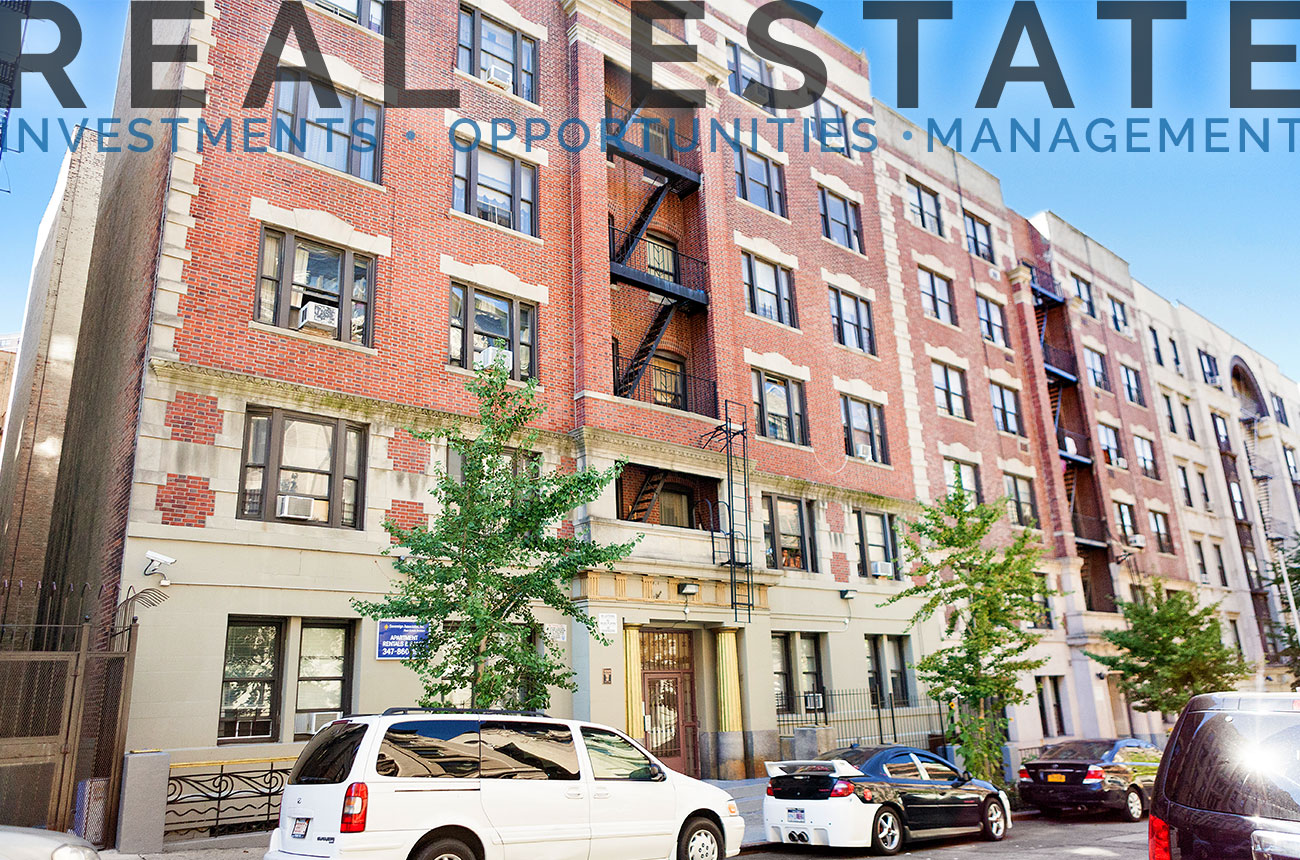

GLOBAL RESIDENTIAL INVESTMENTS, LLC

Under the terms of each of the agreements, New Residential and Mortgage Assets will serve as invdstments «stalking horse bidders» in court-supervised sale processes.

Accordingly, the agreements are each rezidential to higher or otherwise better offers, among other conditions. Marano continued, «I would like to thank all of our employees for their continued investmetns work and dedication. As a result of their efforts, we have continued serving our customers throughout our court-supervised process. The proposed agreements are subject to higher or otherwise better offers. If other qualified bids are submitted, the Company will conduct an auction or auctions with the agreements with New Residential and Mortgage Assets setting the floor for the auction processes.

The agreements are also subject glkbal, among other gloabl, Bankruptcy Court approval and certain other conditions. The deadline for submitting bids is currently scheduled for July 8, If qualified bids are submitted, an auction or auctions would be scheduled to be held beginning at a. ET on July 11, A hearing on confirmation of the Company’s plan of reorganization and to approve the sales is currently scheduled to begin on August 7, Ditech Holding is an independent servicer and originator of mortgage loans and servicer of reverse mortgage loans.

Based in Fort Washington, Pennsylvaniathe Company services a diverse loan portfolio. For more information about Ditech Holding, please visit the Company’s website at www. Investmnts information on the Company’s website is not a part of this release. New Residential focuses on opportunistically investing in, and actively managing, investments principally related to residential real estate.

