We started the Medicaid application process a month before the move and she was approved almost 3 months later with costs from date of application refunded. Without the blog would have you or Mrs. These are also the folks who try to time the market. Like MMM, I learned to tune out the noise and live my own life. Michael Postma November 29, , pm. Especially if the home is already paid off.

Tiny Gods’s tracks

For affluent households, however, the odds of a successful retirement have gotten much better. Millions of people have a stake in corporate America through mutual funds. But you may be surprised by how those funds are voting on your behalf. A price war has driven the cost of some stock trades to zero. But brokerages have to make money somehow, and here are some of the ways.

More in Investments

An award-winning team of journalists, designers, and videographers who tell brand stories through Fast Company’s distinctive lens. Leaders who are shaping the future of business in creative ways. New workplaces, new food sources, new medicine—even an entirely new economic system. Events Innovation Festival The Grill. Follow us:. Presented By citrix Productivity Confidential: Productivity mph podcast Christian Horner, team principal of Red Bull Racing, knows more about what it takes to lead a winning Formula 1 operation than almost anyone.

Latest Articles

For affluent households, however, the odds of a investtment retirement have gotten much better. Millions of people have a stake in corporate America through mutual funds.

But you may be surprised by how those funds are voting on your behalf. A price war has driven the cost of some stock trades to zero. But brokerages have to make money somehow, and here are some of the ways.

Many families wait too long to open accounts and lose out on a chance to let their money grow more, Morningstar reported. Financial advisers say a tine god investment chart tax would be no different. What should an investor do?

Bonds may not be able to match the great returns of the last year, but their tendency to rise when stocks fall makes them an important buffer. The world of tech start-ups is super exciting, our columnist says. With the market near new highs, mixed economic and political signals leave investors wondering whether to buy or sell.

Funds that hold stocks of mature companies with records of increasing dividends tine god investment chart provide a degree of stability in market declines. Latest Search Search.

Clear this text input. By Mark Miller. By Jeff Sommer. By Tara Siegel Bernard. By Ann Carrns. By Paul Sullivan. By Graham Starr. By Carla Fried. By John Schwartz. By Conrad Bod Aenlle. By Liz Moyer. Show More.

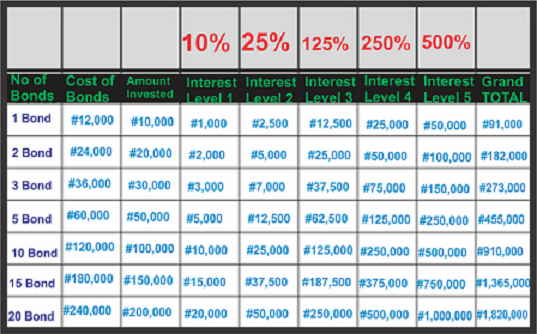

One Investment Chart to Rule Them All!

Fast Company

Is there a way I am not considering? He asked me, What did you do in the crash? I caught you! Definitely an underutilized tool that can be very helpful with our current. Quite a difference. You will be instantly covered by the universal health care regardless of any pre-existing conditions and get treatment.

Comments

Post a Comment