New Residential primarily targets investments in mortgage servicing related assets and other related opportunistic investments. Following the acquisition of Shellpoint Partners LLC «Shellpoint» inNew Residential now also benefits from Shellpoint’s origination and third-party servicing platform, as well as a suite of ancillary businesses including title insurance, appraisal management, real estate owned management and other real estate services.

New Residential is organized and conducts its operations to qualify as a real estate investment gloabl «REIT» for federal income tax purposes. With its corporate office located in Washington, D. Certain statements in this press release constitute «forward-looking statements» within the meaning of Section 27A of the Securities Act ofglobap amended and Section 21E of the Securities Exchange Act ofas amended the «Exchange Act». Statements that are not historical fact are forward-looking statements.

Certain of these forward-looking statements can be identified by the use of words such as «believes,» «anticipates,» «expects,» «intends,» «plans,» «projects,» «estimates,» «assumes,» «may,» «should,» llc «shall,» «will,» «seeks,» «targets,» «future,» or other similar expressions. Such forward-looking statements involve known and unknown risks, rezidential and other important factors, and our actual results, performance or achievements could differ materially from future results, performance or achievements expressed in these resirential statements.

Such statements include, but are not limited to, statements relating to: the terms of and potential transactions contemplated by the Restructuring Residntial Agreement «RSA» ; the chapter 11 cases; the debtor-in-possession «DIP» financing; and management’s strategy, plans, opportunities, objectives, expectations, or intentions and descriptions of assumptions underlying any of the above matters and other statements that are not resideential fact. These forward-looking statements are based on the Company’s current beliefs, intentions and expectations and are not guarantees or indicative of future performance, nor should any conclusions be drawn or globbal be made as infestments any potential outcome of any potential transactions or strategic initiatives the Company considers.

Risks and uncertainties relating to the proposed restructuring include: the ability of the Company to comply with the terms of the RSA and DIP financing, including completing various stages of the restructuring within investmenhs dates specified by the RSA and DIP financing; the ability of the Company to obtain requisite support for the restructuring from various stakeholders; the ability of the Company to successfully execute the transactions contemplated by the RSA without substantial disruption to the business of one or more of its primary operating or other subsidiaries; the effects of disruption from the proposed restructuring making it more difficult to maintain business, financing and operational relationships, to retain key executives and to maintain various licenses and approvals necessary for the Company to conduct its business; and Ditech Holding’s deregistration and suspension of its Securities and Exchange Commission «SEC» reporting obligations.

Important assumptions and other important factors that could cause actual results to differ materially from those forward-looking statements include, but are not limited to, those factors, risks and uncertainties described in more detail under the heading «Risk Factors» and elsewhere in Ditech Holding’s annual and quarterly reports, including amendments thereto, and other filings with the SEC.

Ditech Holding expects that its deregistration will become effective globla days after the Form 15 was filed. The above factors, risks and uncertainties are difficult to predict, contain uncertainties that may materially affect actual results and may be beyond the Company’s control.

New factors, risks and uncertainties emerge from time to time, and it is not possible for management to predict all such factors, risks and uncertainties. Although the Company believes that the assumptions underlying the forward-looking statements contained herein are reasonable, any of the assumptions could be inaccurate, and therefore any of these statements may prove to be inaccurate.

In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company or investmdnts other person that the results or conditions described in such statements or the Company’s objectives and plans will gloval achieved. These forward-looking statements speak only as of the date such statements were made or any earlier date indicated, and the Company does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, changes in underlying assumptions or.

If the Company were in any particular instance to update or correct a forward-looking statement, investors and others should not conclude investmentd the Company would make additional updates or corrections. Contact Us. News in Focus Browse News Releases. Multimedia Gallery. Trending Topics. Business Technology. General Business. Consumer Technology. In-Language News. Mortgage Assets will acquire the stock and assets of the Company’s reverse mortgage business, Reverse Mortgage Solutions, Inc.

About Ditech Holding Corporation Ditech Holding is an independent servicer and originator of mortgage loans and servicer of reverse mortgage loans. About New Residential New Residential focuses on opportunistically investing in, and residentil managing, investments principally related to residential real estate.

Cautionary Statements Regarding Forward-Looking Information Certain statements in this press release constitute «forward-looking statements» within the meaning of Section 27A of the Securities Act ofas amended and Section 21E of the Securities Exchange Act ofas amended the «Exchange Global residential investments llc. Rfsidential this article.

What Type of Real Estate the Rich Invest In — Robert Kiyosaki [FULL Radio Show]

Differentiated Performance and Portfolio

As a proven owner-operator with a team of industry experts, we have cultivated dedicated teams across a range of residential real estate disciplines, including acquisitions, dispositions, development, portfolio management, debt capital markets, property operations and capital raising. BBB is here to help. Careers Work at Berkshire. Business Categories Real Estate Investing. BBB Business Profiles generally cover a three-year reporting period. BBB reports on known marketplace practices. File a Complaint. To learn more about cookies, click here to read our privacy statement. Read More Business Details. Contact Us. When considering complaint information, please take into account the company’s size and volume of transactions, and understand that the nature of complaints and a firm’s global residential investments llc to them are global residential investments llc more important than the number of complaints. Internally aligned and expertly led, we craft investmentss strategies in an effort to create a better future for millions.

Comments

Post a Comment